Wish to keep on high of the science and politics driving biotech right now? Enroll to get our biotech e-newsletter in your inbox.

Good morning, there’s been quite a lot of dialogue recently about how the U.S. can keep aggressive in science, biomedical innovation, and drug improvement. We’ve bought a number of items of reports related to that problem right now.

Trump order goals to spice up U.S. drug manufacturing

President Trump yesterday signed an govt order geared toward making it simpler and quicker for drug corporations to fabricate their merchandise within the U.S.

The order features a mandate for the FDA to scale back the period of time it takes to approve home pharmaceutical manufacturing crops, although particular objectives weren’t talked about within the order.

The FDA was additionally instructed to extend charges for overseas manufacturing crops, beef up its enforcement of overseas producers of lively pharmaceutical substances, and think about publicizing an inventory of services that don’t adjust to inspection and manufacturing necessities.

The order was issued because the business braces for pharmaceutical tariffs, which, notably, the order didn’t point out.

Learn extra from STAT’s Ed Silverman.

Vertex stumbles because it seems to new section of progress

Vertex Prescribed drugs reported disappointing first-quarter earnings yesterday. It noticed weaker-than-expected gross sales of its cystic fibrosis medication and little or no contributions from a gene remedy for sickle cell illness and a lately launched ache medication.

Vertex additionally mentioned it paused an early research involving a intently watched, inhaled, mRNA-based remedy for cystic fibrosis on account of a “tolerability problem.”

The outcomes recommend that the corporate, which has been buying and selling close to its all-time, may have an extended approach to go earlier than its subsequent leg of progress.

Recursion cuts almost half of its pipeline

From my colleague Allison DeAngelis: When AI drug firm Recursion Prescribed drugs merged with Exscientia final 12 months, it gave the corporate an inflow of money — all the time useful to have, on this languorous biotech winter — and a pipeline of 11 medication in medical and preclinical improvement. However yesterday, Recursion revealed that it’s culling almost half of its pipeline.

The firm axed three medical applications — one in all which, a drug for cerebral cavernous malformation, underwhelmed in Part 2 knowledge reported final 12 months. The corporate had steered buyers’ focus to its next-generation compounds, together with a therapy for the frequent bacterial an infection referred to as C. difficile. However that drug was additionally discontinued yesterday, together with a drug for neurofibromatosis and a preclinical drug.

Recursion can also be pausing work on a drug for strong tumors.

“Since we did the mixing, the portfolio has grown and we mentioned that we might really make disciplined selections to sharpen our focus,” the corporate’s R&D and business chief, Najat Khan, mentioned through the firm’s first quarter earnings name. “These strikes mirror a transparent dedication to a excessive bar on differentiated medication… whereas additionally contributing to capital effectivity by reallocating these treasured assets in the direction of the best potential alternatives.”

Buyers reacted negatively to the information. The corporate’s inventory fell greater than 16% yesterday. It’s additionally a setback in Recursion’s ambition to develop 100 medication — a objective the CEO stood by final 12 months.

