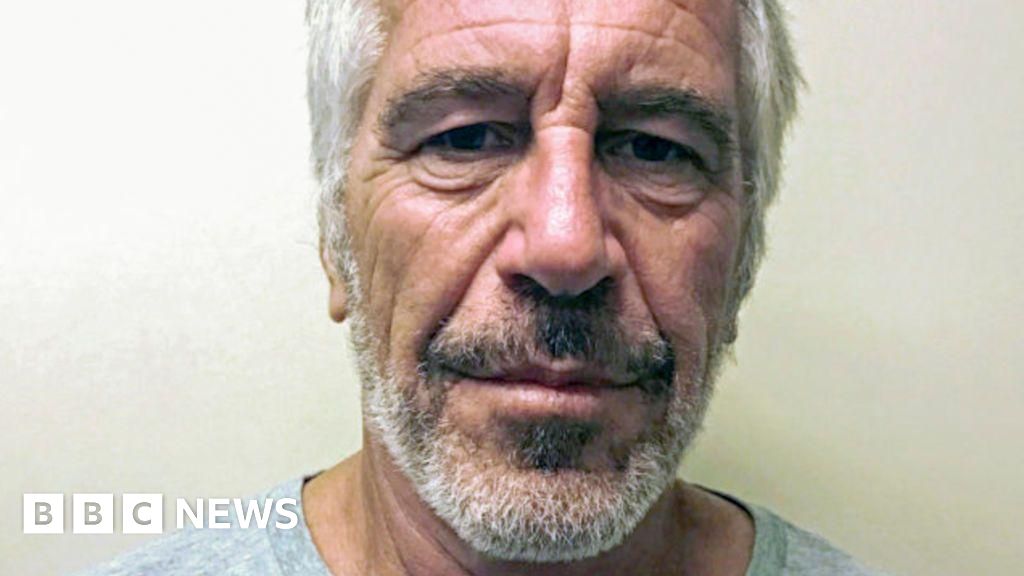

Jeffrey Epstein, the convicted intercourse offender who died by suicide almost six years in the past, invested $40 million in two funds managed by Valar Ventures, a New York-based agency co-founded by Silicon Valley mogul Peter Thiel, in response to a confidential property monetary report obtained by The New York Instances. These investments, made throughout 2015 and 2016, have now grown to an estimated $170 million, making them the most important remaining asset in Epstein’s property.The monetary hyperlink between Epstein and Thiel’s agency had remained undisclosed till now. Valar Ventures focuses on tech-based monetary providers startups, and the agency’s consultant described Epstein in 2014 as a “well-known adviser to world leaders, prime universities and philanthropic organizations.”The property, which at present holds over $200 million in property, has distributed a whole lot of hundreds of thousands in settlements to Epstein’s victims and the US Virgin Islands, the place Epstein maintained a residence. But the substantial returns on the Valar funding are unlikely to profit the roughly 200 victims who beforehand accepted financial settlements, signing releases stopping additional claims towards the property or related people.As a substitute, the funds are anticipated to go to certainly one of Epstein’s former romantic companions and two longtime advisers who’re designated beneficiaries of his property. A confidential doc in regards to the property’s 1953 Belief, the principle automobile for asset distribution, exhibits Epstein supposed to forgive about $19 million in loans, together with some to entities “carefully related” with the property co-executors and advisers Darren Indyke and Richard Kahn.David Boies, a lawyer for a number of victims, criticized federal authorities for his or her lack of pursuit of civil forfeiture actions after Epstein’s dying. “Whereas we’re grateful for the federal government’s prosecution of Epstein and Maxwell, the reality is that, each earlier than and afterwards, the federal government was largely asleep on the change,” Boies stated. Civil forfeiture might have allowed the federal government to grab remaining property property probably usable for sufferer compensation. Nonetheless, an individual aware of the case, quoted by NYT, stated federal prosecutors thought of this however rejected it to keep away from delaying settlement funds.Epstein amassed his wealth by charging excessive charges for tax and property providers to pick out billionaires, together with retail magnate Leslie Wexner and personal fairness investor Leon Black. Black reportedly paid Epstein over $158 million in charges, and Epstein’s Manhattan mansion was as soon as owned by Wexner.Aaron Curtis, talking for Valar, stated the agency “hopes that the eventual distribution of those investments will be put to constructive use by serving to victims transfer ahead with their lives.” Nonetheless, the Valar investments stay illiquid because of typical enterprise capital lock-up intervals, which implies money disbursements to victims or different events are delayed.At his dying, Epstein’s assets- together with investments, properties, paintings, and jewelry- have been valued at round $600 million. The property’s most up-to-date public submitting, as of March 31, lists property exceeding $131 million, together with roughly $50 million in money, although funding values haven’t been up to date since Epstein’s dying.In the meantime, a federal civil lawsuit filed by Boies’ agency seeks to symbolize unsettled victims in a possible class motion towards the property executors. Earlier settlements ranged from $500,000 to $2 million per sufferer. As soon as this lawsuit is resolved, remaining property funds will likely be distributed in response to Epstein’s will, which directs property to the 1953 Belief.