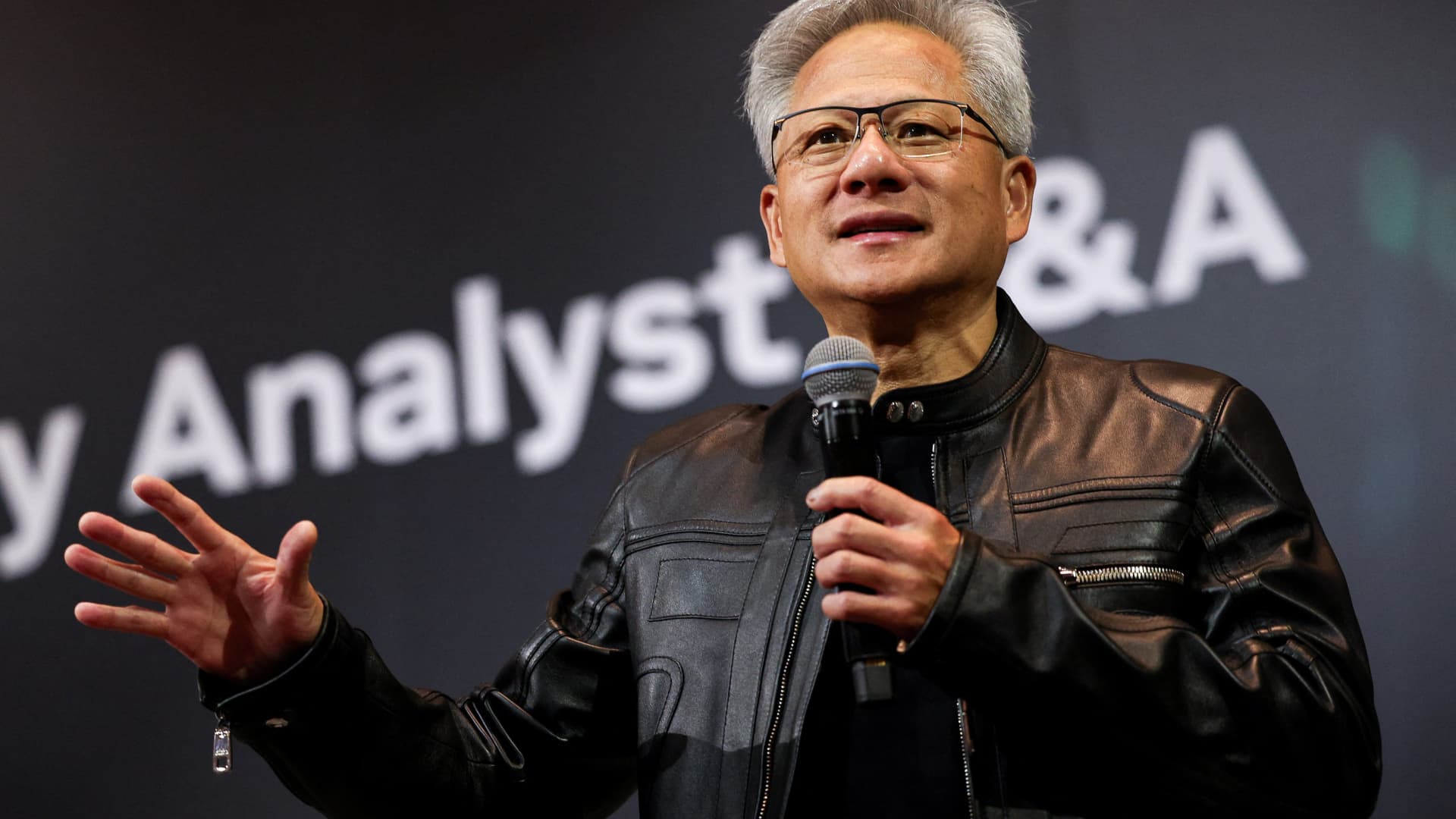

June O’Connell, founder and director at Irish gin and whiskey-makers Skellig Six18 Distillery, mentioned U.S. tariffs have hit her enterprise exhausting this yr.

Paul McCarthy | Skellig Six18 Distillery

Alongside the “final street in Eire,” on the nation’s rugged west coast, June O’Connell’s enterprise Skellig Six18 makes gin and whiskey — a time-intensive course of guided by the wind, rain and funky temperatures that roll in year-round off the Atlantic.

America was a pure goal market as soon as their first spirits have been able to promote in 2019, in line with O’Connell, given its sturdy familiarity with Eire and massive urge for food for premium drinks. As an unbiased provider, negotiations with distributors, entrepreneurs and retailers took greater than a yr, and her first merchandise left County Kerry in November 2023 for a U.S. launch in early 2024.

Then the political tide began turning within the White Home.

“As soon as it turned clear which manner issues have been heading, folks have been attempting to get a variety of product stateside forward of tariffs. We did do a few of that, however now warehouses are full, importers are saying do not ship any extra, and it is solely the massive clients who’re getting precedence,” O’Connell informed CNBC.

Bottles of Irish whiskey at a retailer in Corte Madera, California. The U.S. is a key marketplace for EU-made spirits, accounting for 20-40% of exports for many producers.

Justin Sullivan | Getty Pictures Information | Getty Pictures

For the reason that begin of the yr, President Donald Trump’s unpredictable tariff bulletins have been roiling companies of all sizes.

The European Union specifically has drawn Trump’s ire for its 198 billion euro ($231 billion) commerce surplus in items with the U.S.

He argues tariffs are wanted to create a extra balanced relationship; EU officers, nonetheless, argue that commerce is extra even throughout items, companies and investments, and have pledged to extend oil and gasoline purchases to slender the hole.

