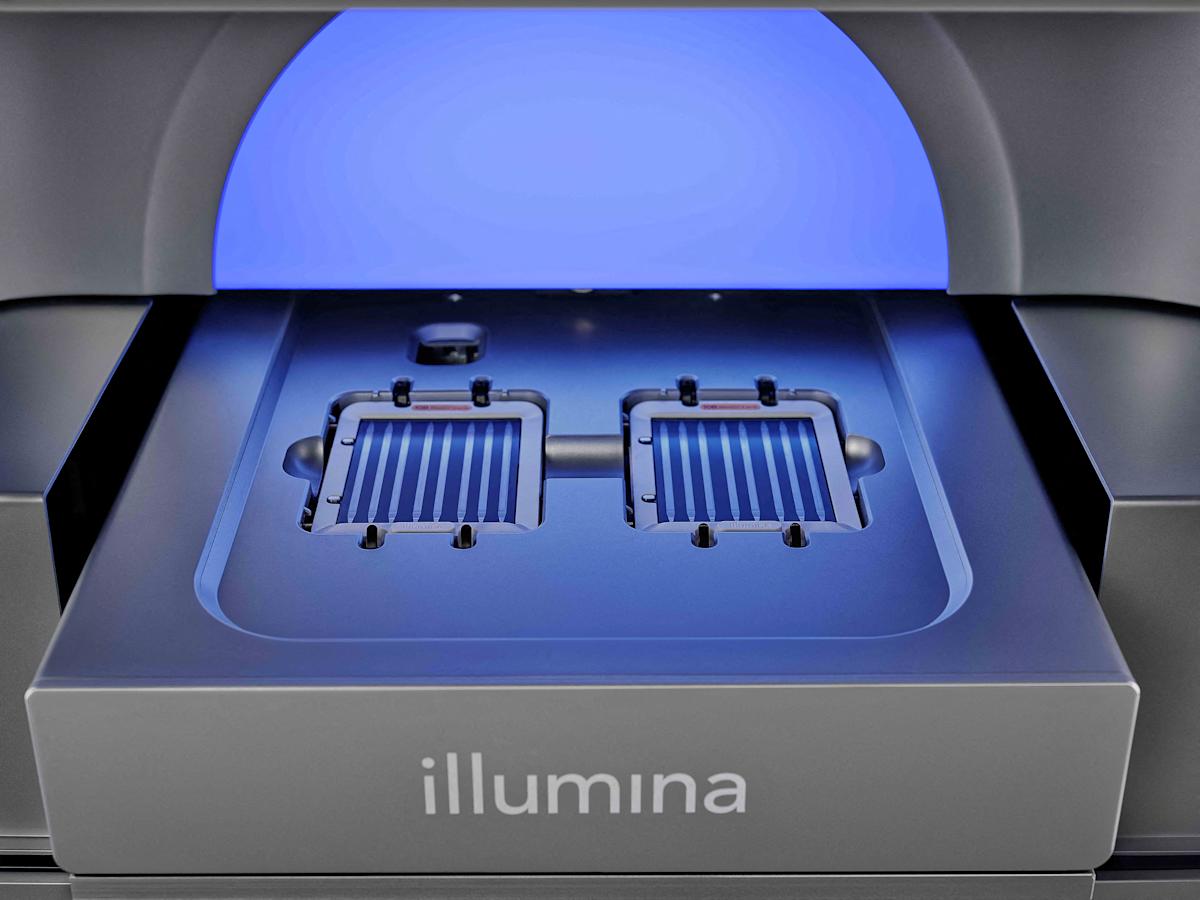

Genetic sequencing firm Illumina (ILMN) has had a tough few years. It has battled activist buyers, confronted off with the Federal Commerce Fee, and, most lately, agreed to a $9.8 million settlement with the Division of Justice over a cybersecurity breach.

So as to add to the pile: sanctions in China and the Trump administration reducing Nationwide Institutes of Well being (NIH) funding, which the corporate depends closely on for medical analysis.

The numbers do not lie. The inventory is down greater than 21% up to now yr and sank greater than 11% in after-hours buying and selling Thursday after the corporate reported an earnings miss for the second quarter. The corporate reported $1.06 billion in revenues in comparison with anticipated revenues of $1.05 billion. Adjusted earnings per share got here in at $1.19 in comparison with estimates of $1.01.

However CEO Jacob Thaysen instructed Yahoo Finance he stays constructive concerning the firm’s near-term development. Why? As a result of, partially, pharmaceutical firms can present a brand new market.

“Now, we’re shifting from small issues to essentially huge applications. A few of the issues making up for the discount from the NIH is type of oblique, however pharma is getting extra curiosity in these huge applications,” he mentioned, noting that 15% of the corporate is uncovered to authorities analysis funding.

“It is not solely about sequencing itself, however actually utilizing huge quantities of information … to essentially determine new drug targets and perceive a illness,” Thaysen mentioned.

The thought to make use of affected person information to assist the pharmaceutical world was additionally recognized by 23andMe, which lately got here out of chapter by means of a nonprofit led by founder Anne Wojcicki. Thaysen mentioned that in contrast to 23andMe, which he has labored with, his firm isn’t going to pursue drug growth by itself.

“We’ve loads of pharma firms which are very excited to work with us,” he mentioned.

Along with genetic testing of affected person samples, the corporate is rising within the preventative facet of care with most cancers screenings. The oncology enterprise, Thaysen mentioned, could have wholesome development over the following 10 or so years.

China banned importations of the San Diego-based firm’s sequencing machines earlier this yr as a part of its retaliatory actions to Trump’s tariff conflict. Thaysen mentioned he’s working with regulators to attempt to reverse that, however “within the meantime, that enterprise is declining, and we predict it to be flat.”

In actual fact, although China has traditionally been about 10% of the corporate’s enterprise, it contributed to half of the decline in earnings this previous week. “China was by no means an enormous a part of Illumina’s enterprise. When it was the most important, it was simply round 10%. We’re down to five% of the enterprise,” Thaysen instructed Yahoo Finance.