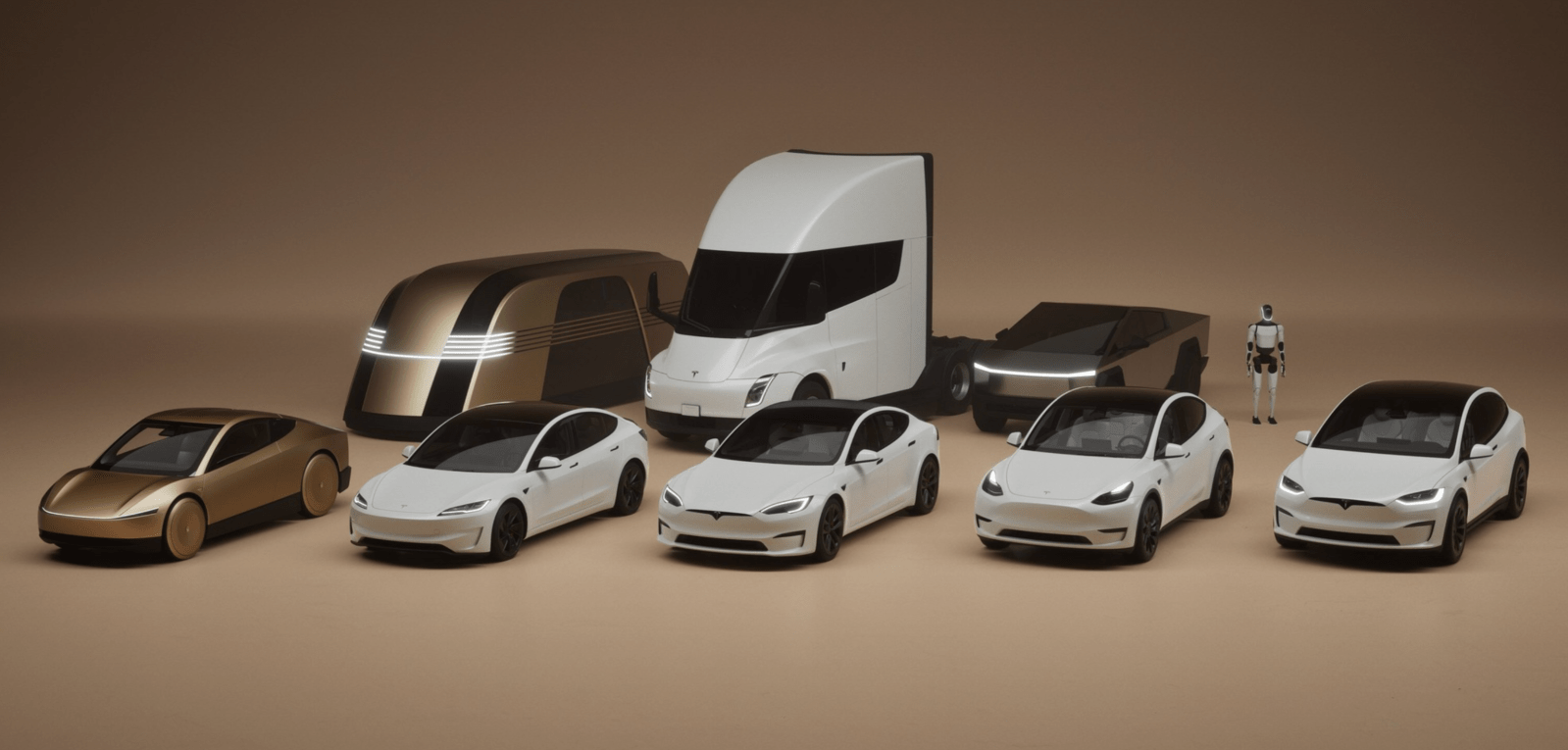

Tesla’s Robotaxi platform is the first focus for the automaker presently, and primarily based on what has been outlined by the corporate as targets for the mission, one agency is saying that the corporate’s valuation ought to “far exceed even present ranges.”

The Robotaxi is a self-driving ride-hailing service that Tesla plans to implement in present and future automobile builds. CEO Elon Musk and different executives have stated that “the overwhelming majority of the Tesla fleet that we’ve made is able to being a Robotaxi,” because of its improvement of Over-the-Air software program updates that improve the aptitude of the automobile with a easy obtain.

Presently, the Robotaxi platform is simply energetic in a portion of Austin, Texas, however Tesla is increasing to different markets, together with California, Nevada, Arizona, and Florida. California would be the subsequent market to open its doorways to the Tesla Robotaxi platform.

🚨 Tesla Robotaxi is near providing rides in California primarily based on this new message we acquired in our app.

There is no such thing as a geofence presently arrange within the Bay Space, however we’ll monitor it transferring ahead. pic.twitter.com/ZrKAqDqQs9

— TESLARATI (@Teslarati) July 26, 2025

However the secret is execution, and that’s what Tesla is aiming for in a well timed vogue. If it could come by on all of its present targets, its valuation might explode, and one agency is holding regular on that narrative as Tesla continues to work towards increasing Robotaxi.

On Tuesday, RBC Capital analysts bumped their worth goal on Tesla shares (NASDAQ: TSLA) to $325 from $319, primarily as a result of Robotaxi enlargement and its success:

“Ought to Tesla achieve success on all of its targets, its valuation might far exceed even present ranges. The Austin Robotaxi launch has been higher than many feared, and the corporate is trying to increase in additional cities.”

There are some dangers to Tesla’s narrative, however they fall exterior the scope of what the corporate can management. In relation to Robotaxi, regulatory hurdles stay. Some areas could also be slower than others to offer Tesla the correct licensing to function of their jurisdiction. This might sluggish the tempo of Robotaxi enlargement, bringing some overhang to the story.

Moreover, Tesla is heading off narratives of slowing demand, and the White Home’s determination to revoke the $7,500 EV tax credit score from customers might mood gross sales previous Q3.

However, Robotaxi is the place Tesla’s true worth appears to be targeted. Efficiently launching a driverless ride-sharing platform is the place the corporate is placing all of its eggs, and revolutionizing passenger journey is the place the main focus lies.

RBC Capital’s observe continued:

“Regulatory hurdles stay, nevertheless. Additional, we anticipate the top of IRA credit and excessive ranges of used EV stock to stress the auto enterprise for the subsequent a number of quarters.”

The slight worth goal bump places RBC Capital’s expectations close to the place the inventory is buying and selling, as it’s presently priced at round $320 at 9:54 a.m. on the East Coast.