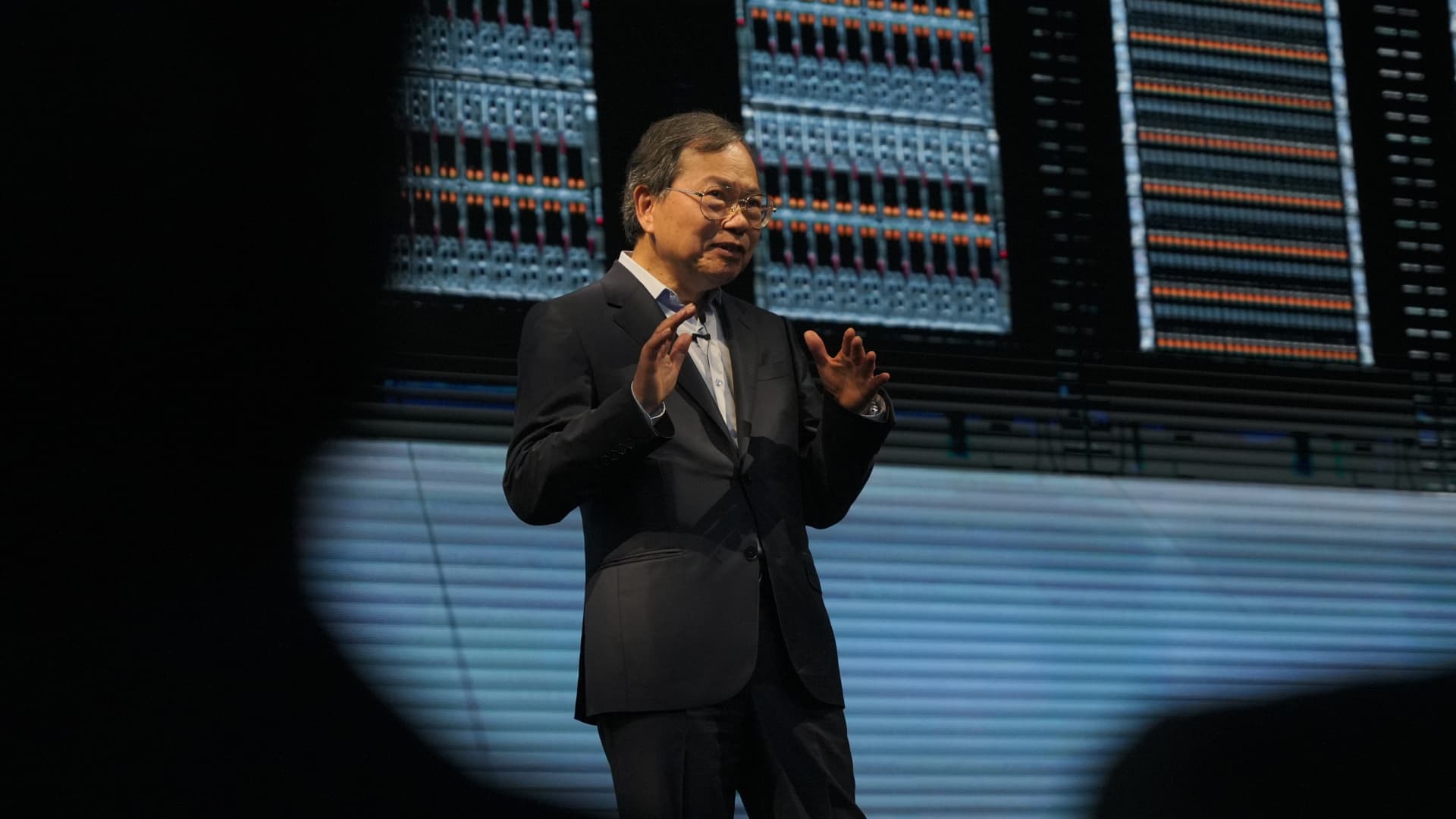

Charles Liang, CEO of Tremendous Micro, speaks on the Computex convention in Taipei, Taiwan, on June 1, 2023.

Walid Berrazeg | Sopa Photographs | Lightrocket | Getty Photographs

Tremendous Micro Laptop shares slid 15% in prolonged buying and selling on Tuesday after the server maker reported disappointing fiscal fourth-quarter outcomes and issued weak quarterly earnings steerage.

This is how the corporate did compared with LSEG consensus:

- Earnings per share: 41 cents adjusted vs. 44 cents anticipated

- Income: $5.76 billion vs. $5.89 billion anticipated

Tremendous Micro’s income elevated 7.5% throughout the quarter, which ended on June 30, in line with a assertion. Web earnings of $195.2 million, or 31 cents per share, was down from $297.2 million, or 46 cents per share, in the identical quarter a yr in the past, partly due to affect from U.S. President Trump’s tariffs on items imported into the U.S.

“Though now we have taken measures to cut back the affect and we are going to see the outcomes,” CEO Charles Liang mentioned on a convention name with analysts.

For the present quarter, Tremendous Micro known as for 40 cents to 52 cents in adjusted earnings per share on $6 billion to $7 billion in income for the fiscal first quarter. Analysts surveyed by LSEG have been searching for 59 cents per share and $6.6 billion in income.

For the 2026 fiscal yr, Tremendous Micro sees not less than $33 billion in income, above the LSEG consensus of $29.94 billion.

Tremendous Micro noticed surging demand beginning in 2023 for its knowledge heart servers full of Nvidia chips for dealing with synthetic intelligence fashions and workloads. Progress has since slowed.

The corporate prevented being delisted from the Nasdaq after falling behind on quarterly monetary filings and seeing the departure of its auditor.

As of Tuesday’s shut, Tremendous Micro shares have been up round 88% thus far in 2025, whereas the S&P 500 index has gained 7%.