-

Warren Buffett’s investments are thriving at the same time as the remainder of the market struggles in opposition to volatility.

-

Berkshire Hathaway’s inventory has outperformed the broader inventory market considerably this yr.

-

“They do not name him the Oracle of Omaha for no motive,” one supply advised BI.

At 94 years outdated, Warren Buffett continues to be beating the market.

The billionaire investor and CEO of Berkshire Hathaway continues to show that investing based mostly on fundamentals and holding on for the long run is the way in which to generate constant positive factors — even whereas the remainder of the market is battered by volatility.

Buyers who’ve gotten on board along with his philosophy are impressed.

“He’s the one man who has confirmed that fundamentals can nonetheless prevail and nonetheless matter, and that point out there and never timing the market begets success in investing, and it goes into the face of all that is well-liked, however in the event you do not consider him, rely the commas,” Michael Farr, CEO of funding agency Farr, Miller & Washington, mentioned, referring to the huge wealth Buffett has created for his shareholders.

For traders flocking to Omaha for Berkshire Hathaway’s annual assembly on Saturday, gleaning insights from the legendary billionaire and his funding choices is a high precedence.

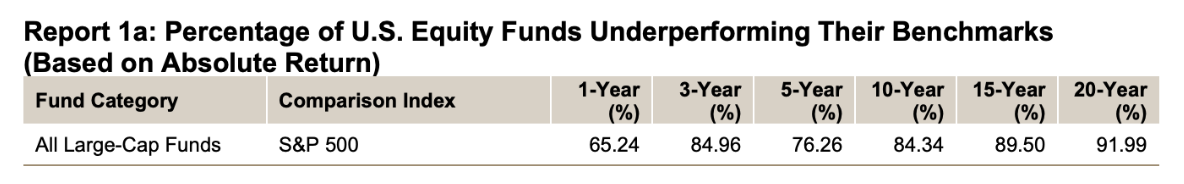

These 4 charts of a few of Buffett’s high investments present how he continues to navigate the market efficiently.

Berkshire Hathaway inventory is buying and selling close to document highs regardless of the continued market volatility sparked by President Donald Trump’s tariffs.

The 17% year-to-date rally is a stark distinction to the 5% decline for the S&P 500—it is also catapulted Buffett larger on the record of the world’s richest folks.

Based on Bloomberg information, the billionaire is the sixth richest particular person on this planet, with a internet price of $166 billion.

Buffett and his group at Berkshire completely timed their large funding in Apple inventory.

Since Berkshire Hathaway first invested within the iPhone maker within the first quarter of 2016, the inventory has soared greater than 800%.

Extra importantly, maybe, is the timing of Buffett’s sale of the inventory. The conglomerate trimmed about 50% of its Apple stake within the second quarter of 2024. The inventory has since traded sideways attributable to considerations about its standing within the AI race and a scramble to reorganize its provide chain amid the Trump tariffs.

One inventory long-held in Berkshire Hathaway’s portfolio is Coca-Cola.

The inventory has been on a tear this yr, rising about 15% and buying and selling close to document highs. Buffett first bought shares of the beverage maker in 1988, shortly after the Black Monday inventory market crash.