A Bengaluru-based tech skilled has gone viral on Reddit after sharing his story of rising from a ₹2.4 LPA job to constructing a internet price of over ₹1 crore earlier than the age of 30.

In an in depth Reddit publish titled “Milestone Verify: Began at 2.4 LPA at 23, Achieved 1cr earlier than turning 30,” the nameless person narrated his journey, which concerned no household wealth, no shortcuts, and loads of classes.

Humble beginnings and a window seat precedence

“I come from a low-income household. My dad earned round ₹7–8K/month, my mother possibly ₹5–7K,” he wrote. Cash was all the time tight, however he ended up in an honest non-public college with a payment of ₹1,200/month. “Miracles occur,” he mentioned.

Regardless of being lazy, he scored 89% in each tenth and twelfth grades, balancing research with cricket. After bombing the JEE resulting from no teaching, he joined a neighborhood non-public engineering school, primarily as a result of the faculty bus began from his space. “Assured window seat for 4 years. Priorities, proper?”

The household struggled to afford school charges. Mortgage purposes had been rejected, however relations helped.

Faculty to code: Discovering ardour

Initially an Electronics and Communications pupil, he spent most of his school life constructing electronics tasks for enjoyable. Regularly, he shifted focus from electronics to programming.

By the ultimate yr, he was among the many 35 college students chosen from over 400 candidates by a identified service-based firm.

Bengaluru job blues: Surviving on ₹15K/month

In 2018, he began his first job in Bengaluru with a wage of ₹2.4 LPA (₹15K/month).

“I used to be terrified. How do you survive in a metropolis like Bangalore with that sort of wage?” he recalled. Residing in a 3-sharing PG and stretching ₹500 like ₹5,000 helped. He managed to avoid wasting ₹2,000/month and loved the method.

After 1.5 years, he felt prepared to maneuver on.

COVID disappointment and a rest room name breakthrough

In early 2020, he cleared all rounds at a Huge 4 agency with an anticipated wage of ₹6–8 LPA. Then COVID hit, and the corporate ghosted him.

In April 2021, whereas in the bathroom, he acquired a callback for a job interview. Anticipating ₹6 LPA, he was shocked when the HR mentioned, “We’ll pay you way more than that.”

It was a ₹12 LPA supply. However he needed to persuade his present employer to launch him inside 60 days.

Fortunately, since he was on the bench, his supervisor agreed to launch him in 15 days. He joined the brand new healthcare startup in April 2021.

Nice Resignation: 13 provides in hand

In 2022, as teammates left through the Nice Resignation, he started making use of once more.

By March 2022, he had 13 job provides. Some nice, some “purple flags dipped in glitter.” He joined a product-based agency providing ₹32 LPA with inventory choices. His complete compensation grew to ₹45–50 LPA over time.

A easy life with strategic spending

He lives merely, enjoys journey and Zomato, and nonetheless makes use of an Android telephone from 2019. Most garments are workplace tees and low-cost denims.

“I’ve by no means felt the urge to chase luxurious,” he wrote. Sneakers? ₹250, with ₹1000 soles. “Gotta shield these knees, not the model picture.”

The funding journey: From FDs to SIPs

Between 2018 and 2020, he saved his financial savings in a wage account. His first funding? A ₹3.5 lakh FD with month-to-month payouts.

He later found private finance through YouTube (particularly Pranjal Kamra). He began SIPs in 2021 with ₹5K every in PPFAS Flexi Cap and ELSS. Regardless of unfavorable returns early on, he remained invested.

