Hiya, that is Ganesh Rao, writing from London. This week, I look into how the Israel-Iran battle was a reminder of India’s vulnerabilities — and the alternatives rising from the disaster.

The Indian Military’s Brahmos missile system takes half Rehearsal in full swing forward of the Republic Day Parade 2025, at Kartavya Path on January 20, 2025 in New Delhi, India.

Raj Ok Raj | Hindustan Occasions | Getty Photos

This report is from this week’s CNBC’s “Inside India” publication which brings you well timed, insightful information and market commentary on the rising powerhouse and the massive companies behind its meteoric rise. Like what you see? You may subscribe right here.

Every weekday, CNBC’s “Inside India” information present provides you information and market commentary on the rising powerhouse companies, and the folks behind its rise. Livestream the present on YouTube and catch highlights right here.

SHOWTIMES:

U.S.: Sunday-Thursday, 23:00-0000 ET

Asia: Monday-Friday, 11:00-12:00 SIN/HK, 08:30-09:30 India

Europe: Monday-Friday, 0500-06:00 CET

The large story

India’s financial system was staring down a ravine over the previous week.

Geopolitical tensions within the Center East may have battered the nation. As an alternative, India discovered within the Israel-Iran struggle a catalyst to beef up its protection sector.

The 2 Center East international locations agreed to a ceasefire on Wednesday, following a U.S. bombing marketing campaign that U.S. President Donald Trump stated obliterated Iranian nuclear ambitions. Oil costs gave up their short-lived positive factors, eradicating India from the precipice. However the episode highlighted lots of India’s vulnerabilities.

India now not buys Iranian oil, however 40% of its complete crude imports nonetheless transit the slender waterway of the Strait of Hormuz, one of many world’s most vital oil chokepoints. Any disruption would have meant a extreme financial fallout for the nation.

For each $10 per-barrel improve in crude costs, India’s shopper value inflation may rise by as much as 35 foundation factors whereas financial development may decline by 30 foundation factors, in accordance with an evaluation by SBI Analysis.

Madan Sabnavis, chief economist on the Financial institution of Baroda, a majority government-owned financial institution in India, echoed that estimate, warning that, whereas a ten% value hike was manageable, a sustained value above $100 per barrel “can have a significant impression.”

The battle additionally places New Delhi in a decent spot between its investments in Iran — notably the Chabahar port, which is operated by Indian firms — and its deep and rising protection relationship with Israel.

India is the one largest purchaser of Israeli arms, accounting for 34% of its protection exports, in accordance with a March 2024 report by the Stockholm Worldwide Peace Analysis Institute. Israel accounts for 13% of India’s imports.

India’s latest “Operation Sindoor” in opposition to Pakistan, launched after an April militant assault in Jammu and Kashmir, reveals the depth of this dependency on arms imports, in accordance with analysts at funding financial institution Jefferies. The operation utilized a mixture of previous Russian gear and new Israeli-made gear, together with Heron surveillance drones, Spyder and Barak-8 surface-to-air missile programs.

Quickly after Russia invaded Ukraine, India discovered that Moscow, traditionally a high arms provider, had change into unreliable. Russian protection manufacturing capability was directed towards Moscow’s personal wants for the struggle in Ukraine, inflicting vital delays for India’s army modernization program.

Worse nonetheless, analysts level out that Russian gear, such because the T-90S tanks which might be a staple of the Indian Military, appeared to have “underperformed” in Ukraine.

Pivoting to home protection

India would definitely not have needed to undergo yet one more delay in weapons procurement, have been the Iran-Israel battle to pull on.

This has created an pressing want for India to pivot. The transition, nonetheless, is extra prone to take years, if not many years, as 90% of India’s armored autos and 70% of its fight plane have been of Russian origin as of 2023, in accordance with analysis from Bernstein.

“I believe undoubtedly the scenario may have elevated the will and conviction that each one the international locations have to extend their defence spending, which was initiated due to the Russian invasion of Ukraine,” stated Anna Mulholland, head of rising market equities analysis at Pictet Asset Administration. The agency’s rising market fund has India because the second largest allocation.

“The Center East turmoil, whereas not new, will certainly have elevated folks’s resolve and dedication to these elevated defence budgets which have been spoken about,” she added.

Alternative out of disaster

Out of this disaster, India has made a chance to develop its home protection trade.

Analysts at JPMorgan recognized the latest geopolitical conflicts as a “pivotal second for widespread recognition of BEL’s capabilities,” referring to the state-owned Bharat Electronics. The inventory is up round 38% to this point this yr.

“A gentle stream of orders, elevated geopolitical dangers each in India and globally, and robust medium-term development prospects … with wholesome [return on equity] ought to proceed to result in outperformance, in our view,” stated JPMorgan’s Atul Tiwari, an government director on the financial institution, in a be aware to shoppers on June 23.

Essentially the most tangible signal of this pivot is “Mission Kusha” — India’s homegrown different to the Russian S-400 air protection system, wherein BEL is a key growth accomplice. “This program is anticipated to contribute considerably to the corporate’s long-term order e book as soon as contracts are finalized,” JPMorgan’s Tiwari added.

India is unlikely to be the lone buyer for these firms. New Delhi can be concentrating on protection manufacturing as an export trade. It goals to double exports to almost $6 billion a yr by 2030, in accordance with Jefferies.

— CNBC’s Michael Bloom contributed reporting.

Prime TV picks on CNBC

Dhiraj Nim from ANZ notes that whereas the latest rise in world oil costs pose draw back dangers for the rupee, the “shaky” ceasefire between Iran and Israel has helped stabilize investor sentiment and improved near-term outlook for the foreign money.

