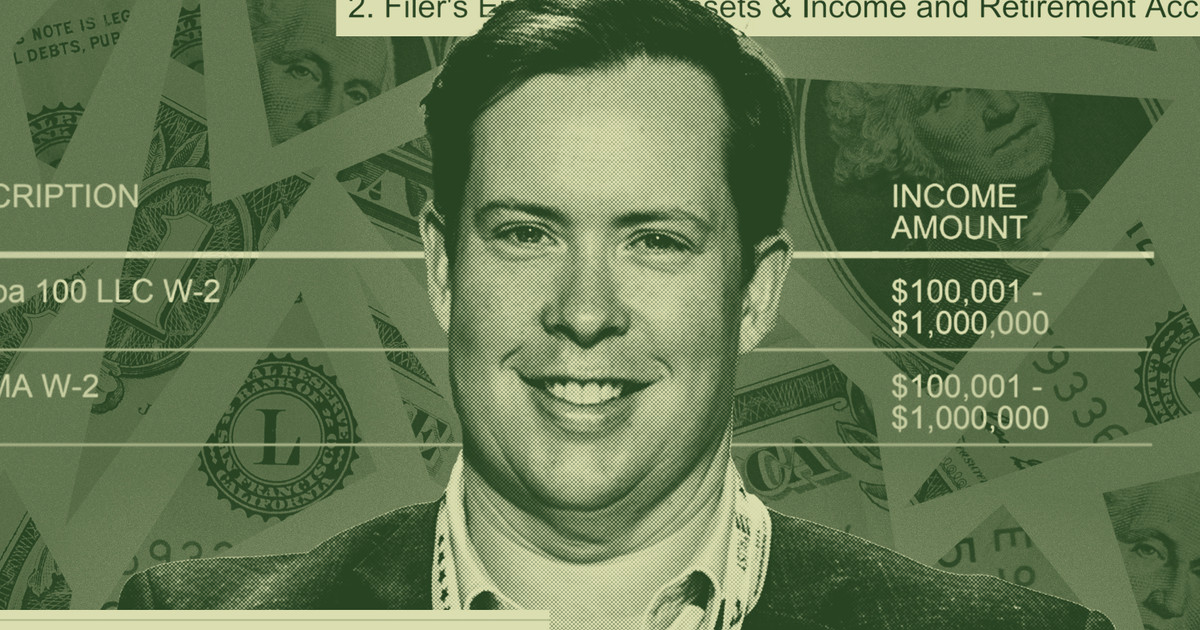

One in every of Elon Musk’s workers is incomes between $100,001 and $1 million yearly as a political adviser to his billionaire boss whereas concurrently serving to to dismantle the federal company that regulates two of Musk’s greatest firms, based on courtroom data and a monetary disclosure report obtained by ProPublica.

Ethics consultants mentioned Christopher Younger’s twin position — working for a Musk firm in addition to the Division of Authorities Effectivity — possible violates federal conflict-of-interest rules. Musk has publicly referred to as for the elimination of the company, the Client Monetary Safety Bureau, arguing that it’s “duplicative.’’

Authorities ethics guidelines bar workers from doing something that “would trigger an affordable individual to query their impartiality” and are designed to forestall even the looks of utilizing public workplace for personal acquire.

Courtroom data present Younger, who works for a Musk firm referred to as Europa 100 LLC, was concerned within the Trump administration’s efforts to unwind the patron company’s operations and fireplace most of its workers in early February.

Younger’s association raises questions of the place his loyalty lies, consultants mentioned. The dynamic is very regarding, they mentioned, provided that the CFPB — which regulates firms that present monetary providers — has jurisdiction over Musk’s electrical automobile firm, Tesla, which makes auto loans, and his social media website, X, which introduced in January that it was partnering with Visa on cell funds.

The world’s richest man has in flip made no secret of his need to put off the bureau, posting simply weeks after Donald Trump’s election victory, “Delete CFPB. There are too many duplicative regulatory companies.”

