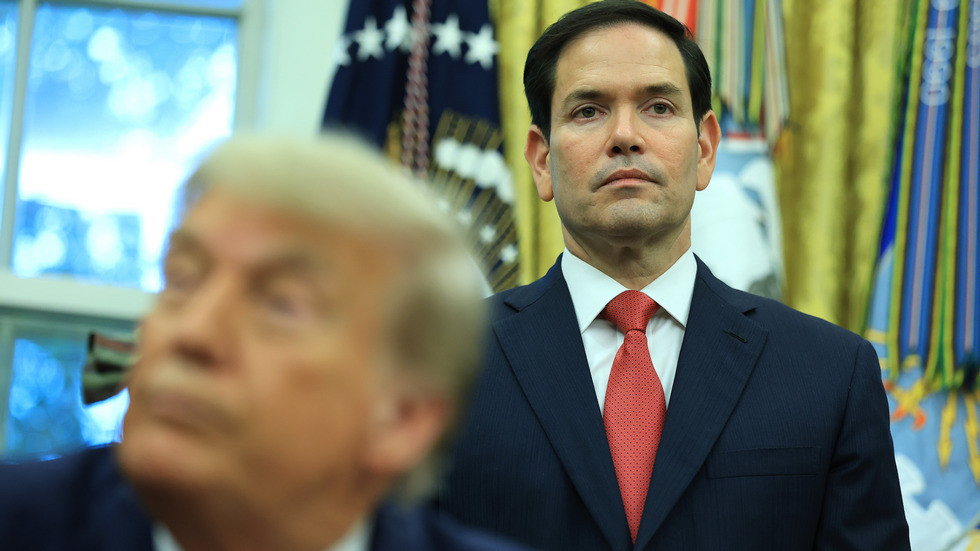

U.S. President Donald Trump speaks to the media throughout a tour of the Federal Reserve Board constructing, which is at present present process renovations, in Washington, D.C., U.S., July 24, 2025.

Kent Nishimura | Reuters

I believe most would agree that the information cycle has been relentless for many of 2025, however sure tales do appear a bit “Groundhog Day” for the time being.

Earlier this month, I wrote in regards to the conundrum going through the newsroom over the best way to strategy President Donald Trump’s then-trade discuss deadline of July 9. Now, on the finish of the month, we discover ourselves in an identical place, however this time the date we’re all watching is August 1.

Why? As soon as once more, it is one other deadline for nations throughout the globe to attempt to agree a commerce truce with the US, with the European Union specifically focus this time spherical.

Debate within the newsroom resurfaces … when is a deadline not a deadline?

The week has grow to be even trickier to foretell, with talks between the U.S. and China now taking middle stage in Stockholm on Monday and Tuesday — probably additional complicating the image for Europe.

A U.S. commerce settlement with the European Union has appeared tantalizingly shut, with CNBC’s Silvia Amaro reporting {that a} 15% baseline tariff fee is the base-case situation, in keeping with an EU diplomat. These experiences drove inventory markets throughout Europe and the U.S. greater final week.

On Friday, nonetheless, Trump instructed reporters there was solely a “50-50 probability” of a deal.

As CNBC’s Holly Ellyatt explains, the EU is retaining its so-called “commerce bazooka” — or Anti Coercion Instrument — heat in case an settlement is just not reached by the August deadline.

Earnings, progress and inflation

The company world is crying out for an settlement, piling strain on the European Union to place an finish to the uncertainty. Puma, VW, Michelin and different corporates throughout Europe have downgraded their outlooks citing the impression of tariffs and the continued strain the restrictions are placing on these companies.

Puma shares

On the info entrance, GDP progress charges for France, Spain, Germany and Italy will likely be launched on Wednesday, offering perception into the broader impression of the market uncertainty.

Final week, the difficult financial situations noticed the European Central Financial institution go for a hawkish maintain of the benchmark fee at 2%, with President Christine Lagarde saying the ECB is “in a superb place to carry and watch how dangers develop over the following few months.”

And so Friday August 1st will likely be an important date for market individuals and corporates (and the newsroom)… till it is not.