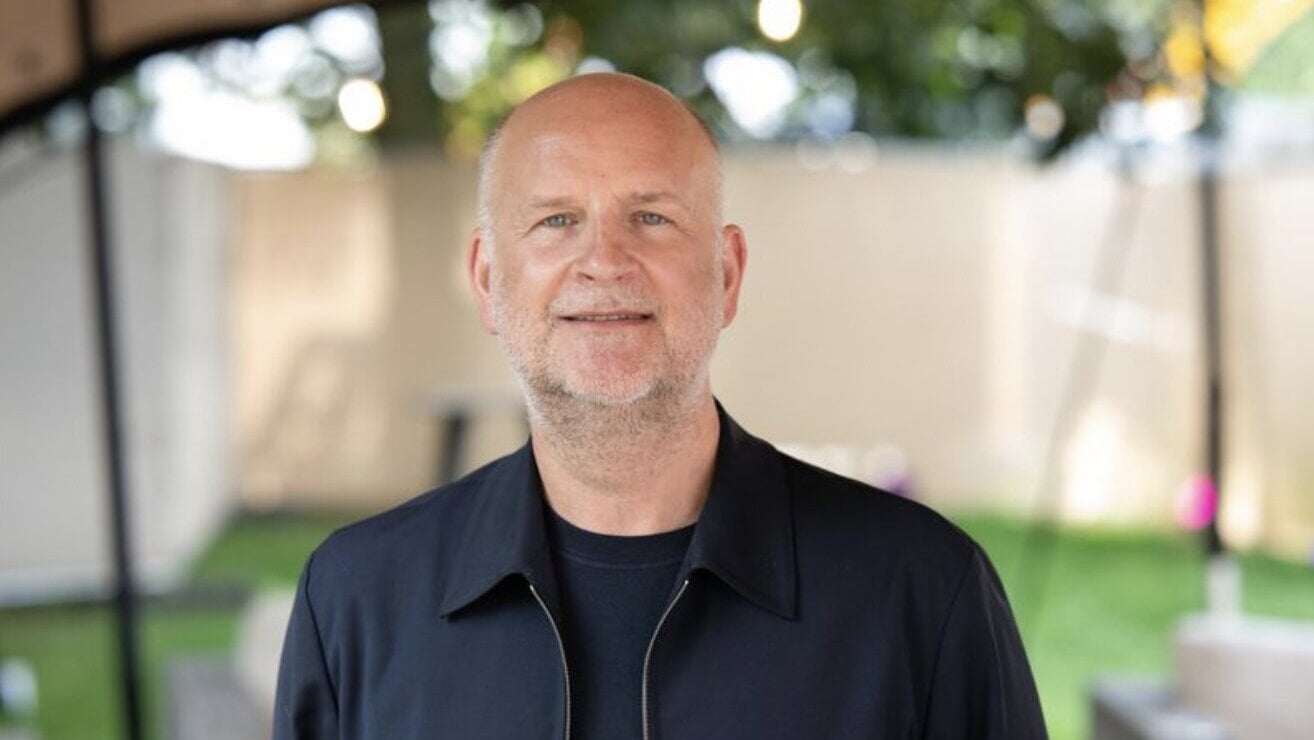

Speaking to “Globes” deputy editor Dror Marmor on the opening of the Israel Actual Property Convention yesterday night, Governor of the Financial institution of Israel Amir Yaron confused the Financial institution of Israel’s warning on rates of interest. Yaron additionally commented on the decline in actual property gross sales within the gentle of macro-economic situations.

When will the excessive rates of interest in Israel begin to fall?

Yaron: “It must be understood that inflation remains to be above the goal vary in the intervening time, and is operating at 3.3%, and apart from that some components of it are sticky. The excellent merchandise is rents, the place inflation has been at round 4% for a very long time. Everybody understands how necessary the rate of interest is for financing actual property tasks, or for the economic system basically, nevertheless it should be remembered that value stability is a necessary situation for a correctly run economic system and a rising economic system.”

Yaron identified that inflation in the beginning hurts the economically weaker sections of the inhabitants, and so it’s necessary to not permit it to rear its head. “The value of a mistake and the worth of correcting it is going to be way more painful,” he mentioned.

Nonetheless, we’re seeing the availability of properties at a peak, and contractors’ gross sales are stagnating, and based on your personal forecast for August inflation will fall under the three% stage. Does that not assist you to reduce some slack?

“In the mean time, inflation is above goal. And other than the sticky components, following Operation Rising Lion, through which properties had been hit, there’ll in all probability be much more stress on rents, which is able to have an effect on inflation, and we’re liable to see increasingly more stress.” Yaron confused that the Financial institution of Israel was doing all the things it might to forestall inflation from strengthening, including that “it’s precisely like antibiotics, which it’s a must to take till the tip even if you happen to begin to really feel just a little higher.”