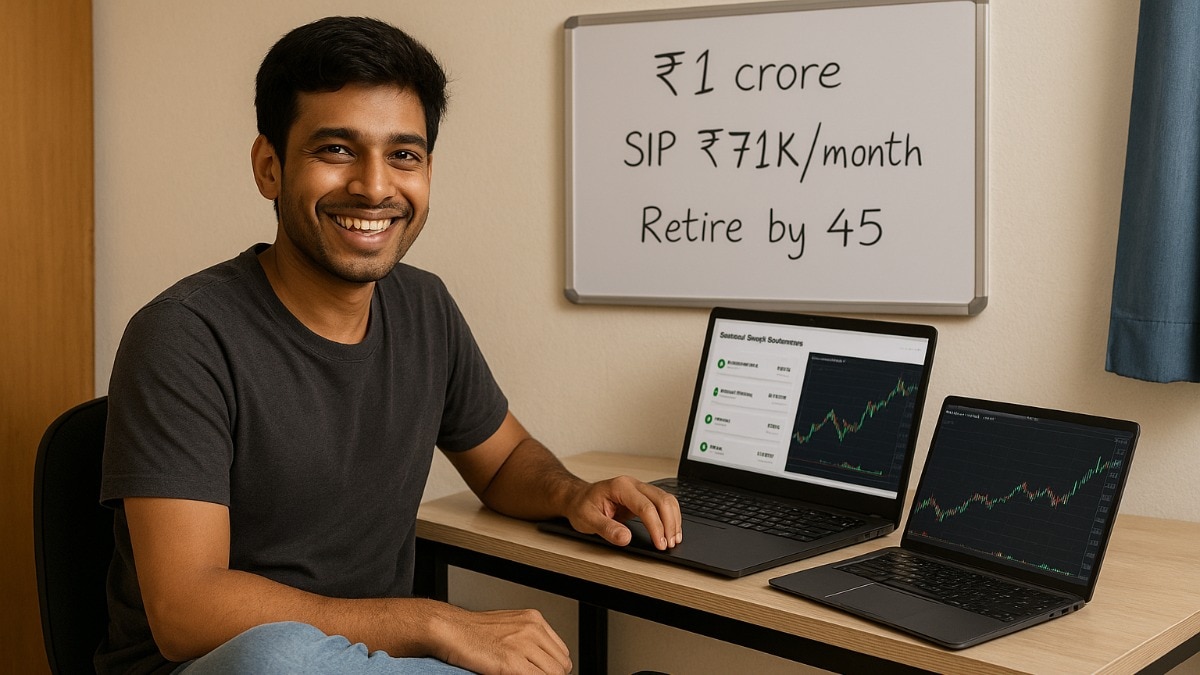

By 2025, he invests ₹71K/month through SIPs. His take-home is ₹1.6L/month. He helps household, pays hire, spends on meals and journey.

His unique FD was transformed to a normal maturity FD, now his emergency fund.

He purchased time period insurance coverage and well being protection: ₹25L for himself and ₹10L for fogeys.

Internet price snapshot

He started monitoring his internet price in 2023. Here is the way it developed:

| Asset | 2023 | 2024 | 2025 |

| Mutual Funds | ₹13L | ₹28L | ₹39L |

| Comp Shares | ₹6.7L | ₹19.6L | ₹43.1L |

| Shares | ₹0.68L | ₹1.05L | ₹0.9L |

| FD | ₹2.5L | ₹2.5L | ₹2.8L |

| PF | ₹4.7L | ₹6.95L | ₹9.38L |

| PPF | ₹3.18L | ₹4.33L | ₹5.12L |

| Money | ₹0.8L | ₹0.8L | ₹0.5L |

| Whole | ₹31.6L | ₹63.2L | ₹100.8L |

The following aim: Early retirement

He plans one other job change inside 1–2 years. The last word aim? Retire by 45.

“Hopefully by then, my investments and financial savings needs to be sufficient. After that, I’d wish to deal with different issues—well being, journey, hobbies, possibly even serving to others who’re the place I as soon as was.”

His last phrases: “You don’t have to have all of it found out. Be frugal the place it issues, splurge the place it counts, and by no means underestimate the ability of compounding—monetary and career-wise.”

“Keep humble. Life has a humorous means of protecting you grounded. Like your ₹250 sneakers falling aside whereas your inventory portfolio quietly climbs.”