Keep knowledgeable with free updates

Merely signal as much as the Pensions myFT Digest — delivered on to your inbox.

Solely 5 per cent of an estimated £160bn of extra belongings held in outlined profit pension schemes will likely be extracted regardless of a change in guidelines to make releasing surpluses simpler, the federal government has predicted.

The Division for Work and Pensions estimated in an affect evaluation that “round £8.4bn” of surplus after tax could be returned from schemes to staff and corporations over 10 years on account of new guidelines tabled in this week’s pensions invoice.

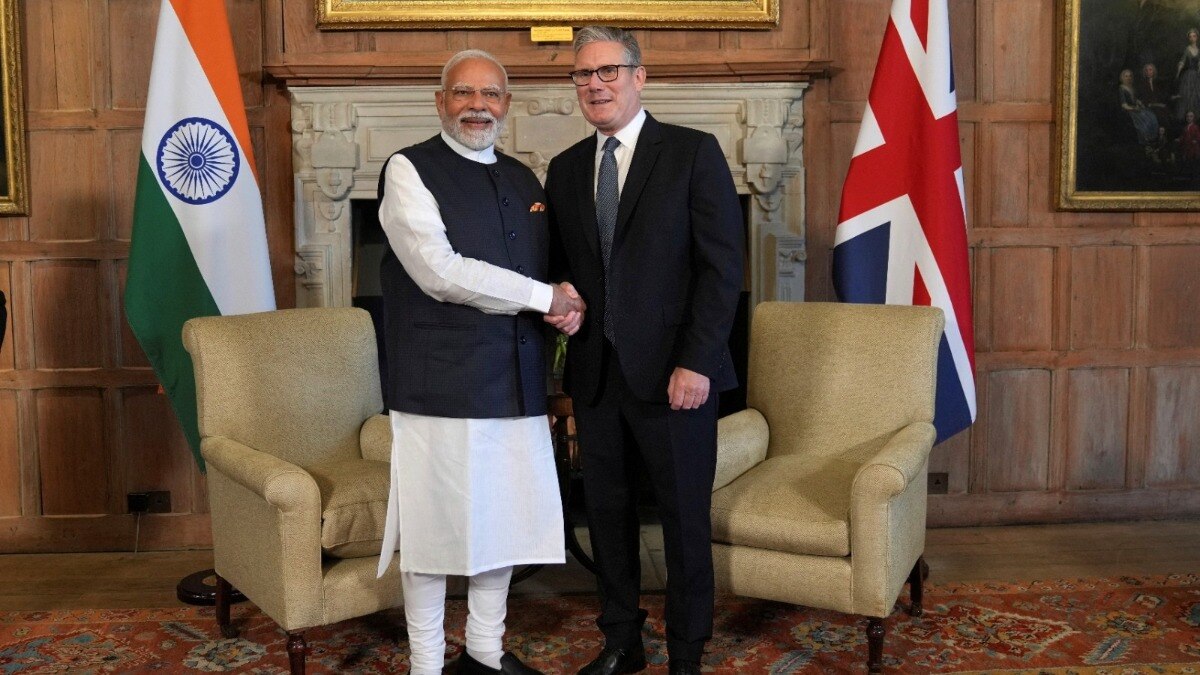

The estimates come after Prime Minister Sir Keir Starmer in January stated the adjustments would assist unlock a wave of funding to “increase wages and drive progress or unlock extra money for pension scheme members”.

He stated three quarters of company DB schemes had been in surplus, collectively value about £160bn.

Steve Hodder, accomplice at consultancy LCP, stated “£8.4bn is low and disappointing”.

John Ralfe, an impartial pensions advisor, added: “It fully undermines the a part of pensions coverage that was presupposed to be the sexiest and with essentially the most speedy affect.”

The proposed guidelines make it simpler for the trustees of well-funded schemes to work with sponsoring employers to return some belongings which might be in extra of what’s required for schemes to fulfill their pension obligations.

DB schemes are funded by employers and their workers and pay fastened pensions to their members relying on how lengthy they labored for an organization and the way a lot they had been paid.

Scheme funding ranges have improved dramatically lately as a result of greater authorities bond yields have elevated anticipated returns on belongings, subsequently decreasing the present accounting worth of future liabilities.

At present, DB scheme surpluses can solely be accessed the place schemes handed a decision by 2016 to retain the facility, below a regulation handed in 2004 by the final Labour authorities. Some schemes had massive deficits and didn’t cross such resolutions.

Beneath the present guidelines, a surplus can be solely accessible if it exceeds the extent wanted for a enterprise to promote its pension scheme to an insurer, often known as a buyout. Guidelines specified by the invoice will decrease this threshold to considered one of “low dependency”, making an estimated £160bn of surplus belongings accessible throughout all schemes in contrast with £68bn on the present buyout foundation.

The foundations are usually not as a result of be in place till the top of 2027, in keeping with the federal government.

“[The government] might be extra aggressive . . . in the event that they bought it by means of in 2026, that would make an even bigger distinction,” stated Joe Dabrowski, deputy director of coverage on the Pensions and Lifetime Affiliation commerce group, noting that the affect would decline over time as extra schemes transfer to buyout.

Consultants stated the estimates that solely a small proportion of the quantity in surplus could be launched mirrored the truth that many pension trustees and firm finance administrators would nonetheless choose to promote their pension belongings and obligations to an insurer to take away danger from firm stability sheets and for administrative ease.

“There’s a actuality that you’re nonetheless in a spot the place most trustees are on the trail to getting schemes to insurance coverage corporations,” stated Gareth Henty, head of UK pensions at consultancy PwC.

A authorities spokesperson stated its proposals would “unlock funds to spice up the financial system, take away limitations to progress and guarantee working individuals and companies are in a position to profit from the chance these belongings convey”.