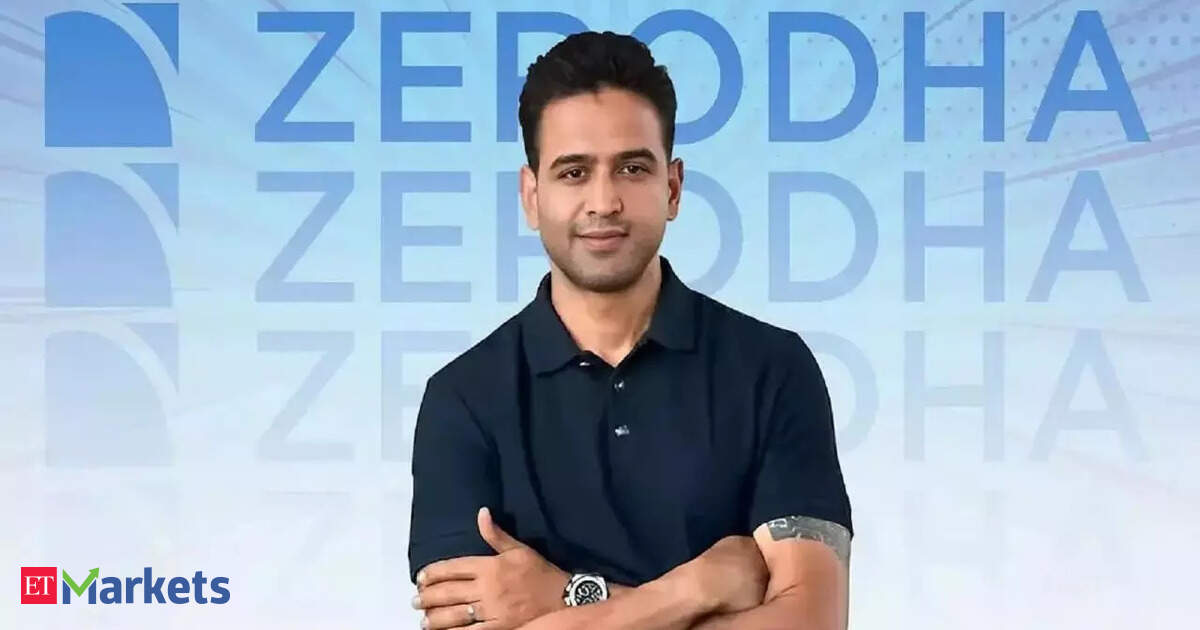

On Thursday, Zerodha Founder & CEO Nithin Kamath posed a query for founders and advertising and marketing professionals on his X deal with if conventional methods used previously to amass prospects might be helpful now. Kamath additionally defined how his firm was coping up with the issue.

“This is the context: Our AUM share is rising (individuals with more cash belief us), however our demat share is shrinking (fewer new accounts). The individuals with cash are sticking with us, however many others aren’t opening accounts with us

. Most certainly, the newer and youthful, and other people from tier 2 and three cities, are most likely investing elsewhere,” Kamath mentioned.

“Query for founders & advertising and marketing of us: Can manufacturers nonetheless depend on the identical techniques and techniques that labored previously, or do altering instances demand new methods,” Kamath probed.

“So, how do you develop when you possibly can’t play the standard acquisition recreation? The apparent reply could also be “content material,” and we have now considerably improved on it, however it’s laborious to measure the affect,” Kamath mentioned. “For those who have been in our sneakers, what would you do?”

Kamath additionally highlighted the challenges of Zerodha. “The problem is that when individuals decide a platform, they hardly ever change. And we have now constraints that our opponents do not: We cannot promote. We cannot supply account-opening incentives. Broking is cyclical by nature,” the tweet mentioned.India’s largest retail brokerage Zerodha lately launched a devoted initiative to help buyers in changing outdated bodily share certificates into digital demat format, even when they aren’t Zerodha prospects. The transfer got here amid rising issues about stranded legacy investments, particularly these inherited by way of household holdings.

Kamath had introduced the initiative on social media, stating that the corporate receives quite a few queries from people who’ve stumbled upon bodily share certificates belonging to their mother and father or grandparents.

Zerodha Kite is Zerodha’s flagship, mobile-first buying and selling platform for buying and selling and investing within the Indian inventory market.

Additionally Learn: Zerodha to assist buyers dematerialise outdated share certificates, no account wanted: Nithin Kamath

(Disclaimer: Suggestions, solutions, views and opinions given by the specialists are their very own. These don’t characterize the views of Financial Occasions)