“Musk clearly has a battle of curiosity and may recuse,” mentioned Claire Finkelstein, who directs the Heart for Ethics and the Rule of Legislation on the College of Pennsylvania. “And subsequently an worker of his, who’s answerable to him on the private aspect, exterior of presidency, and who stands to maintain his job provided that he helps Musk’s private pursuits, shouldn’t be working for DOGE.”

Younger, a 36-year-old Republican guide, has been lively in political circles for years, most not too long ago serving because the marketing campaign treasurer of Musk’s political motion committee, serving to the tech titan spend greater than 1 / 4 billion {dollars} to assist elect Trump.

Earlier than becoming a member of Musk’s payroll, he labored as a vp for the Pharmaceutical Analysis and Producers of America, the commerce affiliation representing the pharmaceutical business’s pursuits, his disclosure exhibits. He additionally labored as a subject organizer for the Republican Nationwide Committee and for former Louisiana Gov. Bobby Jindal, the New York Instances reported.

Younger was appointed a particular governmental worker within the U.S. Workplace of Personnel Administration on Jan. 30 and dispatched to work within the CFPB in early February, based on courtroom data and his disclosure kind. Somebody together with his place may very well be making as a lot as $190,000 a yr in authorities wage, paperwork obtained by Bloomberg present. On the similar time, Younger collects a wage as an worker of Musk’s Texas-based Europa 100 LLC, the place, based on his disclosure report, his duties are to “advise political and public coverage.”

Past that description, it’s not clear what, precisely, Younger does at Europa 100 or what the corporate’s actions are.

It was created in July 2020 by Jared Birchall, a former banker who runs Musk’s household workplace, Excession LLC, based on state data. The corporate has been used to pay nannies to at the very least a few of Musk’s kids, based on a 2023 tabloid report, and, together with two different Musk entities, to facilitate tens of hundreds of thousands of {dollars} in marketing campaign transactions, marketing campaign finance stories present.

As a particular authorities worker, Younger can preserve exterior employment whereas serving for a restricted period of time. However such authorities employees are nonetheless required to abide by legal guidelines and guidelines governing conflicts of curiosity and private and enterprise relationships.

Cynthia Brown, the senior ethics counsel at Residents for Duty and Ethics in Washington, which has sued the administration to supply a variety of public data documenting DOGE’s actions, mentioned that Younger’s authorities work seems to learn his personal sector employer.

“Which hat are you carrying whilst you’re serving the American individuals? Are you doing it for the pursuits of your exterior job?” she requested.

Along with his position at Europa 100, Younger reported different ties to Musk’s personal companies. He affirmed in his disclosure kind that he’ll “proceed to take part” in a “outlined contribution plan” sponsored by Excession, the Musk residence workplace, and that he has served since February as a “vp” of United States of America Inc., one other Musk entity organized by Birchall, the place he additionally advises on “political and public coverage,” the data present. Whereas he lists the latter amongst “sources of compensation exceeding $5,000 in a yr,” the precise determine is just not disclosed.

Younger didn’t return a name and emails searching for remark. The CFPB, DOGE and the White Home didn’t reply to requests for remark.

Musk didn’t reply to an electronic mail searching for remark, and Birchall didn’t return a name left at a quantity he lists in public formation data. A lawyer who helped kind United States of America Inc. hung up when reached for remark and hasn’t responded to a subsequent message. Requested about how his enterprise pursuits and authorities work might intersect, Musk mentioned in a February interview that, “I’ll recuse myself if it’s a battle.”

The revelation of Younger’s obvious violation of federal requirements of conduct follows a collection of ProPublica tales documenting how one other DOGE aide helped perform the administration’s makes an attempt to implement mass layoffs on the CFPB whereas holding as a lot as $715,000 in inventory that bureau workers are prohibited from proudly owning — actions one professional referred to as a “fairly clear-cut violation” of the federal legal conflict-of-interest statute. The White Home has defended the aide, saying he “didn’t even handle” the layoffs, “making this complete narrative an outright lie.” A spokesperson additionally mentioned the aide had till Could 8 to divest, although it isn’t clear whether or not he did and the White Home hasn’t answered questions on that. “These allegations are one other try to diminish DOGE’s essential mission,” the White Home mentioned. Following ProPublica’s reporting, the aide’s work on the CFPB ended.

