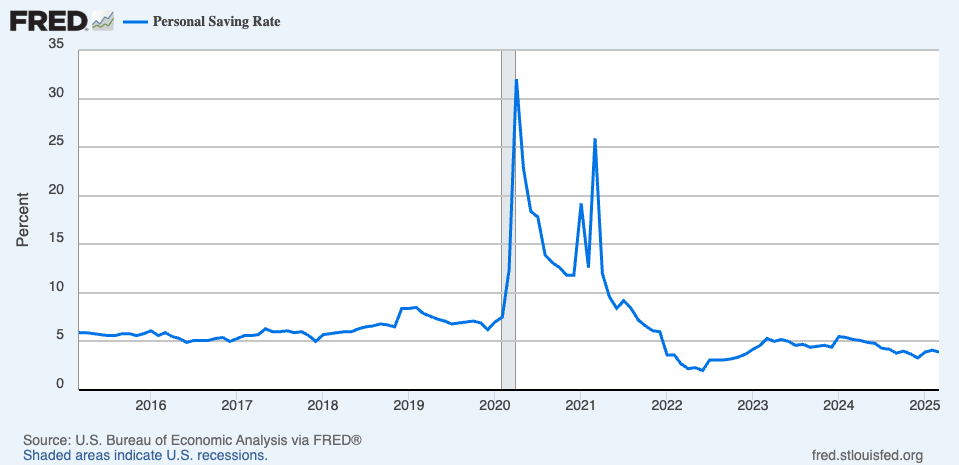

How a lot of their disposable revenue are People saving?

Reply: 3.9%

Discover the latest knowledge from FRED

Questions:

- Summarize the traits within the private financial savings price over the past 10 years.

- What elements do you suppose influence the non-public financial savings price?

- What do you personally suppose is an efficient financial savings price to intention for?

Click on right here for the ready-to-go slides for this Query of the Day that you need to use in your classroom.

Behind the numbers (Bankrate):

“What a “good” financial savings price is relies upon by yourself private objectives and present monetary scenario. Many consultants advocate saving a minimum of 20 % of your revenue – consistent with the 50/30/20 budgeting mannequin that claims 50 % of your revenue ought to go in direction of requirements, 30 % on needs and 20 % to financial savings – however that’s not at all times (or generally ever) possible.

In keeping with the Bureau of Financial Evaluation, the common financial savings price within the U.S. for January 2025 was 4.6 %. This was a rise from December 2024’s 3.5 % financial savings price. Nonetheless, it’s robust for many individuals to avoid wasting something. Virtually 3 in 10 (29 %) of individuals have some financial savings, however not sufficient to cowl three months’ bills, based on Bankrate’s 2025 Emergency Financial savings Report. And 27 % of U.S. adults don’t have any emergency financial savings in any respect.”