BBC Information, Washington DC

Donald Trump’s large tax and spending price range invoice has returned to the US Home of Representatives – because the clock ticks right down to the president’s 4 July deadline for lawmakers to current him with a ultimate model that may be signed into regulation.

The invoice narrowly cleared the Senate, or higher chamber of Congress, on Tuesday. Vice-President JD Vance forged a tie-breaking vote after greater than 24 hours of debate and resistance from some Republican senators.

It has thus far confirmed equally tough for Trump’s allies to go the invoice by way of the Home, the place Speaker Mike Johnson’s hopes of holding a vote on Wednesday seem like scaling down.

Members of Congress had emptied from the Home flooring by the afternoon, after it turned clear there weren’t even sufficient votes for the invoice to go the rule that permits the laws to be delivered to the ground, usually a straightforward procedural job.

The Home, or decrease chamber, accredited an earlier model of the invoice in Could with a margin of only one vote, and this invoice, with new amendments which have annoyed some Republicans, should now be reconciled with the Senate model.

Each chambers are managed by Trump’s Republicans, however inside the social gathering a number of factions are combating over key insurance policies within the prolonged laws.

The president has been very concerned in making an attempt to influence the holdouts and held a number of conferences on the White Home on Wednesday in hopes of profitable them over.

Ralph Norman, a Home Republican from South Carolina, attended one of many conferences however wasn’t persuaded.

“There will not be any vote till we are able to fulfill all people,” he mentioned, including he believes there are about 25 different Republicans who’re at present against it. The chamber can solely lose about three Republicans to go the measure.

“I received issues with this invoice,” he mentioned. “I received hassle with all of it.”

Sticking factors embrace the query of how a lot the invoice will add to the US nationwide deficit, and the way deeply it is going to reduce healthcare and different social programmes.

Throughout earlier indicators of rise up in opposition to Trump at Congress, Republican lawmakers have finally fallen in line.

What’s at stake this time is the defining piece of laws for Trump’s second time period. Listed here are the factions standing in its means.

The deficit hawks

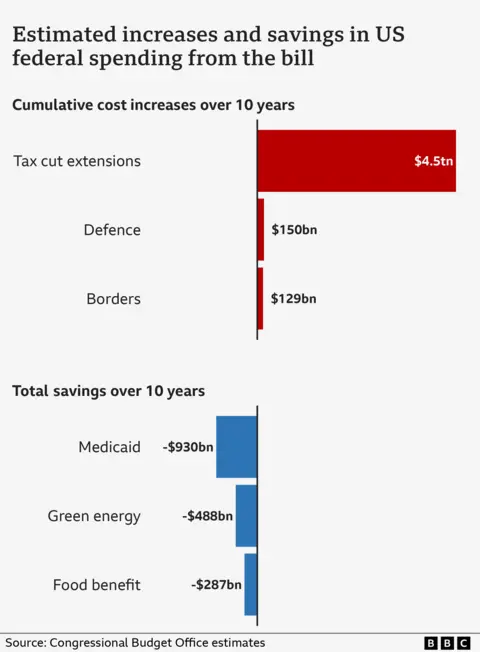

The Congressional Price range Workplace (CBO) estimated that the model of the invoice that was handed on Tuesday by the Senate may add $3.3tn (£2.4tn) to the US nationwide deficit over the following 10 years. That compares with $2.8tn that might be added by the sooner model that was narrowly handed by the Home.

The deficit means the distinction between what the US authorities spends and the income it receives.

This outraged the fiscal hawks within the conservative Home Freedom Caucus, who’ve threatened to tank the invoice.

Lots of them are echoing claims made by Elon Musk, Trump’s former adviser and marketing campaign donor, who has repeatedly lashed out at lawmakers for contemplating a invoice that can finally add to US nationwide debt.

Shortly after the Senate handed the invoice, Texas congressman Chip Roy, of the ultraconservative Home Freedom Caucus, was fast to sign his frustration.

He mentioned the percentages of assembly Trump’s 4 July deadline had lengthened.

Getty Photos

Getty PhotosFreedom Caucus chairman Andy Harris of Tennessee advised Fox Information that Musk was proper to say the US can not maintain these deficits. “He understands funds, he understands money owed and deficits, and now we have to make additional progress.”

On Tuesday, Conservative congressman Andy Ogles went so far as to file an modification that may utterly substitute the Senate model of the invoice, which he known as a “dud”, with the unique Home-approved one.

Ohio Republican Warren Davison posted on X: “Promising another person will reduce spending sooner or later doesn’t reduce spending.”

The Medicaid guardians

Representatives from poorer districts are frightened concerning the Senate model of the invoice harming their constituents, which may additionally harm them on the polls in 2026.

Based on the Hill, six Republicans have been planning to vote down the invoice resulting from considerations about cuts to key provisions, together with cuts to medical protection.

A number of the vital Republicans have attacked the Senate’s extra aggressive cuts to Medicaid, the healthcare programme relied upon by tens of millions of low-income Individuals.

“I have been clear from the beginning that I cannot assist a ultimate reconciliation invoice that makes dangerous cuts to Medicaid, places vital funding in danger, or threatens the steadiness of healthcare suppliers,” mentioned congressman David Valadao, who represents a swing district in California.

This echoes the criticism of opposition Home Democrats, whose chief, Hakeem Jeffries, posted an image of himself on Wednesday to Instagram, holding a baseball bat and vowing to “hold the strain on Trump’s One Massive Ugly Invoice”.

Different Republicans have signalled a willingness to compromise. Randy Wonderful, from Florida, advised the BBC he had frustrations with the Senate model of the invoice, however that he would vote it by way of the Home as a result of “we won’t let the proper be the enemy of the great”.

Home Republicans had wrestled over how a lot to chop Medicaid and meals subsidies within the preliminary model their chamber handed. They wanted the invoice to cut back spending, with the intention to offset misplaced income from the tax cuts contained within the laws.

The Senate made steeper cuts to each areas within the model handed on Tuesday.

Adjustments to Medicaid and the Inexpensive Care Act (higher referred to as Obamacare) within the Senate’s invoice would see roughly 12 million Individuals lose medical health insurance by 2034, in line with a CBO report revealed on Saturday.

Underneath the model initially handed by the Home, a smaller variety of 11 million Individuals would have had their protection stripped, in line with the CBO.

Hakeem Jeffries/Instagram

Hakeem Jeffries/InstagramThe state tax (Salt) objectors

The invoice additionally offers with the query of how a lot taxpayers can deduct from the quantity they pay in federal taxes, primarily based on how a lot they pay in state and native taxes (Salt). This, too, has turn into a controversial subject.

There’s at present a $10,000 cap, which expires this yr. Each the Senate and Home have accredited growing this to $40,000.

However within the Senate-approved model, the cap would return to $10,000 after 5 years. This modification may pose an issue for some Home Republicans.