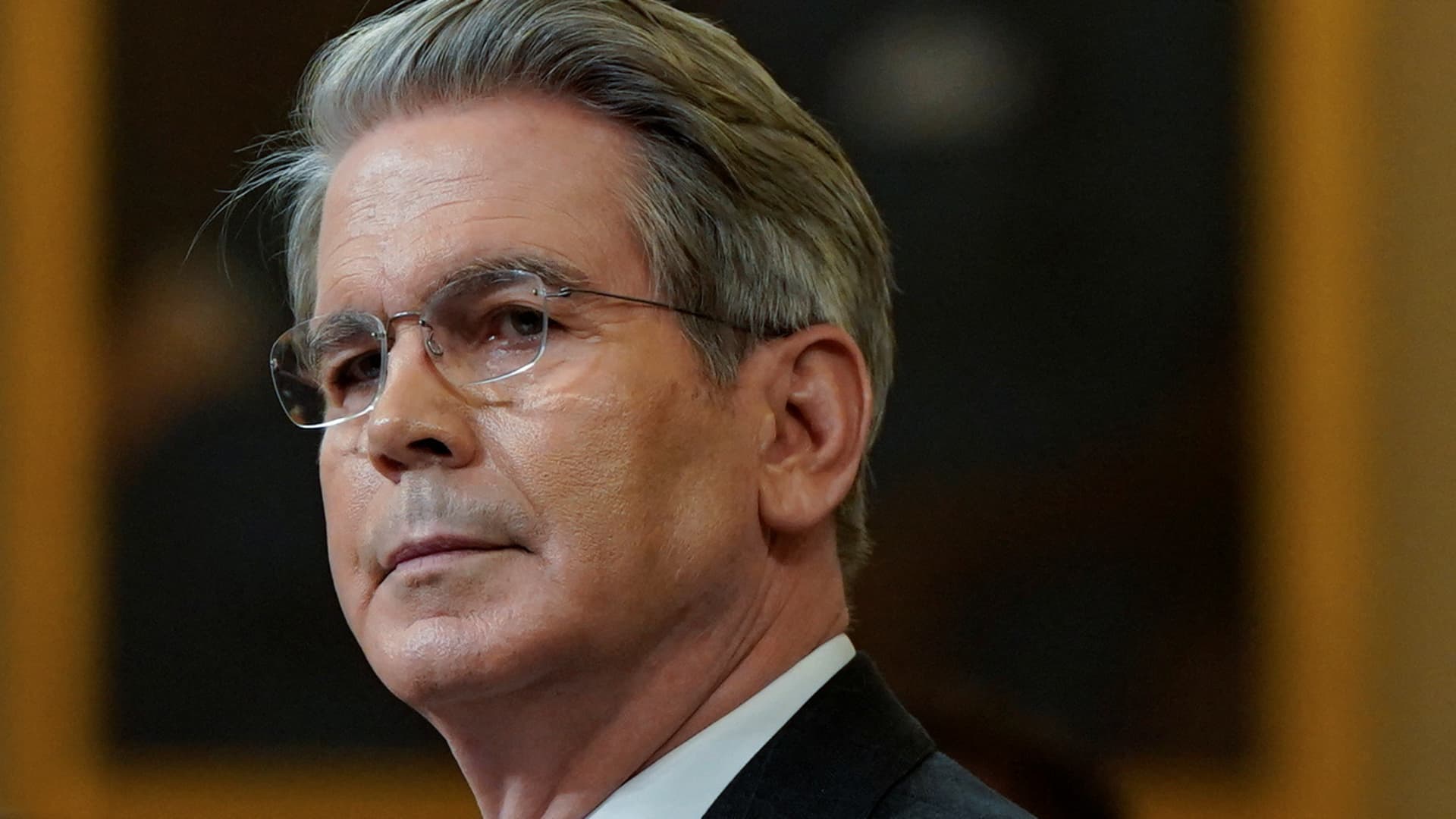

U.S. Treasury Secretary Scott Bessent sits to testify earlier than a Home Methods and Means Committee listening to on Capitol Hill in Washington, D.C., U.S., June 11, 2025.

Elizabeth Frantz | Reuters

With the job market at present being tough for a lot of — in no small half due to synthetic intelligence — it could be tempting to enroll in graduate college within the hopes of securing a greater job finally.

Do not do it. That’s, when you’ve got goals of working at America’s central financial institution.

U.S. Secretary of Treasury Scott Bessent on Monday questioned the Federal Reserve’s determination to not decrease rates of interest this 12 months to date, on condition that the U.S. has “seen little or no, if any, inflation.”

“I believe this concept of them not having the ability to get away of a sure mindset,” Bessent mentioned, referring to Fed officers. “All these Ph.D.s over there, I do not know what they do.”

The headline quantity for June’s client value index was the highest since February.

Whereas navigating the job market has been a problem no matter {qualifications}, the inventory market appears to be on a clean path upward no matter challenges.

The S&P 500 broke the 6,300 closing stage for the primary time on Monday. That is regardless of the Trump administration’s beef with the Fed and its use of heavy tariffs as a bargaining instrument.

Beneath these circumstances, an investor would not want a Ph.D. to know that volatility in markets might lie forward regardless of the constructive sentiment immediately.

What you should know immediately

Scott Bessent requires a overview of the Federal Reserve. In an interview with CNBC on Monday, the U.S. Treasury Secretary steered that the federal government wants to look at the “whole” Fed to assess if it has been “profitable.”

Tariff deadlines will ‘put extra strain’ on international locations. Bessent, in the identical interview, mentioned that the upcoming Aug. 1 deadline will assist the U.S. attain “higher agreements” with its commerce companions, suggesting it might be used as a negotiating instrument.

The S&P 500 closed above 6,300 for the primary time. Boosted by advances in Meta and Amazon shares, the Nasdaq Composite notched a file closing excessive as effectively. Throughout the Atlantic, the Stoxx Europe 600 dipped 0.08%.

Trump Media has constructed a roughly $2 billion bitcoin hoard. These holdings now account for about two-thirds of Trump Media’s whole liquid property, signaling U.S. President Donald Trump’s pivot to cryptocurrency as a supply of wealth whereas in workplace.

[PRO] European small caps have room to develop. A weak greenback and expectations of an bettering regional financial system had been giving small caps a lift, mentioned a Goldman Sachs strategist, who additionally defined why they’re outperforming bigger corporations.

And eventually…

Jensen Huang, chief govt officer of Nvidia Corp., speaks to members of the media in Beijing, China, on Wednesday, July 16, 2025.

Na Bian | Bloomberg | Getty Pictures

Nvidia’s China return buys time for Beijing to spice up its chip drive

When Nvidia mentioned it deliberate to renew chip shipments to China, seemingly with the blessing of Washington, it sparked debate over the strategic implications for the U.S.′ dominance in AI and China’s personal concentrate on boosting its home chip and tech trade.

For the U.S., Nvidia’s return might assist cement American power in AI globally, specialists advised CNBC. For China, it might purchase the nation time because it continues by itself path to construct Nvidia rivals and maintain tempo with AI software program growth.

— Arjun Kharpal