Amid world uncertainty because of U.S. commerce coverage and geopolitical developments, the federal government is often reviewing the capital administration of all public sector enterprises.

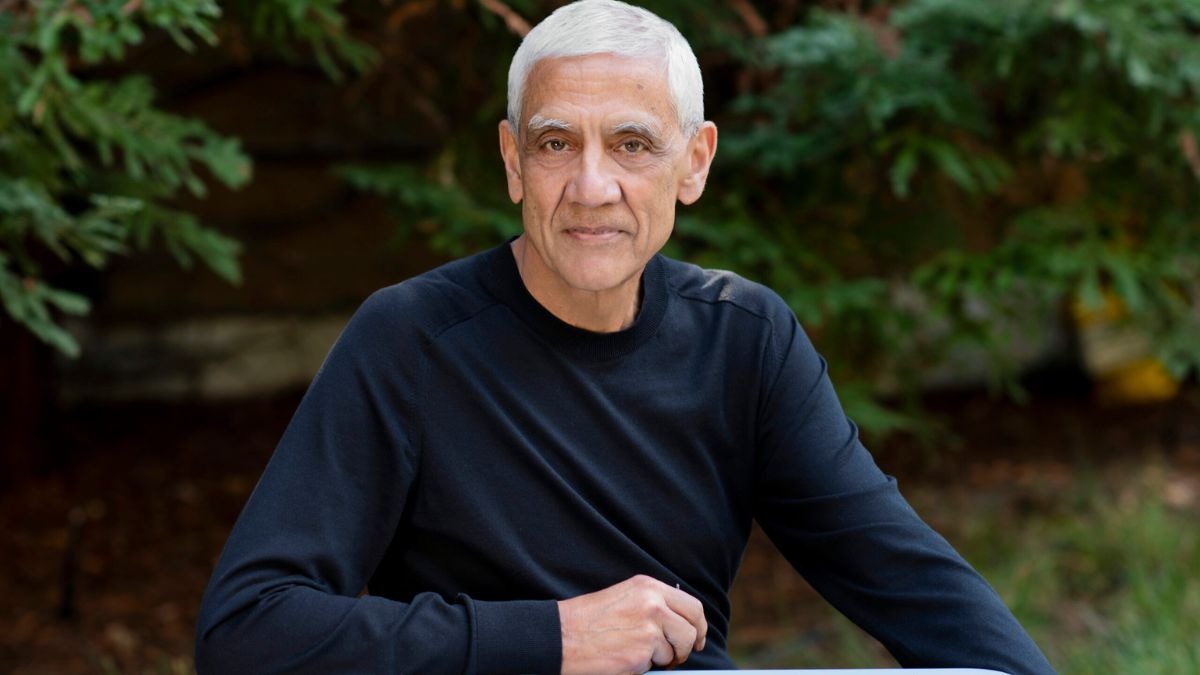

“We’re endeavor a capital overview of all PSUs on a weekly foundation and dealing on methods to insulate our financial system from geopolitical dangers,” mentioned Arunish Chawla, Secretary, Division of Funding and Public Asset Administration (DIPAM).

Highlighting that PSUs account for 15% of market capitalisation, he mentioned the main focus is to make sure they proceed assembly efficiency milestones and executing capex programmes to maintain financial development momentum.

His feedback come at a time when U.S. tariff insurance policies have created important uncertainty for the home financial system. The federal government’s emphasis on capital expenditure has been a key development driver in recent times.

The DIPAM Secretary additionally mentioned the federal government has appointed service provider bankers for potential stake gross sales in public monetary establishments, together with the Life Insurance coverage Company of India.

“The appointment course of has been accomplished. Service provider bankers have been appointed for 3 years, extendable to 5,” Chawla mentioned.

Nevertheless, transaction particulars for any potential stake sale aren’t accessible but. “Particular person transactions can occur anytime,” he famous.

DIPAM had floated a request for proposal in February this yr, inviting bids from service provider bankers to help in stake gross sales of public sector banks and monetary establishments.

A potential provide on the market of LIC might occur later this yr, although the DIPAM Secretary declined to remark. The Centre presently holds a 96.5% stake within the life insurance coverage big, after promoting 3.5% in Might 2022.