Common Music Group has filed a draft registration assertion for a proposed secondary itemizing within the US.

The world’s largest music rights firm confirmed in a press launch on Monday night (July 21) that it has “confidentially” submitted a Kind F-1 to the US Securities and Trade Fee, “referring to a proposed public providing in america of the corporate’s bizarre shares held by sure shareholders”.

Monday’s press launch didn’t disclose the timing, pricing, or venue of UMG’s proposed US itemizing.

The corporate wrote: “UMG won’t obtain any proceeds from the sale of bizarre shares by the promoting shareholders. The variety of bizarre shares to be supplied and the value vary for the proposed providing haven’t but been decided.”

“UMG won’t obtain any proceeds from the sale of bizarre shares by the promoting shareholders. The variety of bizarre shares to be supplied and the value vary for the proposed providing haven’t but been decided.”

Common Music Group

UMG famous that the proposed providing stays topic to the completion of the SEC evaluation course of, in addition to market and different situations.

UMG has been buying and selling within the Netherlands underneath the ticker UMG since September 2021, after spinning off from French media conglomerate Vivendi.

The corporate’s shares on the Euronext Amsterdam had been priced at EUR €26.95 at market shut on Monday (July 21) and had been buying and selling at round €27.28 at 9:30am CEST this morning (July 22) with a market cap worth of €50.05 billion (USD $58.5bn).

Because the title suggests, any future ‘secondary itemizing’ on a US inventory alternate would come along with UMG’s presence on the Euronext Amsterdam.

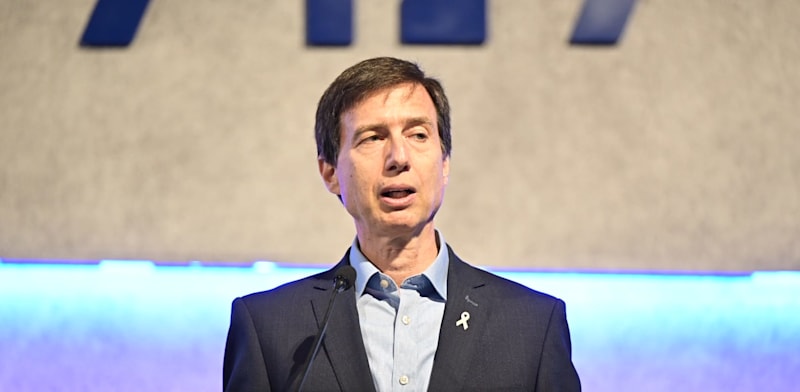

UMG’s announcement after the corporate introduced in January that Pershing Sq. Holdings, led by billionaire investor Invoice Ackman, had requested a secondary itemizing of the music firm on a US inventory alternate.

The deal required Pershing to promote no less than $500 million price of its UMG holdings as a part of the itemizing course of, based on an earlier announcement.

Additionally in January, Pershing Sq. Capital Administration distributed 47 million shares, representing 2.6% of UMG, to the fund’s co-investors.

Following that distribution, Pershing Sq. retained 140 million shares, equal to a 7.6% stake in Common.

Then, in March, shareholders affiliated with Pershing Sq. bought a additional 2.7% stake in Common Music Group, for proceeds of round USD $1.4 billion.

Invoice Ackman stood down from Common’s board in Might.

Common Music Group generated revenues of EUR €2.901 billion (USD $3.052bn) in calendar Q1 throughout all of its divisions (together with recorded music, publishing and extra).

That Q1 income determine was up 9.5% YoY at fixed forex, pushed, based on UMG, by stable development in Recorded Music and Music Publishing.

The corporate’s subscription streaming revenues grew 9.3% YoY at fixed forex to achieve €1.252 billion ($1.317bn) in Q1.Music Enterprise Worldwide