Michele Bullock, governor of the Reserve Financial institution of Australia (RBA), speaks throughout a information convention on the financial institution’s head workplace in Sydney, Australia, on Tuesday, Apr. 1, 2025.

Bloomberg | Bloomberg | Getty Photographs

Australia’s central financial institution minimize its coverage charge by 25 foundation factors to the bottom in two years as inflation issues within the nation proceed to recede, giving room for the financial institution to ease financial coverage.

The Reserve Financial institution of Australia minimize the benchmark charge to three.85%, its lowest stage since Could 2023, according to expectations from economists polled by Reuters.

Whereas the RBA stated that the upside dangers to inflation had diminished “considerably,” the uncertainty over international commerce coverage will possible proceed to weigh on the economic system.

“Headline inflation is anticipated to extend over the second half of 2025 as momentary authorities subsidies to households are unwound, earlier than returning to across the midpoint of the goal vary later within the forecast interval,” the central financial institution stated in its financial coverage assertion.

Australia’s inflation has been on a downtrend, with the latest headline inflation determine coming in at a four-year low of two.4% within the first quarter of 2025. The RBA’s goal vary for inflation is between 2% and three%.

Nevertheless, the central financial institution cautioned that family consumption could get better at a slower tempo than beforehand anticipated, leading to subdued development in total demand and a sharper deterioration within the job market.

“There’s a good likelihood that [the RBA] will minimize charges additional than we’re at the moment anticipating [in] this cycle,” Abhijit Surya, senior APAC economist at Capital Economics, stated in a notice.

Surya, nonetheless, believes that the financial institution overestimated the extent to which its economic system shall be damage by the widespread commerce tensions.

The Australian economic system has seen considerably of a turnaround, with the latest GDP studying exhibiting a 1.3% year-on-year growth within the fourth quarter and marking its first growth since September 2023.

Nevertheless, analysts, forward of the RBA assembly, have highlighted draw back dangers for the Australian economic system attributable to international commerce tensions and uncertainty across the home economic system.

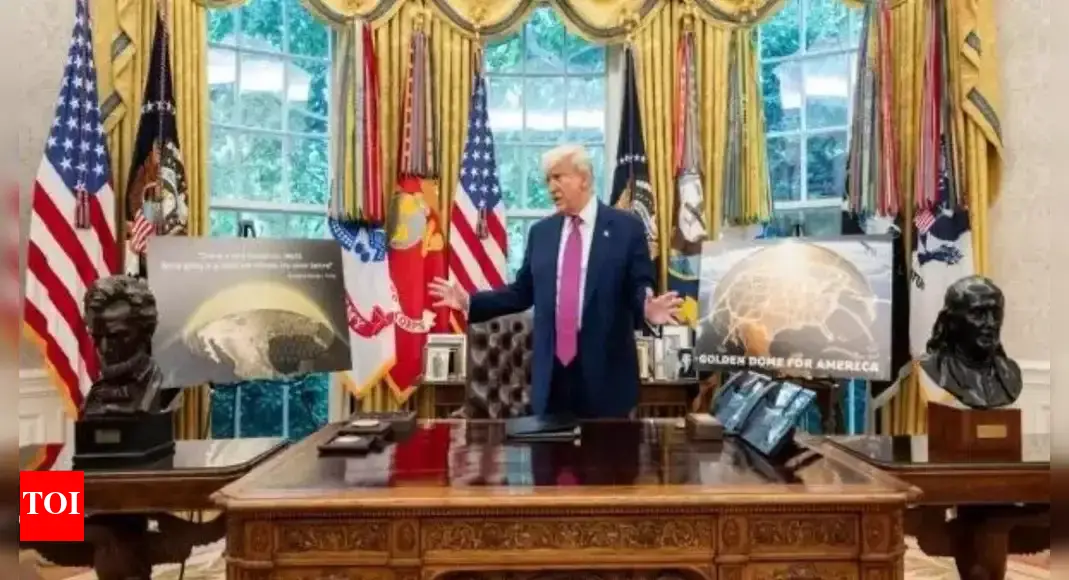

In a Could 16 notice, HSBC analysts famous that “the worldwide economic system and monetary markets have had tumultuous occasions” for the reason that RBA’s final assembly on April 1, together with the imposition — and subsequent suspension — of U.S. President Donald Trump’s “Liberation Day” tariffs.

The analysts forecasted a “modest destructive development affect” on the nation, and stated that the market shocks are possible barely disinflationary for Australia.

This is because of weaker anticipated international development and commerce diversion of manufactured items from China into non-U.S. markets, together with Australia.

Carl Ang, Fastened Revenue Analysis Analyst at MFS Funding Administration, additionally famous in a Could 15 notice that draw back dangers and uncertainty round Australia’s financial outlook have elevated considerably, attributable to “Liberation Day” and international commerce insurance policies.

This may possible immediate a “tangibly dovish pivot from the RBA,” he stated, forecasting that the central financial institution will attain a terminal charge of three.1% in early 2026.