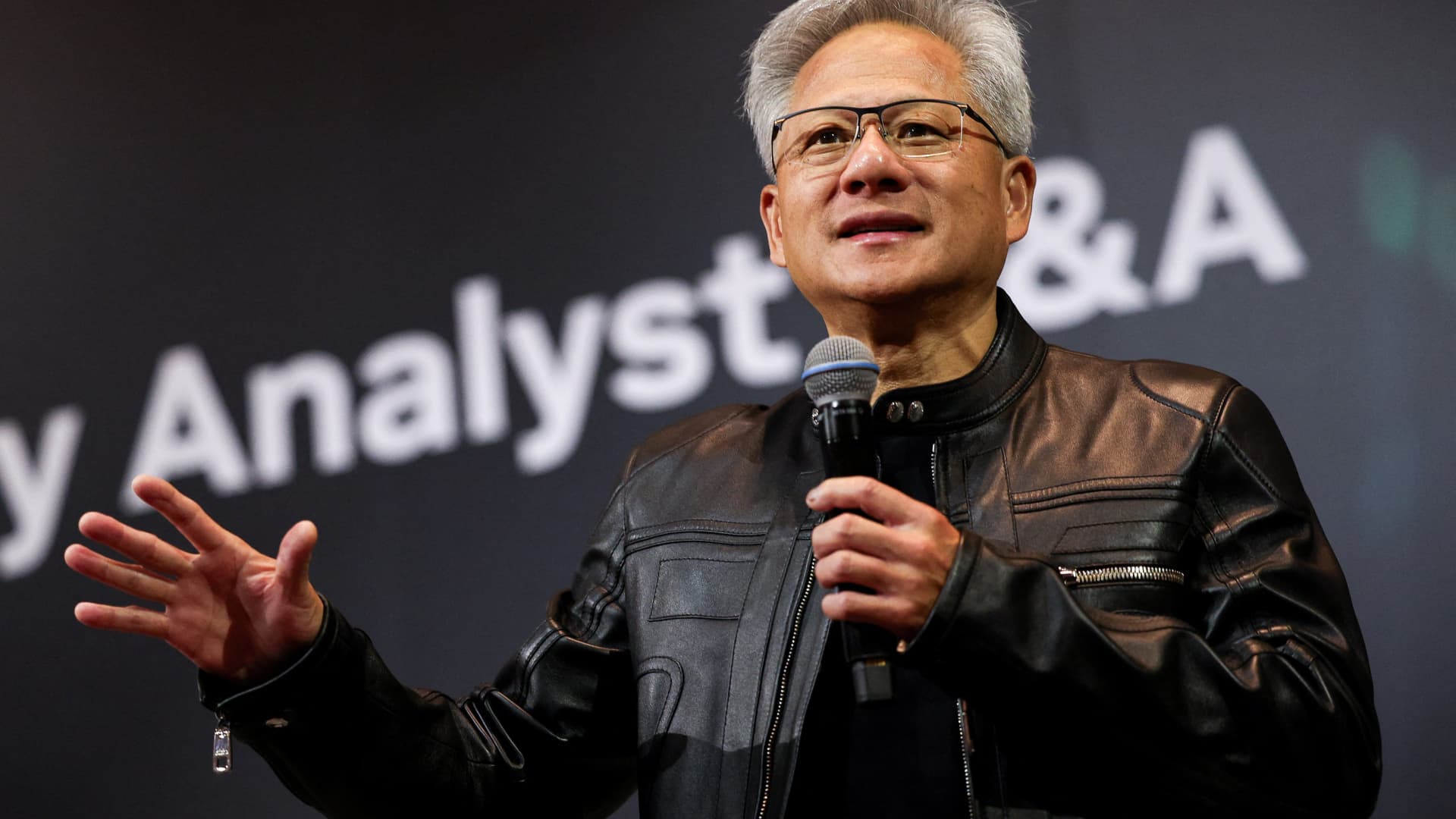

Nvidia CEO Jensen Huang attends a roundtable dialogue on the Viva Know-how convention devoted to innovation and startups at Porte de Versailles exhibition middle in Paris on June 11, 2025.

Sarah Meyssonnier | Reuters

Nvidia inventory rose on Wednesday lifting the corporate’s market cap briefly previous $4 trillion for the primary time as buyers scooped up shares of the tech big that is constructing the majority of the {hardware} for the generative synthetic intelligence growth.

Nevertheless, Nvidia inventory ended ending the day solely up 1.8%, giving the corporate a market cap of $3.97 trillion.

Nvidia is the world’s most precious firm, surpassing Microsoft and Apple, each of which hit the $3 trillion mark earlier than Nvidia. Microsoft can also be certainly one of Nvidia’s largest and most vital prospects. The chipmaker is the primary firm to ever obtain this market worth throughout buying and selling.

The California-based firm, which was based in 1993, first handed the $2 trillion mark in February 2024, and surpassed $3 trillion in June.

Nvidia has profited closely from the rising demand for AI {hardware} and chips because the launch of ChatGPT in late 2022. The corporate has positioned itself because the decisive chief in creating the graphics processing items that energy massive language fashions.

The surge in demand has boosted shares within the chipmaking behemoth greater than fifteenfold during the last 5 years. Nvidia’s shares are up greater than 15% during the last month and 22% because the begin of the 12 months.

The latest rally in Nvidia has come regardless of geopolitical tensions and ongoing chip curbs which have hampered gross sales to China. Nvidia has additionally recovered from fears sparked by China’s DeepSeek mannequin earlier this 12 months that future AI would not want so many chips.

In Could, Nvidia mentioned {that a} latest export restriction on its H20 chips created for China would value it $8 billion in misplaced gross sales.

“The $50 billion China market is successfully closed to U.S. business,” Huang mentioned throughout a Could earnings name.

Huang beforehand informed CNBC that getting blocked from promoting chips in China could be a “super loss” for the corporate.

Correction: In Could, Nvidia mentioned {that a} latest export restriction on its H20 chips created for China would value it $8 billion in misplaced gross sales. An earlier model misstated the timing.