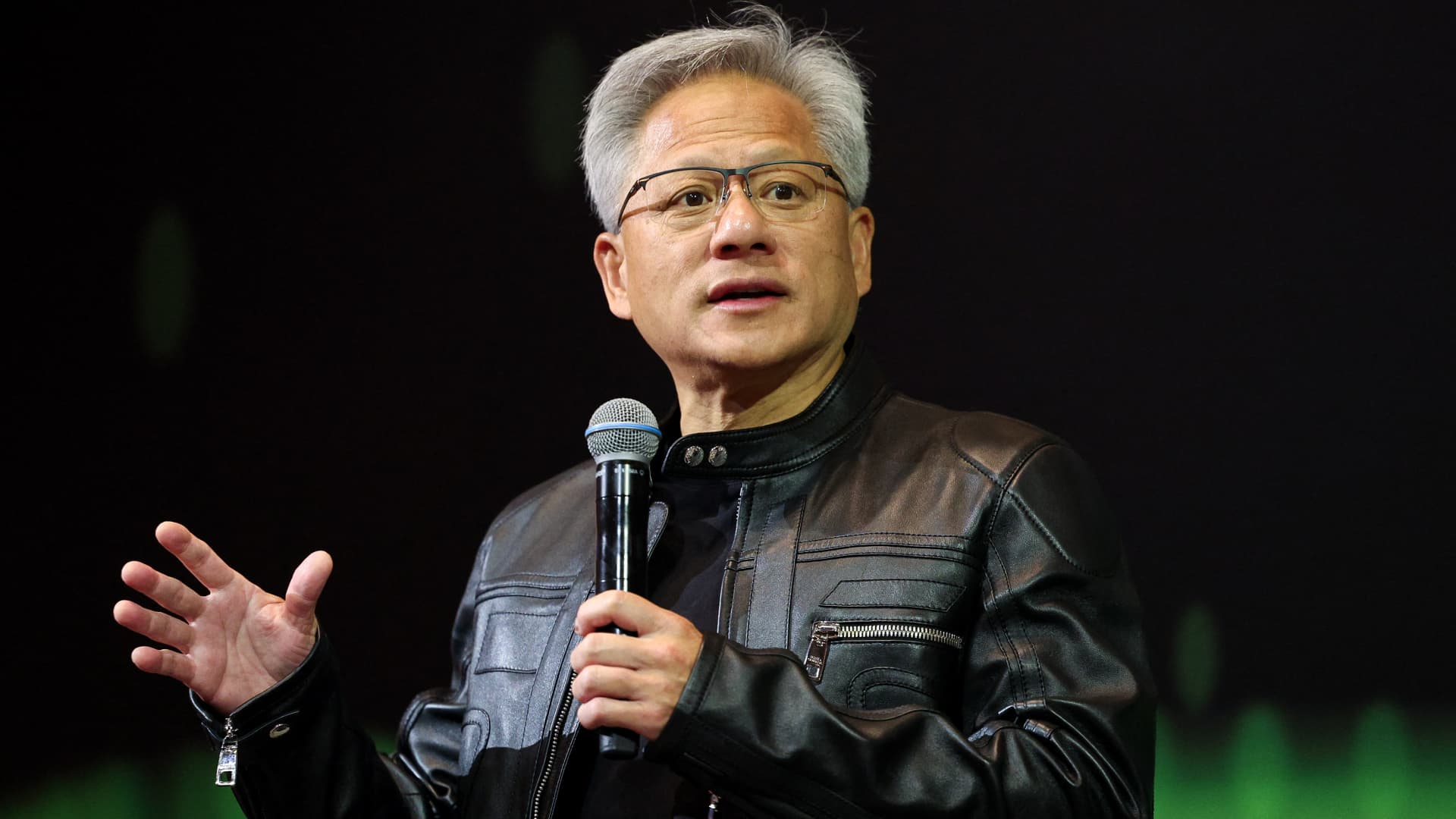

Jensen Huang, co-founder and CEO of Nvidia Corp., speaks throughout a information convention in Taipei on Might 21, 2025.

I-hwa Cheng | Afp | Getty Photos

Changing Nvidia is a tall order. Whereas Chinese language rivals are years behind the corporate’s cutting-edge expertise, many analysts and insiders warn they’re catching up, because of U.S. export restrictions.