On Monday, a gaggle of 10 good authorities and shopper advocacy teams, citing ProPublica’s protection, despatched a letter to the performing inspector normal of the CFPB, asking him to “swiftly examine these clear conflicts of curiosity violations of Trump Administration officers performing in their very own private monetary curiosity.”

ProPublica has recognized practically 90 officers assigned to DOGE, although it’s unclear what number of, if any, have potential conflicts. Authorities companies have been gradual to launch monetary disclosure types. However Finkelstein mentioned the instances reported by ProPublica name into query the motivation behind DOGE’s efforts to undo the patron watchdog company.

“It issues as a result of it implies that the officers who work for the federal government, who’re purported to be devoted to the pursuits of the American individuals, are usually not essentially centered on the great of the nation however as a substitute could also be centered on the great of themselves, self enrichment, or attempting to please their boss by specializing in enriching their bosses and rising their portfolios,” she mentioned.

Unionized CFPB employees have sued the CFPB’s performing director, Russell Vought, to cease his makes an attempt to drastically scale down the bureau’s workers and its operations. Since taking workplace, the Trump administration has twice tried to fireside practically the entire company’s workers, tried canceling practically all of its contracts and instituted stop-work mandates which have stifled just about all company work, together with investigations into firms, ProPublica beforehand reported.

The events will seem earlier than an appeals courtroom this Friday for oral arguments in a case that may decide simply how deeply Vought can lower the company whereas nonetheless guaranteeing that it carries out dozens of mandates Congress tasked it with when lawmakers established the bureau within the wake of the 2008 monetary disaster.

The courtroom data produced within the litigation provide a window into the position Younger performed in gutting the CFPB through the administration’s first try to unwind the bureau starting in early February.

He was dispatched to the CFPB’s headquarters on Feb. 6, simply two days after Treasury Secretary Scott Bessent, then the company’s performing director, instructed the workers and contractors to cease working. The next day, Younger and different DOGE aides got entry to nonclassified CFPB techniques, courtroom data present. That very same day, Musk posted “CFPB RIP” with a headstone emoji.

On Feb. 11 and 12, Younger was included on emails with prime company officers. A type of messages mentioned the cancellation of greater than 100 contracts, an act {that a} contracting officer described in a sworn affidavit as together with “all contracts associated to enforcement, supervision, exterior affairs, and shopper response.” One other message concerned find out how to switch to the Treasury Division a number of the greater than $3 billion in civil penalties that the bureau has collected from firms to settle shopper safety instances, a transfer that might deny harmed shoppers compensation. A 3rd mentioned the phrases of an settlement that will permit for the mass layoff of staffers, courtroom data present.

In his monetary disclosure kind, which he signed on Feb. 15, Younger listed his employment by Musk’s Europa 100 as lively, starting in August 2024 by the “current.”

Then, in early March, because the authorized struggle over the administration’s cuts performed out earlier than a federal decide, Younger despatched the CFPB’s chief working officer a message about forthcoming firings, referred to as a “discount in drive,” or RIF, in authorities parlance. Within the electronic mail, he requested whether or not officers have been “ready to implement the RIF” if the decide lifted a short lived keep, based on a March district courtroom opinion that has for the second stopped a lot of the administration’s proposed cuts.

Along with his employment, Younger’s disclosure presents one other potential battle.

He additionally lists proudly owning as a lot as $15,000 in Amazon inventory, an organization that’s on the bureau’s “Prohibited Holdings” record. Company workers are forbidden from having such investments, and ethics consultants have mentioned that collaborating in an company motion that might enhance the inventory’s worth — comparable to stripping the CFPB of its workers — constitutes a violation of the legal conflict-of-interest statute.

Younger hasn’t responded to questions on that both.

Al Shaw contributed reporting and Alex Mierjeski contributed analysis.