Final weekend, Trump introduced he’s planning to hit the EU with a blanket tariff price of 30% from Aug. 1, after last-minute negotiations failed to supply a framework deal. Large uncertainty now hangs over whether or not an settlement may be struck within the subsequent two weeks, and what particulars or compromises it’d comprise.

‘It will likely be a lose-lose scenario’

The Trump administration has already imposed a ten% baseline obligation on EU imports, together with increased charges for automotives and metals.

The truth that the U.Ok.’s commerce cope with the U.S. maintained a ten% baseline tariff with some sector exemptions has led many to imagine that this may very well be Europe’s finest hope. The Monetary Instances reported Friday that Trump is now taking a more durable line in EU negotiations and pushing for minimal tariffs of 15-20%, citing folks briefed on the talks. CNBC has not independently confirmed the report.

The EU’s food and drinks commerce with the U.S. is value nearly 30 billion euros, and commerce group FoodDrinkEurope warned this week that any escalation in tariffs — that are usually paid by the importer — would hit European producers and farmers, whereas limiting selection and driving up prices for U.S. shoppers.

Even the ten% U.S. import tariff imposed in April has been a blow to enterprise, Skellig Six18’s O’Connell mentioned, with the ultimate worth impression on the patron being a lot increased as soon as further prices have been handed up the provision chain.

“By way of pricing, 30% [tariffs] can be untenable. The entire scenario undoubtedly stifles your ambition stateside,” she added.

For Franck Choisne, president of French distillery Combier, a ten% tariff has been nearly manageable. Based in 1834, Combier is finest recognized for making the liqueur triple sec – utilized in margarita cocktails – and the U.S. represents round 25% of its total gross sales.

France’s Distillerie Combier, which produces spirits together with triple sec. President Franck Choisne says a 30% U.S. tariff may halve gross sales to the market.

Nevertheless, Choisne notes that the ten% tariff comes on prime of a success from the forex market. A weaker U.S. greenback this yr has made it costlier for the U.S. to import overseas items, an extra dampener on demand.

A 30% tariff, plus change price results, would imply an total price of 45-50% is mirrored in remaining shopper costs, he mentioned, a degree that might halve his firm’s U.S. gross sales.

“We perceive President Trump desires a greater stability between imports and exports, however at that 30% degree then after all the EU will reply, commerce can be hit and it is going to be a lose-lose scenario,” he mentioned.

U.S. exporters of merchandise resembling bourbon would additionally endure, an element Choisne mentioned stored him optimistic that the 2 sides will ultimately negotiate a zero-tariff deal for the spirits trade.

In Italy’s Lombardy countryside, greater than half 1,000,000 big wheels of Grana Padano cheese roll off the provision strains of family-run enterprise Zanetti every year. The corporate, which additionally makes parmesan and different exhausting cheeses, exports over 70% of its merchandise, and the U.S. accounts for 15% of whole turnover.

A shopkeeper holds a Grana Padano Italian cheese inside a grocery store on April 17, 2025 in Turin, Italy.

Stefano Guidi | Getty Pictures Information | Getty Pictures

In response to its president and CEO Attilio Zenetti, the volatility created by tariffs this yr has been not like any earlier than, with contradictory bulletins producing an enormous quantity of further admin.

“It provides a variety of uncertainty and doesn’t permit us to organise an actual technique,” he mentioned, bar attempting to ship as many merchandise as attainable earlier than increased charges doubtlessly come into impact.

Zenetti mentioned that the weaker greenback plus tariffs had already elevated the corporate’s U.S. retail costs by 25%. “Additional will increase would after all straight replicate once more on U.S. wholesale and retail costs and we worry that this may have an effect on volumes,” he mentioned.

Provide chain shifts

For some companies, mitigating the tariff impression has meant new provide chain choices.

Alex Altmann, associate at accounting agency Lubbock Advantageous and VP of the British Chamber of Commerce in Germany, mentioned that some EU producers have been contemplating shifting their meeting strains to the U.Ok. to attempt to benefit from its present 10% settlement. In doing so, they need to navigate the complexity of “guidelines of origin” that decide the supply of a product for tax functions.

Altmann gave the instance of a German kitchen equipment producer with sturdy demand within the U.S. The corporate sources most of its supplies cheaply from Asia and imports them into the EU at a low tariff price. It isn’t too tough to then shift the ultimate meeting course of to a manufacturing facility within the U.Ok., he mentioned, to profit from a ten% — as a substitute of a possible 30% — tariff on merchandise as they enters the U.S.

“We would not be dealing with these huge tariff variations for a very long time, however even for those who money in for a couple of months it is fairly vital cash,” he added.

Elsewhere, huge companies are contemplating shifting not less than some manufacturing to the U.S. German industrial big Siemens, for instance, informed CNBC it had taken steps to localize manufacturing, and engineering group Bosch likewise mentioned it was prioritizing a local-for-local mannequin because it appears to be like to increase its North America enterprise.

Nevertheless, for Skellig Six18’s O’Connell, shifting manufacturing is just not attainable. That is as a result of the manufacturing of “origin protected” objects — like an Irish whiskey, Italian parma ham or French champagne — cannot be moved elsewhere.

As a substitute, O’Connell’s is specializing in new potential markets in Asia, Africa and Latin America, however famous the problem of doing so in locations with out strong present whiskey gross sales. Combier distillery’s Franck Choisne, in the meantime, identified that turning into established someplace new is resource-intensive, expensive and will take years. In different phrases, it is no simple repair for a decline in U.S. gross sales.

“At occasions like this I simply attempt to do not forget that I am in an trade that is practically 700 years previous, requires endurance and reminds you that issues do not final endlessly,” O’Connell mentioned. “You simply need to maintain controlling the controllables.”

— CNBC’s Sam Meredith contributed to this story.