Frederic Neumann, chief Asia economist at HSBC and Tim Seymour, CIO at Seymour Asset Administration, see EM as undervalued, with Korea, India, Vietnam standing out.

Must know

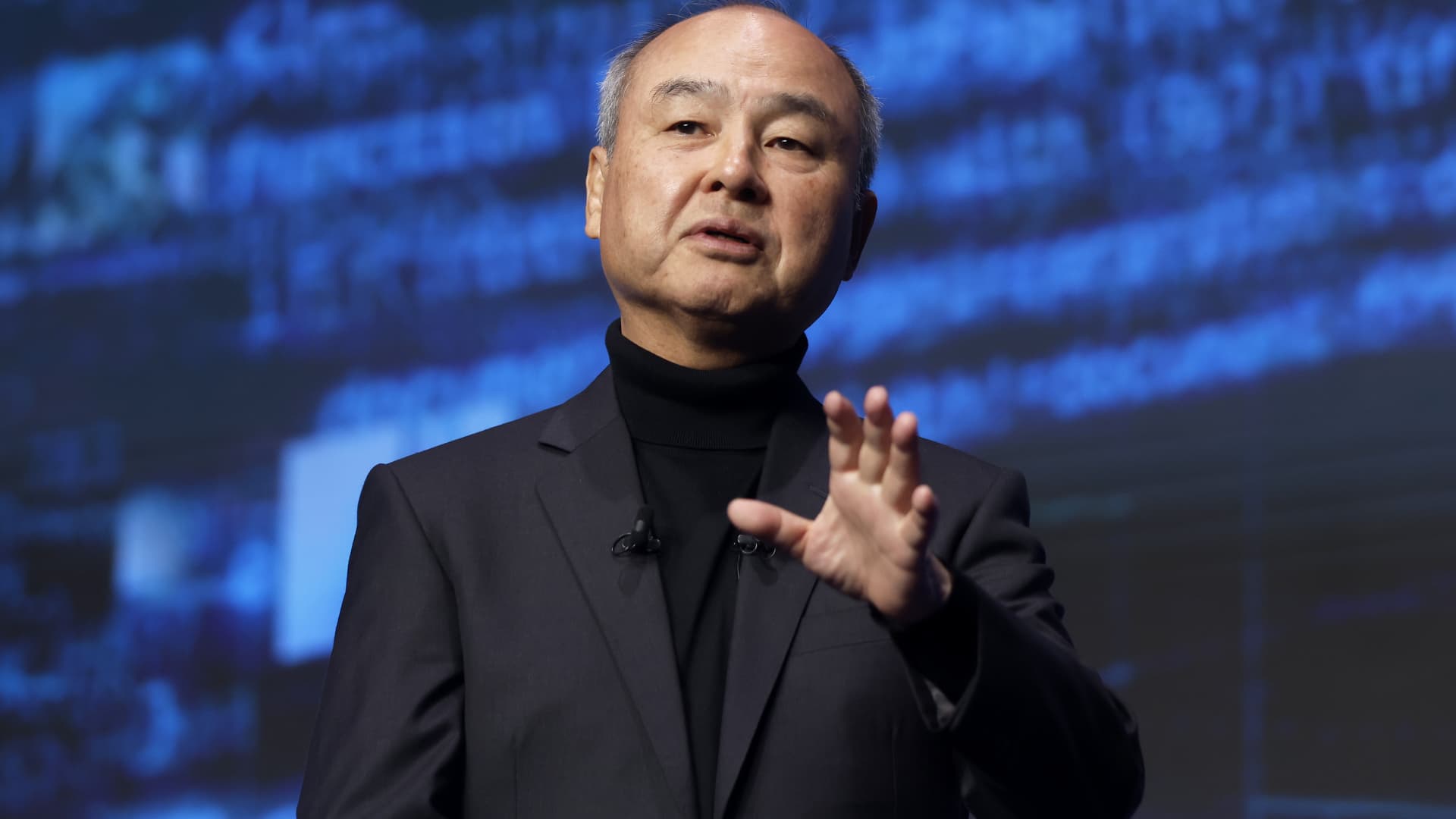

India will produce a $100 billion tech firm. That is in accordance with the CEO of Proseus, one of many greatest tech traders on the earth. Proseus has invested within the buzziest tech corporations in India, resembling funds service PayU and e-commerce firm Meesho.

Blended image for India’s financial system. The Reserve Financial institution of India famous that manufacturing unit and providers exercise in Might remained wholesome, however city demand slowed sharply.

Capital injection for Air India. Throughout India’s monetary yr 24-25, Tata Sons and Singapore Airways pumped in 9,588 crore Indian rupees ($1.1 million) within the airline. Air India is coping with a tragic air crash on June 12.

– Yeo Boon Ping

What occurred within the markets?

The Nifty 50 hit its 2025 excessive at 25,549 factors. Traders rushed into equities after easing tensions within the Center East. The index added over 2% since final week and gained greater than 7% within the yr up to now.

The benchmark 10-year Indian authorities bond yield moved decrease by 3 foundation factors in comparison with final week and now trades at 6.27%.

What’s occurring subsequent week?

June 30: India industrial output in Might

July 1: Industrial gases producer Ellenbarrie Industrial Gases IPO, development company Globe Civil Initiatives IPO, India manufacturing PMI in June

July 2: Loans supplier HDB Monetary Companies IPO

July 3: India providers PMI in June