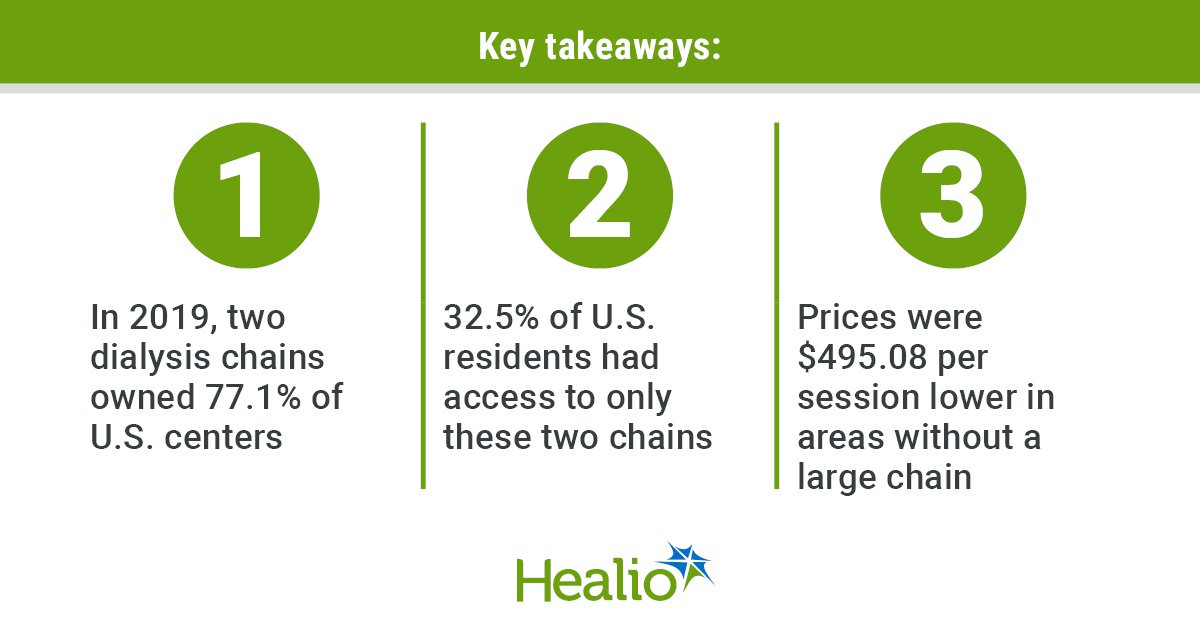

Key takeaways:

- In 2019, two dialysis chains owned 77.1% of U.S. facilities.

- These chains have been the one native choices for 32.5% of U.S. residents.

- Business insurance coverage costs have been practically $500 decrease in areas with out a big chain.

From 2005 to 2019, two corporations consolidated possession within the dialysis middle market and have been the one choice for practically one-third of U.S. residents, in keeping with outcomes of an financial evaluation.

As well as, in service areas with a number of giant chain, facilities acquired increased imply funds from industrial insurers for hemodialysis classes, Ryan C. McDevitt, PhD, professor of economics at Washington College’s Olin College of Enterprise and College of Public Well being whereas on depart from Duke College Fuqua College of Enterprise, and colleagues reported in JAMA Well being Discussion board.

The researchers used information from 2005 to 2019 from CMS and different sources on dialysis middle possession, prices and compensation and on Medicare and industrial insurance coverage claims to characterize the dialysis market. The examine inhabitants included freestanding U.S. dialysis facilities and physicians who owned a minimum of a 5% share in or served as a medical director for a dialysis middle.

Market consolidation

Throughout the examine interval, the 5 largest chains have been DaVita, Fresenius, U.S. Renal Care, American Renal Associates and Dialysis Clinic Inc. Market share of DaVita and Fresenius grew from 59.1% to 77.1%, and that of impartial facilities declined from 20.4% to 10.6%, in keeping with the researchers. The rise in market share for the big chains was primarily the results of buying impartial dialysis facilities and smaller chains, in keeping with the researchers.

