By Alun John

LONDON (Reuters) -European shares took an early lead in 2025, outperforming Wall Road because of erratic U.S. policymaking and Germany’s once-in-a-generation fiscal shift, however U.S. markets have caught up.

The broad European STOXX 600 (^STOXX) index was up 6.6% thus far this yr, as of Friday’s shut, in contrast with 6.8% for the S&P 500 (^GSPC).

In March the STOXX was 10 proportion factors forward, main European bulls to assume this could be their time after years of European markets underperforming Wall Road.

Requires European outperformance nonetheless ring true in currencies, nevertheless, with the euro up 14% towards the greenback yr up to now.

Commerce talks and the brand new U.S. tax-cut and spending legislation are checks for the rotation out of the U.S. and into Europe, mentioned UBS Asset Administration’s head of worldwide sovereign markets technique Max Castelli.

“I don’t assume U.S. exceptionalism will come again with the identical energy and depth,” he mentioned. “However I might not rule out the massive interval of outperformance of European property over the U.S. being over.”

This is a have a look at how Europe’s efficiency towards the U.S. stacks up.

Marija Veitmane, head of fairness analysis at State Road World Markets, mentioned Wall Road shares began bouncing again in mid-April, partly as a result of the “commerce conflict grew to become commerce negotiations.”

However the “actual turning level” was company earnings season when “tech CEOs stood up and mentioned ‘Our earnings are going to be very robust’.”

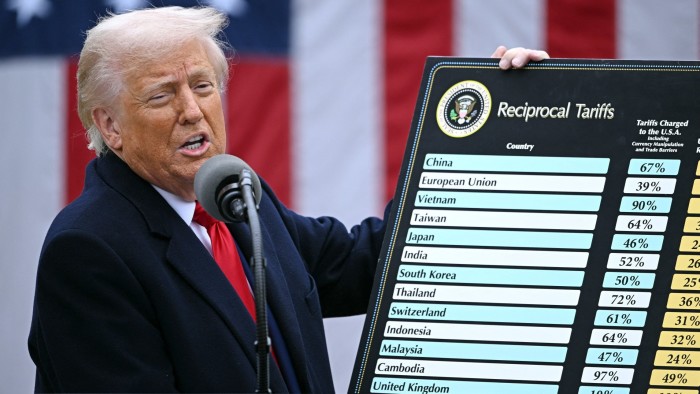

Tech accounts for roughly one-third of the S&P 500, and the sector is up 24% for the reason that begin of April, even together with its plunge when U.S. President Donald Trump introduced his tariff plans.

Nvidia (NVDA), as soon as once more the world’s largest firm by market cap, has risen an much more dramatic 45%, and there is not something in Europe to match.

However not at all all buyers are speeding again to Wall Road with the S&P 500 at file highs, suggesting valuations are getting stretched.

“The tariff announcement confirmed how briskly sentiment can change and the way dangerous these excessive (U.S.) valuations are,” mentioned Madeleine Ronner, senior fairness portfolio supervisor at asset supervisor DWS, including that European valuations are extra affordable.

And whereas that hole had been applicable due to gradual company earnings development, “Europe’s (earnings per share) is beginning to develop once more, and the differential is getting smaller, which must be mirrored in valuations,” she mentioned.