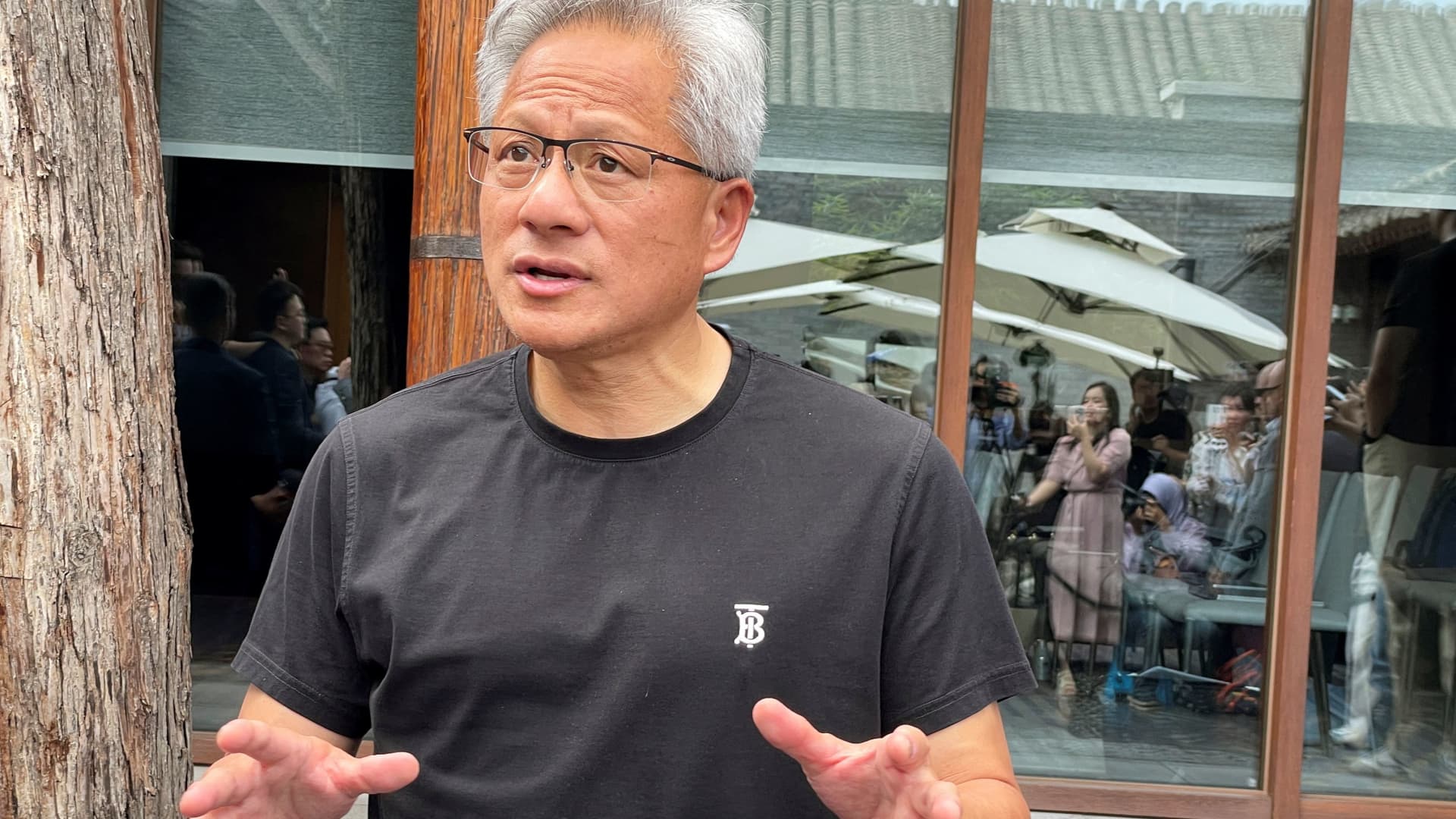

A Hugo Boss retailer in Berlin, Germany, on Tuesday, April 25, 2023.

Bloomberg | Getty Photos

Shares of Hugo Boss jumped on Tuesday after it posted a lower-than-feared decline in first-quarter gross sales and reiterated its full-year steering regardless of macroeconomic and tariff uncertainty.

The high-end German retailer mentioned revenues fell 2% on a forex adjusted foundation over the three month interval to 999 million euros ($1.13 billion), barely forward of the 979 million euros forecast by analysts in an LSEG ballot.

Shares rose as a lot as 8.8% on the information. The inventory was final seen buying and selling up 5.13% at round 10:30 a.m. London time.

Weaker gross sales had been led primarily by mushy demand within the Asia-Pacific area, and particularly “ongoing subdued client demand in China,” which the corporate attributed to a extra unsure client outlook.

“Following a robust end to 2024, our efficiency within the first quarter of 2025 was affected by the rising macroeconomic uncertainty, which impacted international client sentiment and our business,” CEO Daniel Grieder mentioned in a press release.

The group nonetheless confirmed its 2025 outlook, forecasting full-year gross sales to be according to final yr’s at between 4.2 billion euros and 4.4 billion euros.

It added that it’s persevering with to observe the financial outlook, after Grieder famous in March that international commerce tensions had already had a visual impression on first-quarter demand.

“We’re intently monitoring macroeconomic developments and stay vigilant in gentle of the elevated uncertainties, together with the present tariff discussions,” he added.

Navigating U.S. tariffs

Shopper items corporations have been assessing the possibly disruptive impression of U.S. tariffs on international provide chains and client confidence, with a number of corporations flagging the probability of forthcoming worth hikes.

The U.S. is Hugo Boss’ largest single market, accounting for about 15% of group revenues, although it has no home U.S. manufacturing. Nearly half (40%) of the group’s exports to the U.S. derive from Europe, whereas a “mid-single-digit proportion” of products are sourced from China, Grieder informed an earnings name on Tuesday.

The CEO mentioned that client confidence within the U.S. “has actually diminished” however that the state of affairs round tariffs was altering every day and that it was “nonetheless too early to attract remaining conclusions.” He additionally famous that uncertainty round U.S. recession dangers and immigration coverage had dampened each home and vacationer spend.

Grieder mentioned the corporate is pursuing a number of strategic steps to navigate the potential impression of tariffs. These embody the redirecting of merchandise coming from China to the U.S. and substitute with merchandise from different markets, optimizing its international sourcing footprint and evaluating demand-sensitive worth changes.

In a notice Tuesday, Citi analysts wrote that any “main change within the exterior political or financial atmosphere” that immediately or not directly impacts client confidence would pose a “threat” to Hugo Boss’ gross sales efficiency.

Hugo Boss has been pushing forward with its strategic overhaul agenda in recent times because it seeks to revive waning client demand, which Grieder mentioned had contributed to its barely improved first quarter efficiency.

Yanmei Tang, analyst at Third Bridge, mentioned the group had efficiently expanded its attraction past formal put on, pointing to enhancements in retailer codecs, product diversification and engagement with youthful shoppers.

“Nonetheless, areas like womenswear stay a weak spot, with no standout merchandise or a transparent technique rising,” she wrote in a notice, including that acquisition of a longtime feminine vogue model may assist speed up the group’s development agenda.