Ryan C. McDevitt

From 2005 to 2019, entry to a neighborhood dialysis middle elevated. The share of U.S. residents with no dialysis middle of their space dropped to 11.7% in 2019. These with entry to solely a DaVita or Fresenius middle in 2019 elevated to 32.5%, in keeping with the researchers.

“The general extent of the duopoly was a bit shocking,” McDevitt informed Healio. “One other proven fact that was a bit shocking is that one-third of Individuals now have entry to just one or each of these two chains of their well being service space.”

Doctor possession, employment

Throughout the examine interval, the share of dialysis facilities owned by physicians elevated from 11.4% to 29.1%, and 81.1% of physician-owned facilities have been collectively owned by chains in 2019. Physicians in joint ventures tended to have an possession curiosity in facilities of just one giant chain, in keeping with the researchers.

Compensation for medical administrators was increased in areas with giant chains — a imply $564.56 per affected person in markets with one giant chain, in keeping with the researchers.

Greater costs

Business insurers paid extra per hemodialysis session in areas with giant chains, in keeping with the researchers.

In service areas with one giant chain, costs elevated throughout the examine interval from $1,292.91 to $1,362.76 and have been related for areas with any variety of giant chains. On the identical time, costs fell in areas with no giant chains from $929.40 to $827.49 per session.

In 2019, imply industrial value per hemodialysis session was $1,333.90 in service areas with giant chains and $495.08 (37.1%) decrease in areas with out a big chain. Imply industrial value per session was $1,409.80 in areas with no impartial dialysis facilities and $112.48 (8%) decrease in areas with a minimum of one impartial middle.

Implications, future analysis

“We went from a place of predominantly impartial amenities going again 50 years in the past to about half of amenities 30 years in the past to about 10% at the moment,” McDevitt mentioned. “The developments in consolidation usually are not distinctive to dialysis. All through well being care, it’s uncommon to search out an impartial solo practitioner working locally.”

Steven M. Brunelli, MD, vp of outcomes analysis at DaVita, highlighted elevated entry to care offered by growth of chain facilities throughout the examine interval.

“We’re pleased with the position we’ve performed in increasing entry to life-sustaining dialysis care throughout the U.S., serving to to maintain kidney care accessible and equitable no matter ZIP code, revenue or background,” Brunelli informed Healio. “Because the examine notes, the share of the inhabitants with out entry to any dialysis facility dropped from 29.3% to 11.7% between 2005 and 2019 — a interval throughout which we considerably expanded entry by means of our operations.”

The priority with domination of the dialysis market by one or two giant chains is costs shall be increased and innovation much less seemingly than in a extra aggressive market, in keeping with McDevitt.

“What’s more durable to mannequin is what would occur in a world that’s extra aggressive,” McDevitt mentioned. “The design, a minimum of, was to have competitors the place everyone seems to be preventing to ship the very best care on the lowest price for sufferers, to win their enterprise, however we don’t have that now. We now have a monopoly or a duopoly throughout a lot of the nation, so we don’t see what would occur when it comes to innovation.”

McDevitt mentioned the researchers are planning to review whether or not doctor ties to chains as house owners and medical administrators are related to elevated referrals to these chains and whether or not market construction has implications for affected person outcomes.

Brunelli mentioned DaVita acknowledges “that whereas there’s a lot to be pleased with, there’s additionally a lot work to be completed. For over 25 years, we’ve labored to be a part of the answer — enhancing entry, enhancing high quality of life and lowering mortality. Actual progress calls for actual conversations, and we stay dedicated to working collectively to determine root causes and design patient-centered, sustainable options.”

For extra data:

Steven M. Brunelli, MD, may be reached at newsroom@davita.com.

Ryan C. McDevitt, PhD, may be reached at mcdevitt@wustl.edu.