The UK is dealing with “daunting” dangers to the general public funds as its hovering debt load results in “substantial erosion” of its capability to answer future shocks, the impartial price range watchdog has warned.

The Workplace for Price range Duty mentioned on Tuesday that efforts to place the UK on a extra sustainable fiscal footing have met with solely “restricted and short-term” success lately.

Underlying public debt is at its highest stage because the early Sixties and set to rise additional, and addressing the difficulty has turn out to be “significantly tougher” given low financial development and rising rates of interest, the OBR added.

“In opposition to this tougher home and world backdrop, the size and array of dangers to the UK fiscal outlook stays daunting,” the watchdog mentioned in its fiscal dangers and sustainability report.

“The end result has been a considerable erosion of the UK’s capability to answer future shocks and rising pressures on the general public funds,” it added.

The report comes as chancellor Rachel Reeves faces renewed stress to lift taxes within the autumn Price range given indicators of an extra deterioration within the well being of the general public funds.

U-turns on welfare reforms coupled with strains on the UK economic system and the specter of productiveness downgrades from the OBR might pressure tax rises or spending cuts exceeding £20bn within the autumn, economists say.

Downing Road mentioned: “The federal government is getting the general public funds below management however we recognise the realities set out within the OBR report.”

The OBR famous that the UK now has the sixth-highest debt, fifth-highest deficit, and third-highest borrowing prices amongst 36 superior economies.

Not like many different huge economies, the UK has not pared again public debt after it was elevated throughout the Covid-19 pandemic and vitality disaster, leaving the nation’s state of affairs “more and more weak” by worldwide requirements, the OBR mentioned.

Rising public borrowing within the UK and different superior economies is creating wider pressures in world sovereign debt markets, it added.

The watchdog famous that borrowing prices have risen additional as a result of long-term gilt yields are actually increased within the UK than at any time because the begin of the century.

Gilts gross sales by home pension funds might additionally put stress on borrowing prices as savers transition from outlined profit to outlined contribution schemes. The watchdog projected that UK pension fund possession of gilts will fall from nearly 30 per cent of GDP in 2025 to 11 per cent by 2074.

It added that increased rates of interest could be wanted to “entice” consumers reminiscent of abroad buyers into the UK gilt market if the pension sector’s holdings decline. This might finally enhance debt curiosity spending by £22bn a yr in at the moment’s phrases, the OBR discovered.

It additionally forecast that spending on the state pension — the second-largest merchandise within the authorities price range after well being — would rise from nearly 5 per cent of GDP to 7.7 per cent by the early 2070s.

The forecast relies on a continuation of the so-called “triple lock”, which was launched by the 2010 coalition authorities and ensures the state pension will increase yearly by shopper value rises, common earnings development or 2.5 per cent, whichever is highest.

Labour has confronted criticism of its pledge to guard the coverage, as ministers put together to launch a evaluate into pensions adequacy.

The OBR discovered that due to inflation and earnings volatility, the triple lock is on observe to value about 3 times greater than preliminary expectations by 2029-30.

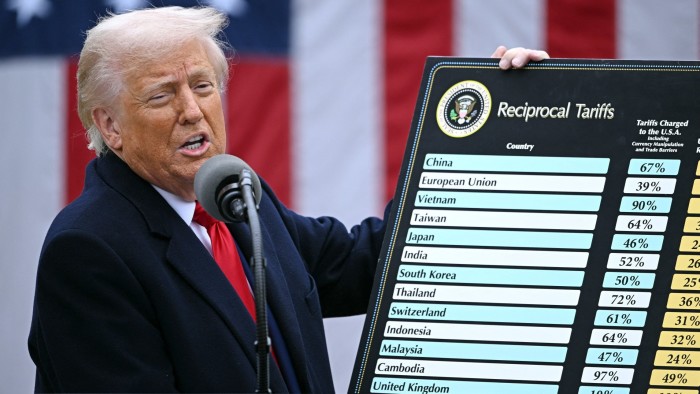

The watchdog additionally highlighted extra pressures from the prices of local weather harm and the online zero transition, in addition to dangers stemming from US President Donald Trump’s commerce warfare and rising defence commitments.

A key near-term threat for Reeves is productiveness development, which is essential to the fiscal outlook given its significance for tax income.

In a press convention, Richard Hughes, OBR chair, famous that only a 0.1 share level discount within the OBR’s productiveness development forecast over 5 years would by itself wipe out Reeves’ £9.9bn of headroom towards her key fiscal rule.

The chancellor has pledged that day-to-day spending shall be matched by tax revenues by 2029-30.

The OBR predicts that productiveness development will attain 1.25 per cent by 2029-30, in contrast with Financial institution of England projections for medium-term productiveness development of 0.75 per cent a yr.

David Miles, one other member of the OBR’s steering committee, acknowledged that the fiscal forecaster’s productiveness outlook is extra optimistic than these of many different economists.

Whereas productiveness development was once round 2 per cent a yr earlier than the monetary disaster, it has been simply 0.5 per cent since then, partly as a result of the UK has been hit by a sequence of shocks, he mentioned.

The important thing query, he mentioned, was whether or not the UK would return to extra traditionally regular development charges or proceed to see “garbage productiveness development”.

Responding to the report, the Treasury mentioned: “We recognise the long-standing financial realities the OBR units out.”

“For this reason we’re dedicated to making sure stability within the economic system by our non-negotiable fiscal guidelines, which have allowed us to spend money on the UK to drive a decade of renewal and put extra money in individuals’s pockets,” it added.

Extra reporting by George Parker