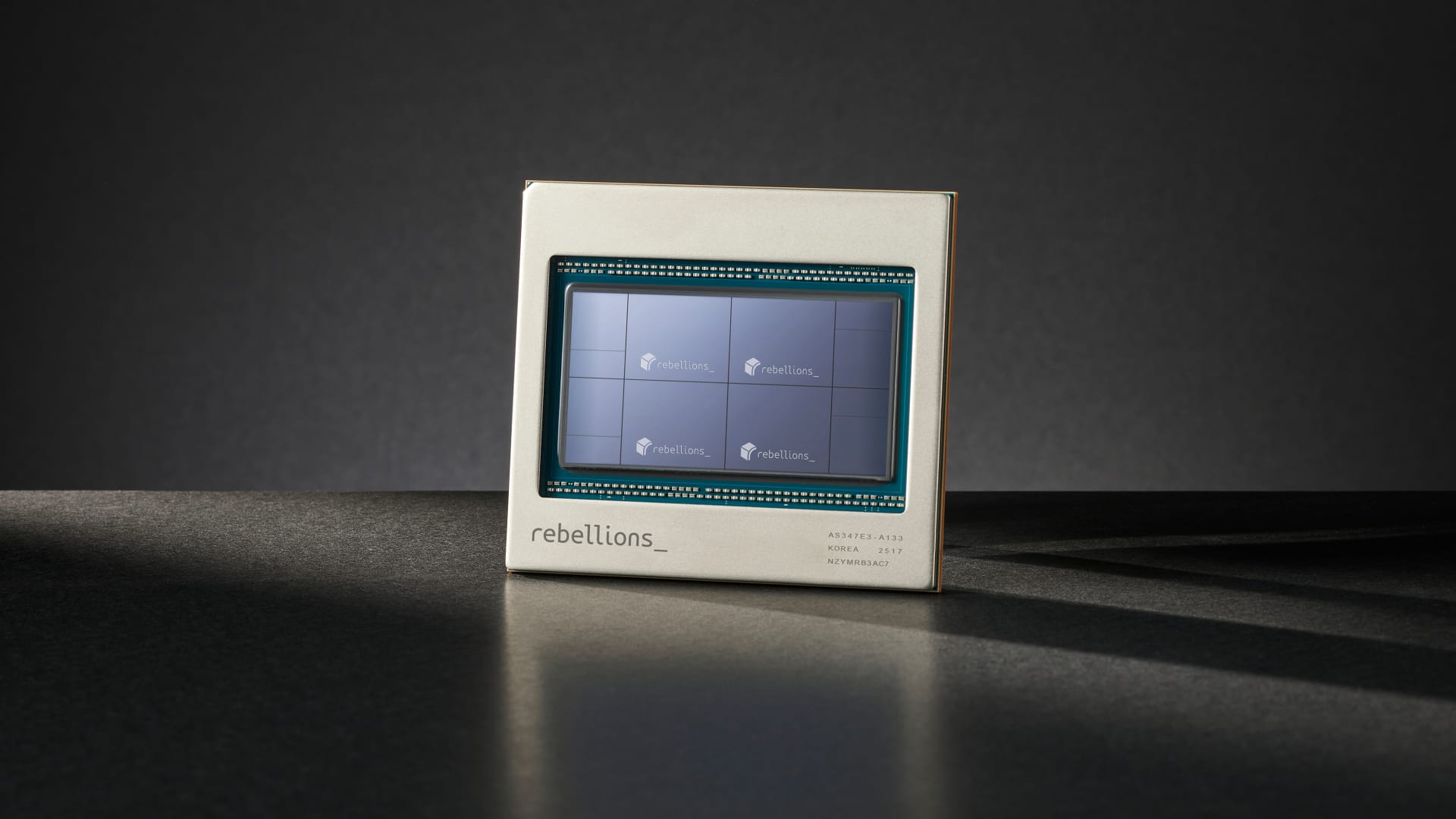

The Insurgent-Quad is the second-generation product from Rebellions and is made up of 4 Insurgent AI chips. Rebellions, a South Korean agency, is seeking to rival corporations like Nvidia in AI chips.

Rebellions

South Korean synthetic intelligence chip startup Rebellions has raised cash from tech big Samsung and is focusing on a funding spherical of as much as $200 million forward of a public itemizing, the corporate’s administration instructed CNBC on Tuesday.

Final yr, Rebellions merged with one other startup in South Korea referred to as Sapeon, making a agency that’s being positioned as one of many nation’s promising rivals to Nvidia.

Rebellions is at present elevating cash and is focusing on funding of between $150 million and $200 million, Sungkyue Shin, chief monetary officer of the startup, instructed CNBC on Tuesday.

Samsung’s funding in Rebellions final week was a part of that, Shin stated, although he declined to say how a lot the tech big poured in.

Since its founding in 2020, Rebellions has raised $220 million, Shin added.

The present funding spherical is ongoing and Shin stated Rebellions is speaking to its present buyers in addition to buyers in Korea and globally to take part within the capital increase. Rebellions has some large buyers, together with South Korean chip big SK Hynix, telecommunication companies SK Telecom and Korea Telecom, and Saudi Arabian oil big Aramco.

Rebellions was final valued at $1 billion. Shin stated the present spherical of funding would push the valuation over $1 billion however declined to provide particular determine.

Rebellions is aiming for an preliminary public providing as soon as this funding spherical has closed.

“Our grasp plan goes public,” Shin stated.

Rebellions designs chips which might be targeted on AI inferencing somewhat than coaching. Inferencing is when a pre-trained AI mannequin interprets stay knowledge to give you a outcome, very like the solutions which might be produced by common chatbots.

With the backing of main South Korean companies and buyers, Rebellions is hoping to make a worldwide play the place it’s going to look to problem Nvidia and AMD in addition to a slew of different startups within the inferencing area.

Samsung collaboration

Rebellions has been working with Samsung to carry its second-generation chip, Insurgent, to market. Samsung owns a chip manufacturing enterprise, often known as foundry. 4 Insurgent chips are put collectively to make the Insurgent-Quad, the product that Rebellions will finally promote. A Rebellions spokesperson stated the chip will likely be launched later this yr.

The funding will partly go towards Rebellions’ product improvement. Rebellions is at present testing its chip which can finally be produced on a bigger scale by Samsung.

“Preliminary outcomes have been very promising,” Sunghyun Park, CEO of Rebellions, instructed CNBC on Tuesday.

Park stated Samsung invested in Rebellions partly due to the the nice outcomes that the chip has to this point produced.

Samsung is manufacturing Rebellions’ semiconductor utilizing its 4 nanometer course of, which is among the many modern chipmaking nodes. For comparability, Nvidia’s present Blackwell chips use the 4 nanometer course of from Taiwan Semiconductor Manufacturing Co. Rebellions can even use excessive bandwidth reminiscence (HBM) in its chips. One of these reminiscence is stacked and is required to deal with giant knowledge processing hundreds. Rebellions has not chosen an HBM vendor.

That would change into a strategic win for Samsung, which is a really distant second to TSMC when it comes to market share within the foundry enterprise. Samsung has been seeking to increase its chipmaking division. Samsung Electronics lately entered right into a $16.5 billion contract for supplying semiconductors to Tesla.

If Rebellions manages to seek out a big buyer base, this might give Samsung a serious buyer for its foundry enterprise.

Correction: This story was up to date to mirror that Rebellions has not chosen an HBM vendor.