A excessive credit score restrict could also be handy, but it surely makes overspending simple.

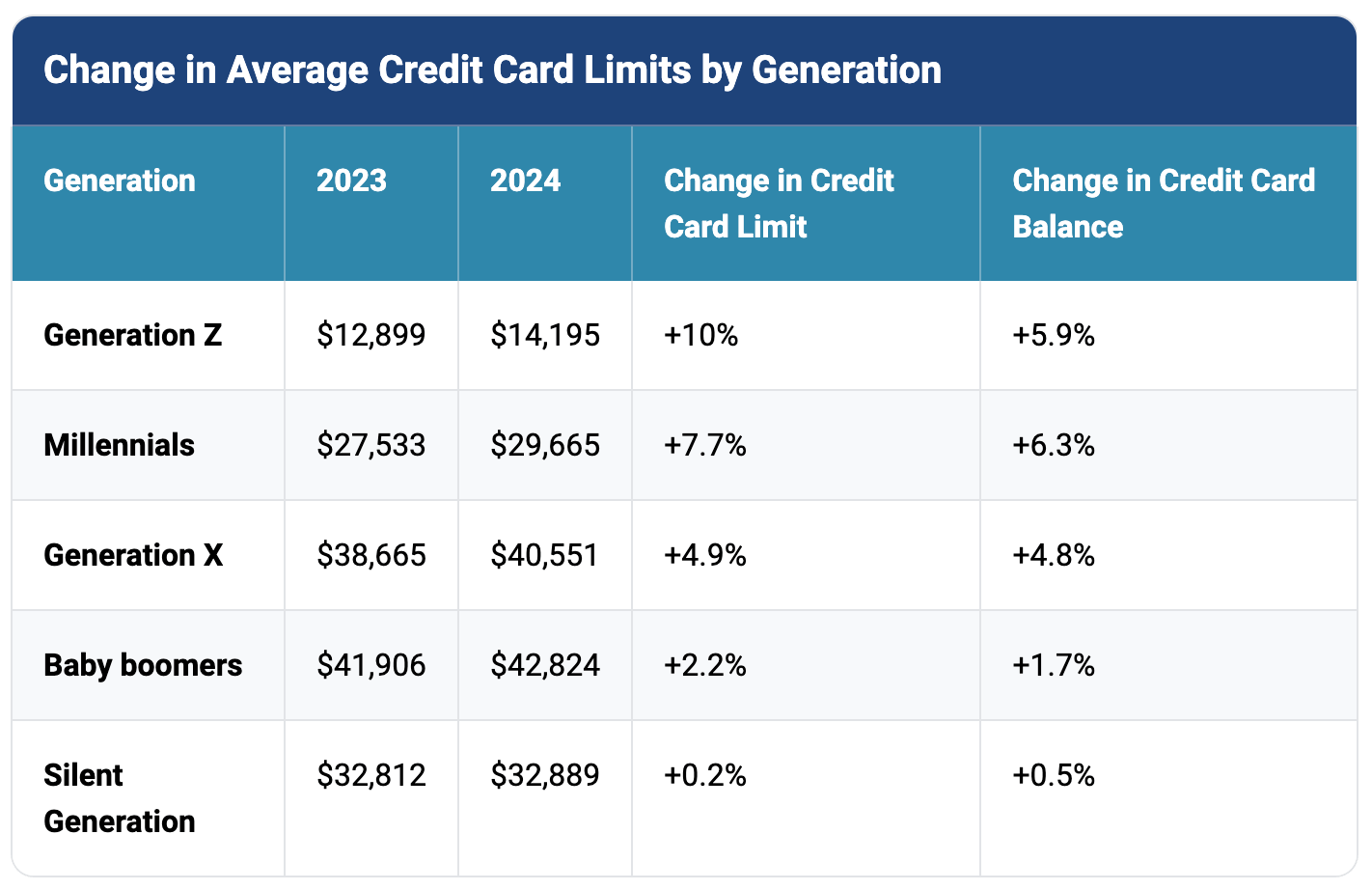

Reply: $14,195

Questions:

- A credit score restrict is the utmost you possibly can borrow with a bank card. What are the professionals and cons of getting a card with a excessive credit score restrict?

- Why do you suppose credit score limits have a tendency to extend with age (up to some extent)?

- Consultants suggest utilizing lower than 30% of your accessible credit score. Based mostly on that guideline, what’s the most stability for the common Gen Z card holder?

Listed below are the ready-to-go slides for this Query of the Day that you should use in your classroom.

Behind the numbers (Experian):

“Whereas lenders look like accommodating the extra demand for credit score for different generations, Technology X, seems to be in a squeeze. Though their common balances grew by 4.8% in 2024, collectively they’ve solely acquired 4.9% in extra credit score—maybe a sign that they’ve hit a ceiling.”

About

the Creator

Kathryn Dawson

Kathryn (she/her) is worked up to affix the NGPF group after 9 years of expertise in schooling as a mentor, tutor, and particular schooling instructor. She is a graduate of Cornell College with a level in coverage evaluation and administration and has a grasp’s diploma in schooling from Brooklyn Faculty. Kathryn is wanting ahead to bringing her ardour for accessibility and academic justice into curriculum design at NGPF. Throughout her free time, Kathryn loves embarking on cooking initiatives, strolling round her Seattle neighborhood along with her canine, or lounging in a hammock with a guide.