The $29 trillion federal debt held by the general public is turning into an more and more native drawback. Washington’s fiscal challenges have led to elevated borrowing prices in addition to decreased federal support to states, cities, and different native governments—who might quickly must rethink their budgets as they face a tough selection: lower companies, increase taxes, dip into reserves, or incur additional debt.

Based mostly on estimates accomplished earlier than the newest reconciliation invoice (the One Large Lovely Invoice Act, which is anticipated to considerably deteriorate the nation’s fiscal outlook), the federal debt is anticipated to develop from 124 % of gross home product (GDP) in 2025 to 135 % in 2035, which signifies that the federal authorities will take up an more and more bigger share of the economic system and capital markets.

Consequently, investable capital will move at growing charges to U.S. debt, making it obligatory for different debtors—together with state and native governments—to supply larger rates of interest on their bonds to compete with U.S. Treasury debt.

Certainly, as federal charges have risen, it has already turn into dearer for native governments to borrow. As of late July 2025, the Bloomberg 30-year tax-exempt municipal bond yield benchmark reached a peak of 4.81 %, a pointy rise from the COVID-era lows of 1.5 %.

Federally, web curiosity prices are forecasted to surpass all different spending classes, in addition to Social Safety, by 2052. This development of rising curiosity prices crowding out different spending is prone to trickle all the way down to state and native governments.

One other channel by way of which the nationwide debt might affect native budgets is federal support. Federal grants are presently the most important single income for state and native governments, and they’re lowering. Based on the Census Survey of State and Native Authorities Funds, in 2022 (the newest 12 months out there), 28 % of all state and native income got here from the federal authorities—a share bigger than revenue, property, gross sales, or another tax. A few of this cash got here within the type of particular COVID-relief grants. These grants offered American municipal and state governments with $885 billion in direct support and had been required to be spent by 2024. Earlier than COVID, federal support represented about 20 % of state and native authorities funding and primarily funded Medicaid.

In concept, these COVID grants had been meant to fund public well being spending or mitigate COVID-related financial impacts. They might not be used to repay authorized judgments, settle money owed, fund underfunded public worker pensions, or prop up rainy-day/reserve funds. In follow, nevertheless, a lot of the cash went to nonemergency and recurring packages. With pandemic-era grants expiring in 2024, state and native governments are actually beneath strain to search out various funding for these companies.

Apart from the scheduled phase-out of COVID support, fiscal strain in Washington has led to reductions in different sorts of funding for states. The most recent reconciliation invoice capped the federal Medicaid reimbursements, handed a bigger share of Supplemental Diet Help Program (SNAP) prices to states, and drastically decreased Biden-era clear vitality infrastructure grants. Funding for some transportation initiatives was slashed, too. Extra cuts are prone to come.

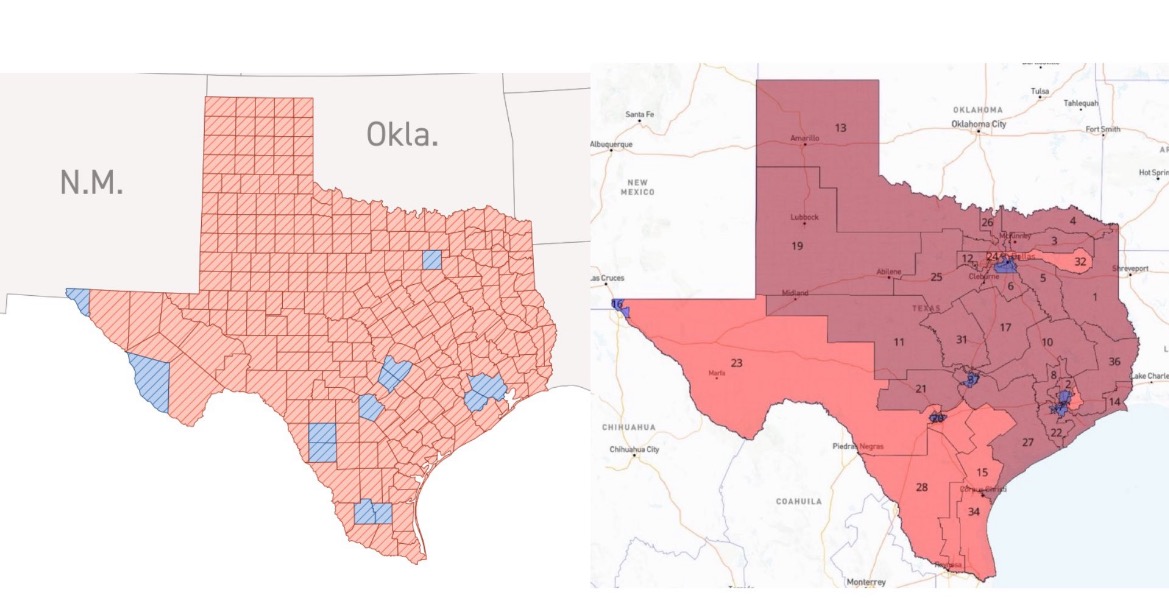

This comes as states have already been feeling a pressure on their budgets. This 12 months, many states are projecting shortfalls within the billions—together with California, Washington, Maryland, Pennsylvania, and Illinois. Even Florida is anticipated to face deficits of $2.8 billion in 2026, and probably $6.9 billion in 2027.

This fiscal tightening just isn’t restricted to states: Main cities like Los Angeles, San Diego, Houston, and Chicago are additionally dealing with substantial funds gaps.

Though most of the fiscally confused governments have introduced hiring freezes and different prudent value containment measures, they haven’t been sufficient. As an alternative of “right-sizing” the scope of their actions, state and native governments—confronted with each larger borrowing prices and fewer federal assist—have sadly opted to dip into their record-high financial savings gathered throughout COVID and concern extra bonds, even amid as we speak’s elevated rates of interest.

As federal assist dries up from many ends, and its return turns into not solely politically however economically much less possible, state and native governments ought to resist the temptation to push prices to an indefinite future and drive down treasured financial savings to fund everlasting packages—exactly the method that has led to the established order—and choose as a substitute for a critical, accountable reorganization of their funds.