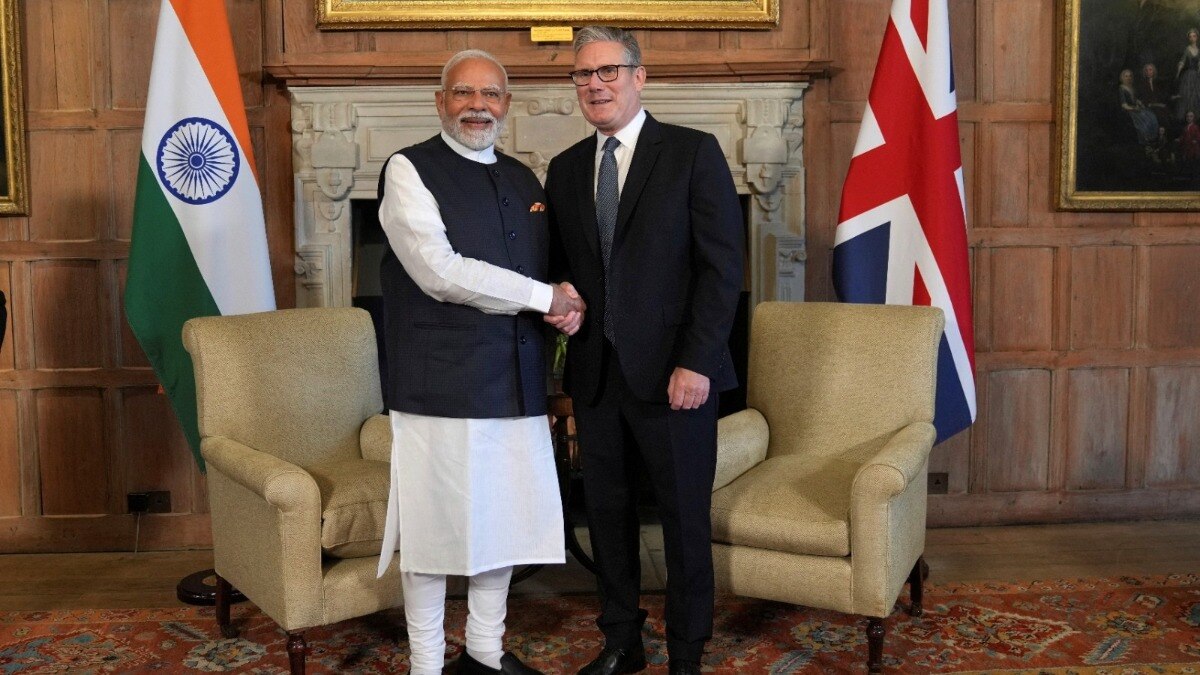

The not too long ago signed Double Contribution Conference (DCC) between India and the UK, a part of the Complete Financial and Commerce Settlement (CETA), is about to considerably profit Indian expatriates working briefly within the UK. Below this settlement, Indian nationals on short-term visas will probably be exempt from contributing to the UK’s Nationwide Insurance coverage Contributions (NIC) for as much as three years, enabling financial savings of Rs 30-40 lakh per particular person. This exemption gives substantial monetary aid to the expatriates concerned.

Round 75,000 Indian staff on short-term visas within the UK and 900 British employers are set to profit from the Double Contribution Conference (DCC), which took impact alongside the signing of the UK-India Complete Financial and Commerce Settlement (CETA) on Thursday. The DCC exempts Indian staff and their employers from paying the UK’s Nationwide Insurance coverage Contribution (NIC) for as much as three years. The same exemption will apply to British residents working in India.

The DCC goals to forestall twin social safety contributions, enhancing the monetary safety of round 75,000 Indian expats and 900 Indian employers. Ministry officers, as reported by the Hindu Businessline, highlighted that the typical IT skilled, incomes roughly £50,000 per 30 days, will contribute 23% of their wage to India’s Staff’ Provident Fund Organisation (EPFO) as a substitute of the UK system, making certain substantial financial savings. This monetary redirection is anticipated to offer a safer financial future for the employees.

“This official pro-worker value profit evaluation was factored into by the Labour and Employment Ministry on the time of getting ready the Union Cupboard be aware forward of the negotiations with the UK for eliminating double social safety contributions by expats briefly employed in Britain,” a senior official defined. The settlement displays the broader ethos of the Worldwide Labour Organisation, which advocates for equal therapy of all staff, together with migrants. Such ideas are foundational to honest labor practices globally.

The UK anticipates financial good points from the deal, with projections suggesting an annual addition of £4.8 billion to its GDP and a £2.2 billion enhance to UK wages. “When agreeing to barter a DCC with India, the federal government took account of the advantages of the broader commerce deal,” the UK administration famous, indicating the mutual advantages anticipated from this bilateral association. These projections spotlight the potential for vital financial progress and improved labor market circumstances.

Social safety preparations

For India, the settlement aligns with current social safety preparations with 22 different international locations, and the Modi authorities is hopeful of negotiating comparable phrases with america. The deal is anticipated to streamline social safety contributions, making it simpler for companies and workers to handle their funds. This alignment with worldwide requirements is essential for fostering international financial partnerships.

The monetary implications are substantial. With contributions redirected to the EPFO, Indian staff can anticipate an improved monetary end result upon finishing their assignments within the UK. Moreover, the exemption from UK NICs might translate into vital value financial savings for each workers and their employers. This monetary technique helps long-term financial stability for the expatriates.

The UK hosts 1,197 Indian-owned corporations—a 23% rise from 971 in 2024—using 126,720 folks with a mixed income of £72.14 billion, in accordance with Grant Thornton UK.

India already has social safety agreements with 22 international locations, and the Labour Ministry has urged prioritising comparable schemes in future FTAs, particularly with international locations just like the US which have a big Indian expat base.

The broader context of CETA and DCC displays a strategic transfer to not solely shield expatriate staff but in addition to bolster financial ties between India and the UK. This settlement is seen as a proactive measure to reinforce competitiveness and financial collaboration on either side.