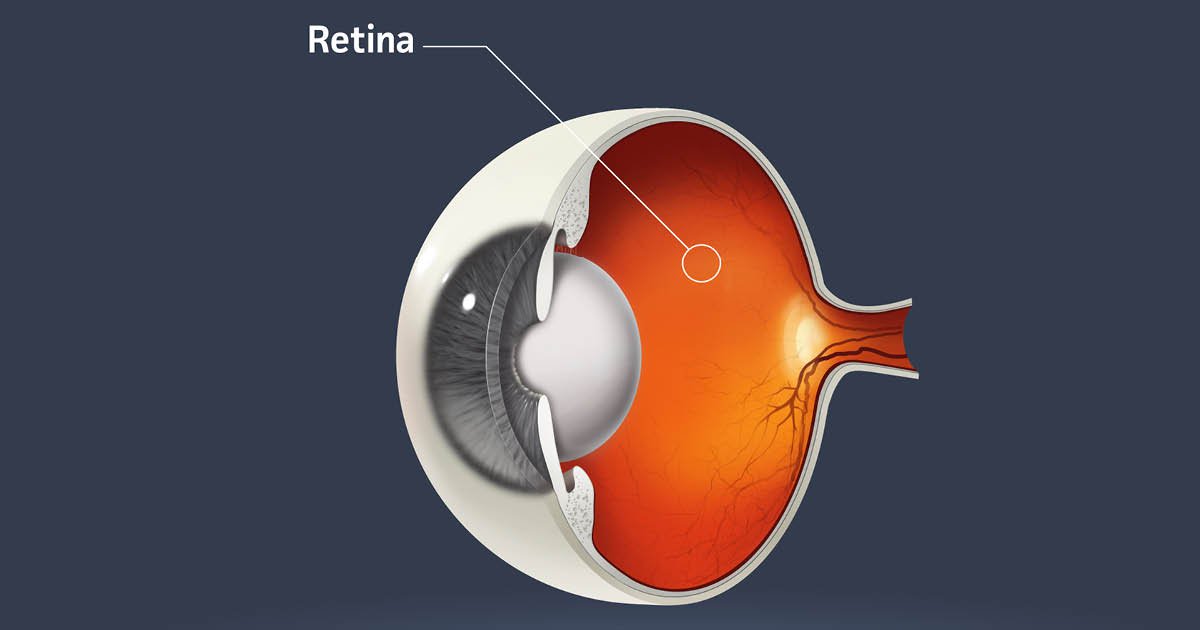

One other gene remedy for imaginative and prescient loss fails

From my colleague Jason Mast: J&J mentioned late final week {that a} gene remedy it was growing for a uncommon type of imaginative and prescient loss failed in a medical trial. Though sufferers with X-linked retinitis pigmentosa who obtained the remedy have been, after a 12 months, higher capable of navigate a maze than those that obtained a sham injection, the distinction was not statistically important, the corporate mentioned in an replace to suppliers.

The failure for J&J, which purchased the therapy from a biotech for $130 million in “upfront and near-term milestone funds” in 2023, provides to a rising record of disappointments for eye illness gene therapies.

When Spark Therapeutics’ Luxturna, designed to deal with one other type of hereditary blindness, was OK’d in 2017 as the primary FDA-approved gene remedy, it sparked hopes that related expertise could possibly be used to deal with doubtlessly a whole bunch of various eye problems. But right now Luxturna stays the one ocular gene remedy in the marketplace.

Biogen spent $800 million in 2019 after which failed in the identical illness, together with a situation referred to as choroideremia. A gene-editing therapy from Editas failed. Different medication have proven some promising early knowledge, however funding has been restricted by the rarity of most inherited types of imaginative and prescient loss.

Biopharma execs stress the necessity for NIH funding

Because the Trump administration makes cuts each to the funding that NIH offers out to establishments and to the NIH itself, a number of biopharma executives yesterday spoke of the significance of sustaining strong public funding to make sure the U.S. maintains aggressive in biomedical innovation.

Amgen’s chief scientific officer, Jay Bradner, mentioned on a panel on the the Milken Institute World Convention that funding from the NIH “is the very basis that every one of our medicines are constructed from.” It fuels primary science analysis, and so it acts as “a drive multiplier in a means that analysis and improvement funding and personal business actually can’t be,” he mentioned.

“At this second of unprecedented alternative, we will’t take our foot off the gasoline pedal. We’ll lose our aggressive edge,” Bradner added.

Neil Kumar, CEO of BridgeBio, mentioned he thinks it’s value reassessing how NIH funding is distributed to completely different universities, on condition that it appears extra funding has been concentrated in choose establishments. However, he additionally mentioned, “we’d like the magnitude of capital to stay the identical. Alternatives from it will likely be profound.”

These feedback got here as researchers expertise disruptions on the NIH Scientific Middle, a hospital that goals to run trials for the hardest-to-treat illnesses, my colleagues report. Learn extra on that right here.

Gottlieb’s plan to stem Chinese language drug licensing offers

U.S. drugmakers are more and more licensing medication from China, and as a way to cease this shift, U.S. regulators ought to ease the necessities for corporations to have the ability to begin medical testing, Scott Gottlieb, former FDA commissioner, writes in a brand new opinion piece.

One of many greatest hurdles for drug corporations is the animal testing that the FDA requires earlier than Part I research, Gottlieb says. Whereas he helps the current transfer by present commissioner Marty Makary to section out animal testing, he additionally expresses concern that the company received’t have the ability to develop new various instruments to evaluate medication given current cuts to the FDA’s workforce.

“The crucial to modernize early-stage drug improvement — to make sure that groundbreaking drug discovery stays within the U.S. reasonably than migrating to China — is colliding head-on with an impulse to slash the very authorities workforce able to spearheading these reforms,” he writes.

Extra reads