Yaron additionally commented on the uncertainty that also exists within the Israeli economic system, pushed by two forces. “On the one hand we’re seeing enchancment in lots of market parameters, reflecting an enchancment in Israel’s geopolitical place, however what actually impacts inflation basically is appreciation of the foreign money. The opposite aspect of the coin is that that very same enchancment within the geopolitical state of affairs that the markets mirror is liable to deliver with it renewed demand pressures.” In Yaron’s view, this can be a good state of affairs for the economic system, however he mentioned that so far as inflation was involved these had been two opposing forces. “In the mean time, we don’t know which of those forces shall be dominant within the quick time period.”

RELATED ARTICLES

On the appreciation of the shekel, Yaron defined that when demand is excessive, it’s not sure that we received’t see transmission from strengthening of foreign money, “and subsequently we have to observe that cautious, data-dependent coverage.”

On future rate of interest cuts, Yaron mentioned, “The forecast of the Analysis Division is for 3 rate of interest cuts inside a yr, however that relates solely to a situation through which we actually see inflation coming inside the goal vary.”

You talked about demand pressures, and we’re two years into very excessive rates of interest, and but demand within the housing market remains to be comparatively excessive. To what extent does that shock you? And did you prohibit the financing affords just a little too late?

“To begin with, the economic system has demonstrated very excessive resilience and energy, actually given what has occurred right here since October 7. It’s a must to keep in mind that a tectonic occasion occurred right here, and within the final quarter of the yr was nonetheless an annual 3.5%, which is across the potential of the Israeli economic system. At current, we nonetheless have a spot of 4% from the place we should always have been had been it not for this complete horrible occasion, however we’re seeing a renewed rise in bank card purchases as properly.”

On actual property, Yaron mentioned, “We’ve a excessive start price, and really excessive demand for housing, which is an impressive function of Israel. What occurred right here on October 7 was that in the first place there was a halt in demand, and the contractors’ particular affords performed an important bridging position.”

Yaron defined, nonetheless, that at a sure stage “the particular affords turned tooo widespread and so the Financial institution of Israel determined to intervene sporting its client safety hat.”

However we’re nonetheless seeing avenue indicators promoting finance affords with zero rates of interest and cost solely after 5 years.

“We continuously monitor the market, however the huge distinction I make is between actual property affords that also give the shopper some form of safety in that he completes a questionnaire about his monetary circumstances, and is aware of the place he shall be within the course of in three or 4 years’ time, versus a state of affairs through which you set down 10% from your personal cash and get no assist from a mortgage marketing consultant, or a financial institution, or every other adviser, and also you don’t know the place you’ll be in one other three or 4 years and whether or not it is possible for you to to fulfill your dedication.

“The Financial institution of Israel understands that there shall be additional developments, and we proceed to watch and be sure that this is not going to be one thing that may trigger issues for the buyer, or issues for the economic system basically.”

On the big provide of properties, Yaron mentioned, “It must be understood that of a inventory of 80,000 properties, solely about 20,000 are properties prepared for occupation. A lot of the availability of properties is simply on paper.”

You already know that half of the kids born in Israel immediately are born into the haredi and Arab households, and we have now an issue with the speed of individuals becoming a member of the workforce in these sections of the inhabitants, significantly haredi males and Arab ladies. You warn about this yr after yr, however not a lot has modified, actually not on the price you anticipated.

“To begin with, you’re proper, bringing Arab ladies and haredi males into the workforce is one thing I’ve been speaking about since I took up the put up. If you take a look at basic measures of productiveness, of training, we have now a really huge downside.

“So far as the haredi inhabitants is worried, it’s a must to perceive that in, say, 2050-2060, they are going to be twenty one thing % of the entire inhabitants, whereas Arab society’s proportion of the inhabitants will stay at its present share. That may in fact weigh closely on the economic system. We received’t have the ability to develop in the way in which we want.

“We’d like them to hitch the workforce, and earn properly, and as a way to try this they will need to have the core curriculum. We all know that that’s the key to later success, actually in a altering world with AI through which you want excellent basic abilities with which you’ll develop.”

Full disclosure: The convention was held in cooperation with Financial institution Leumi and sponsored by Mivne Group, Shikun and Binui, Solel Boneh and the Fischer regulation agency. (FBC)

Printed by Globes, Israel enterprise information – en.globes.co.il – on July 22, 2025.

© Copyright of Globes Writer Itonut (1983) Ltd., 2025.