Tesla (TSLA) will launch its Q2 2025 monetary outcomes on Wednesday, July 31, after the market closes. As standard, a convention name and Q&A with Tesla’s administration are scheduled after the outcomes.

Right here, we’ll have a look at what the road and retail buyers count on for the quarterly outcomes.

Tesla Q2 2025 deliveries and vitality deployment

CEO Elon Musk and his loyal shareholders typically declare that Tesla is now an AI/Robotics firm. Nevertheless, the reality is that the corporate’s automotive enterprise continues to drive the overwhelming majority of its monetary efficiency.

Tesla’s income stays tied primarily to the variety of automobiles it delivers.

Earlier this month, Tesla disclosed its Q2 2025 automobile manufacturing and deliveries:

| Manufacturing | Deliveries | Topic to working lease accounting | |

| Mannequin 3/Y | 396,835 | 373,728 | 2% |

| Different Fashions | 13,409 | 10,394 | 7% |

| Complete | 410,244 | 384,122 | 2% |

The deliveries got here in proper on expectation, which is about 13.5% down from the identical interval final 12 months.

Tesla additionally produced 25,000 automobiles greater than it delivered, however that gained’t have an effect on its financials this quarter because the automaker solely accounts for delivered automobiles in its price of revenues.

The corporate additionally disclosed having deployed 9.6 GWh of vitality storage in the course of the quarter – roughly the identical as the identical interval final 12 months.

Tesla Q2 2025 income

For income, analysts usually have a fairly good concept of what to anticipate, because of the supply numbers and now the vitality storage deployment information.

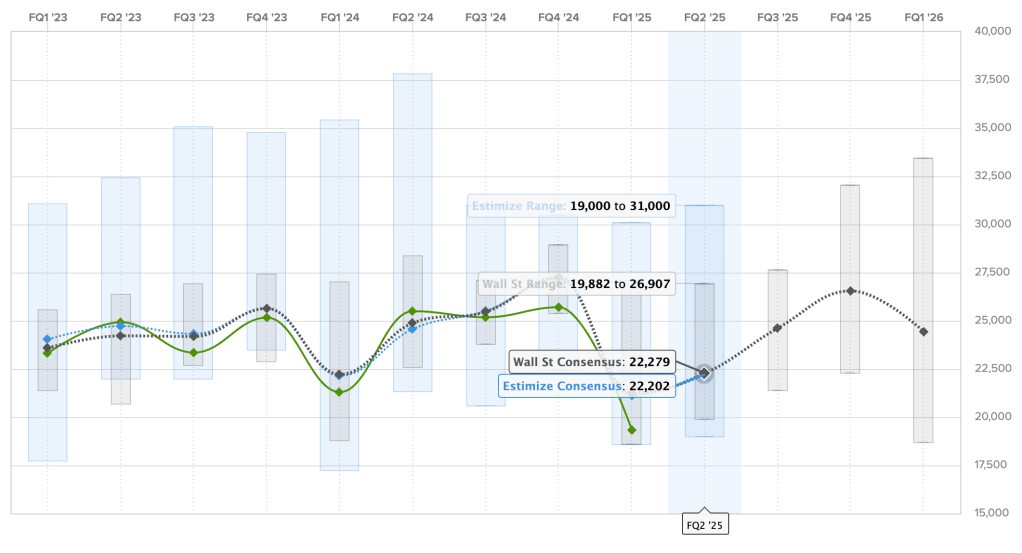

The Wall Road consensus for this quarter is $22.279 billion, and Estimize, the monetary estimate crowdsourcing web site, predicts a barely decrease income of $22.202 billion.

Listed here are the predictions for Tesla’s income over the previous two years, with Estimize predictions in blue, Wall Road consensus in grey, and precise outcomes are in inexperienced:

This consequence could be considerably decrease than the $25 billion in income that Tesla delivered throughout the identical interval in 2024.

It’s value nothing that over the past 3 quarters, Tesla’s income got here underneath expectations.

Tesla Q2 2025 earnings

Tesla claims to persistently attempt for marginal profitability each quarter, because it invests the vast majority of its funds in progress, however its progress has disappeared from its automotive enterprise over the past 12 months, and its gross margin goes in the identical route.

Analysts try to estimate Tesla’s gross margin with the decrease deliveries and better reductions to determine its precise earnings per share.

For Q2 2025, the Wall Road consensus is a achieve of $0.40 per share and Estimize’s crowdsourced prediction is slightly decrease at $0.39.

Listed here are the earnings per share over the past two years, the place Estimize predictions are in blue, Wall Road consensus is in grey, and precise outcomes are in inexperienced:

If Tesla delivers on expectations, it could be a big drop in earnings from $0.52 per share in Q2 2024.

Different expectations for the TSLA shareholder’s letter, analyst name, and particular ‘firm replace’

In Q1, Tesla blamed its poor efficiency on the Mannequin Y changeover. It doesn’t have this excuse within the second quarter.

CEO Elon Musk has been extraordinarily deceptive to shareholders about Tesla’s demand scenario. He was caught straight up mendacity about it final quarter.

However I count on Musk to have Tesla shareholders concentrate on future income prospects from robotaxi and robots, one thing he has been prosming for years with none actual proof that Tesla will lead any of these sectors.

Tesla may also take questions from retail shareholders primarily based on the preferred ones on Say. Listed here are the highest 5 questions and my ideas on them:

- Are you able to give us some perception how robotaxis have been performing thus far and what charge you count on to develop when it comes to automobiles, geofence, cities, and supervisors?

- Tesla has by no means launched publicly any information about its self-driving efforts and it went out of its option to keep away from reporting it to authorities and the general public. I count on nothing right here aside from “we’re rising as quick as regulators permit it”, which is a lie. Tesla nonetheless makes use of security supervisors and mapping, that are the limiting components.

- Are you able to present an replace on the event and manufacturing timeline for Tesla’s extra inexpensive fashions? How will these fashions stability price discount with profitability, and what influence do you count on on demand within the present financial local weather?

- Tesla stated that these cheaper fashions would come within the first half of 2025, however they didn’t. As we now have beforehand talked about, they’re mainly stripped down variations of the Mannequin 3 and Mannequin Y, permitting Tesla to scale back the bottom worth. We count on them to launch after the federal tax credit score to finish on the finish of Q3.

- What are the important thing technical and regulatory hurdles nonetheless remaining for unsupervised FSD to be accessible for private use? Timeline?

- Tesla hasn’t solved self-driving and it’s not coming to client automobiles any time quickly.

- What particular manufacturing facility duties is Optimus presently performing, and what’s the anticipated timeline for scaling manufacturing to allow exterior gross sales? How does Tesla envision Optimus contributing to income within the subsequent 2–3 years?

- When do you anticipate buyer automobiles to obtain unsupervised FSD?

- He’s going to say “subsequent 12 months” like he has been saying yearly for the final 6 years and once more, it gained’t occur.

Something to distract from the truth that Tesla would possibly begin to turn into unprofitable as quickly as Q1 2026.

Tesla’s earnings have been taking place over the past 2 years and the development is evident. Moreover, the removing of the federal tax credit score for EVs within the US, Tesla’s healthiest massive market, and most ZEV credit going away are accelerating the development in This fall 2025 and Q1 2026.

Tune in with Electrek after market shut right now to get all the most recent information from Tesla’s earnings, convention name, and now additionally an obvious “firm replace.”

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.