U.S. chip restrictions on the sale of superior semiconductor expertise, particularly these utilized in synthetic intelligence, have been rolled out over a number of years, with the preliminary intention of curbing China’s navy development and defending US dominance within the AI business.

Nevertheless, in line with Nvidia CEO Jensen Huang, U.S. semiconductor export controls on China have been “a failure,” inflicting extra hurt to American companies than to China.

Whereas the objectives of chopping again the Chinese language navy’s entry to superior U.S. expertise and sustaining U.S. management in AI seem to have had some success on paper, loopholes and present semiconductor stockpiles in China have difficult these goals, stated Ray Wang, an unbiased tech and chip analyst with a give attention to U.S.-China competitors.

“That is partly why we’re seeing a closing of the hole between Chinese language and U.S. AI capabilities,” added Wang.

A self-inflicted wound?

Leaders of Nvidia and different American chip designers have lengthy lobbied towards chip controls as they fear about shedding profitable enterprise offers. Huang stated on the annual Computex expertise commerce present in Taipei that Nvidia’s GPU market share in China fell to 50% from 95% over the previous 4 years.

Certainly, chip specialists say that the curbs create extra hurt than good for the U.S.

“The results of the controls are twofold. They’ve the impression of lowering the flexibility of U.S. corporations to entry the China market and, in flip, have accelerated the efforts of the home business to pursue better innovation,” stated Paul Triolo, Associate and Senior VP for China at DGA Group.

“You create rivals to your main corporations on the identical time you are chopping them off from a large market in China,” he added.

Whereas Washington’s most complete export controls have been handed throughout former U.S. President Joe Biden’s time period within the White Home, curbs on Huawei and SMIC, China’s largest chipmaker, return to Donald Trump’s first time period in workplace.

On April 15, Nvidia disclosed that new controls, which restricted gross sales of its H20 graphics processing models to China, had led to a $5.5 billion cost towards its income.

Counter-intuitive curbs

The restrictions are anticipated to be a boon for the demand and improvement of native Nvidia alternate options like Huawei, which is working by itself AI chips. In addition they come towards the background of Beijing mobilizing billions as a part of its chip self-sufficiency marketing campaign.

“The underside line is, the controls have incentivized China to turn out to be self-sufficient throughout these provide chains in a means they by no means would have contemplated earlier than,” Triolo stated.

Chinese language AI-related achievements, similar to DeepSeek’s R1 mannequin and information of Huawei chip progress, have led observers to query the effectiveness of chip controls.

In accordance Wang, the unbiased analyst, China’s semiconductor and AI house has seen an acceleration of startups, market alternatives, and AI expertise alongside the restrictions, which has clearly resulted in home improvements.

“I believe the arguments that export controls speed up innovation is sort of legitimate,” Wang stated.

Nivida’s Haung additionally famous these traits in April, telling lawmakers in Washington that the nation has made monumental progress within the final a number of years and is true behind the U.S.

Transferring objective posts?

Nvidia’s H20 chip was designed particularly to adjust to present chip controls previous to the clampdown on exports.

“We aren’t simply speaking about one export management, we’re speaking a couple of collection of export controls that originate from all the best way again in 2019,” stated Wang, noting that the evolving insurance policies have had a few totally different aims.

In the meantime, in what DGA’s Paul Trilio calls a “transferring of the goalposts,” evidently the goals of the restrictions have shifted to an intention to decelerate and include Chinese language AI and semiconductor developments.

“The continued enlargement of the controls, and the dearth of an articulation of what the clear finish sport right here is, has actually created lots of points, and created lots of collateral injury,” Trilio stated, including that it has led extra individuals to query the coverage.

In a assertion earlier this month, the Info Expertise & Innovation Basis, a U.S. suppose tank which has acquired funding from varied expertise corporations, stated in a submit that “the Biden administration’s export management coverage for AI chips has largely been a failure since day one. But, yr after yr, it has doubled down, trying to plug varied loopholes.”

“Whereas [the U.S. government] is actually proper to stop U.S. corporations from promoting superior AI expertise to the Chinese language navy, chopping U.S. corporations off from the whole industrial Chinese language market is a treatment worse than the illness,” Stephen Ezell of ITIF advised CNBC in an electronic mail.

“U.S. export controls have value NVIDIA a minimum of $15 billion in gross sales, and people are revenues the corporate wants to have the ability to earn to spend money on future generations of innovation.”