Monetary advisors play an important function in serving to people plan for his or her futures, handle investments, and put together for retirement. Many are moral professionals who prioritize their shoppers’ greatest pursuits. Nonetheless, the monetary companies trade is a enterprise, and like every enterprise, it operates on incentives. These incentives don’t at all times align completely together with your objectives.

Behind the polished shows and reassuring recommendation lies a actuality that the majority shoppers by no means see. There are issues some advisors would moderately you not know, as a result of in case you did, you may ask more durable questions, demand decrease charges, and even take your cash elsewhere.

In the event you assume your advisor’s job is solely to make you wealthy, assume once more. Listed below are 10 issues many monetary advisors hope you by no means uncover, and why these truths matter greater than you assume.

10 Issues Your Monetary Advisor Hopes You By no means Be taught

1. They Typically Earn Extra When You Pay Extra

Monetary advisors ceaselessly cost charges that aren’t instantly apparent. Fee-based advisors, for example, earn cash once you purchase particular monetary merchandise equivalent to annuities, mutual funds, or insurance coverage insurance policies. The upper the price of the product, the upper their fee.

Which means that generally, the recommendation you obtain could also be influenced extra by what pays them greatest than by what advantages you most. Even fee-based advisors, who cost a proportion of your property, have a built-in incentive to maintain your cash below their administration moderately than suggesting you repay your mortgage or put money into one thing outdoors their portfolio. Understanding how your advisor is compensated is vital. In the event that they dodge questions on charges, that’s a pink flag.

2. “Fiduciary” Doesn’t At all times Imply What You Suppose

You’ve most likely heard the time period “fiduciary” thrown round as a gold normal. A fiduciary is legally obligated to behave in your greatest curiosity. However right here’s the catch: not all monetary professionals are fiduciaries on a regular basis. Some advisors function below a “suitability normal,” which solely requires {that a} advice be appropriate, not essentially the best choice obtainable.

Even advisors who declare fiduciary standing may solely apply that function in sure circumstances, leaving room for conflicts of curiosity. Earlier than signing on, ask in case your advisor is a fiduciary 100% of the time—and get it in writing.

3. Energetic Administration Not often Beats the Market

Advisors like to tout their skill to select profitable shares or mutual funds, however many years of analysis present that the majority energetic managers fail to outperform the market constantly, particularly after charges. Regardless of this, many advisors push actively managed funds with excessive expense ratios, which eat away at your returns over time.

Why? As a result of these funds typically pay advisors greater than low-cost index funds do. The cruel fact: your advisor is perhaps promoting you on a dream of market-beating efficiency when a easy index fund technique might outperform in the long term, at a fraction of the associated fee.

4. Excessive Charges Can Quietly Drain Your Wealth

You’ve most likely heard the phrase “charges matter,” however most individuals don’t notice how devastating they are often over time. A 1% annual advisory price may not sound like a lot, however over 30 years, it might price you lots of of hundreds of {dollars} in misplaced development. Add fund expense ratios and different hidden expenses, and the image will get worse.

Advisors not often spotlight this as a result of their livelihood typically depends upon these charges. They might level to their “value-added companies” as justification, however you need to do the mathematics. In lots of instances, a low-cost automated investing service or self-directed plan might ship comparable outcomes with out the hefty price ticket.

5. Their Job Typically Includes Gross sales, Not Simply Recommendation

Many monetary advisors are basically salespeople with licenses. Their companies set quotas, observe income, and push merchandise with excessive revenue margins. Whereas some advisors genuinely prioritize shopper wants, the strain to hit targets can affect suggestions greater than you notice.

In case your advisor typically pitches new merchandise or pushes complicated investments, ask your self: Is that this actually for my profit, or theirs? Probably the most reliable advisors concentrate on training and long-term planning, not frequent product gross sales.

6. They Might Downplay Threat Till It’s Too Late

Market downturns are inevitable, however some advisors decrease danger to maintain shoppers invested (and their charges flowing). They may use reassuring language like “the market at all times bounces again” with out addressing whether or not your portfolio aligns together with your true danger tolerance and time horizon.

In some instances, shoppers discover themselves overexposed to equities proper earlier than retirement or saddled with illiquid investments they will’t simply promote. These errors could be catastrophic and preventable with sincere, proactive conversations about danger. In case your advisor hasn’t stress-tested your portfolio or mentioned worst-case eventualities, it’s time to start out asking why.

7. “Free” Monetary Plans Aren’t Free

Ever been supplied a “complimentary” monetary plan? It sounds beneficiant, however these plans are sometimes advertising and marketing instruments designed to get you within the door—and into their merchandise. The recommendation you obtain in these plans might steer you towards investments that generate commissions for the advisor or agency.

The hidden agenda isn’t unlawful, nevertheless it’s value recognizing. If one thing is free, you’re most likely the product. Be cautious about making huge monetary selections based mostly on recommendation tied to a gross sales pitch.

8. They Don’t At all times Plan for Taxes—You Ought to

Taxes are one of many greatest elements affecting your wealth over time, however many advisors aren’t tax consultants. Some keep away from the topic altogether as a result of it requires specialised information and coordination with accountants.

This hole can price you huge. From capital features on investments to tax-efficient withdrawal methods in retirement, overlooking taxes can wipe out hundreds in potential financial savings. In case your advisor glosses over tax planning or says, “Speak to your CPA,” they’re leaving a part of your monetary puzzle incomplete.

9. They Profit When You Keep within the Darkish

The much less you already know about investing, charges, and monetary planning, the better it’s for an advisor to justify their worth, even when they’re not delivering a lot. Complexity is a robust instrument. Some advisors deliberately overwhelm shoppers with jargon, charts, and acronyms to create dependency.

However right here’s the reality: monetary literacy is your greatest protection. The extra you perceive, the more durable it’s for anybody to benefit from you. Advisors who genuinely care about your success will welcome your questions and clarify ideas clearly. In the event that they don’t, that’s a warning signal.

10. You Don’t At all times Want an Advisor

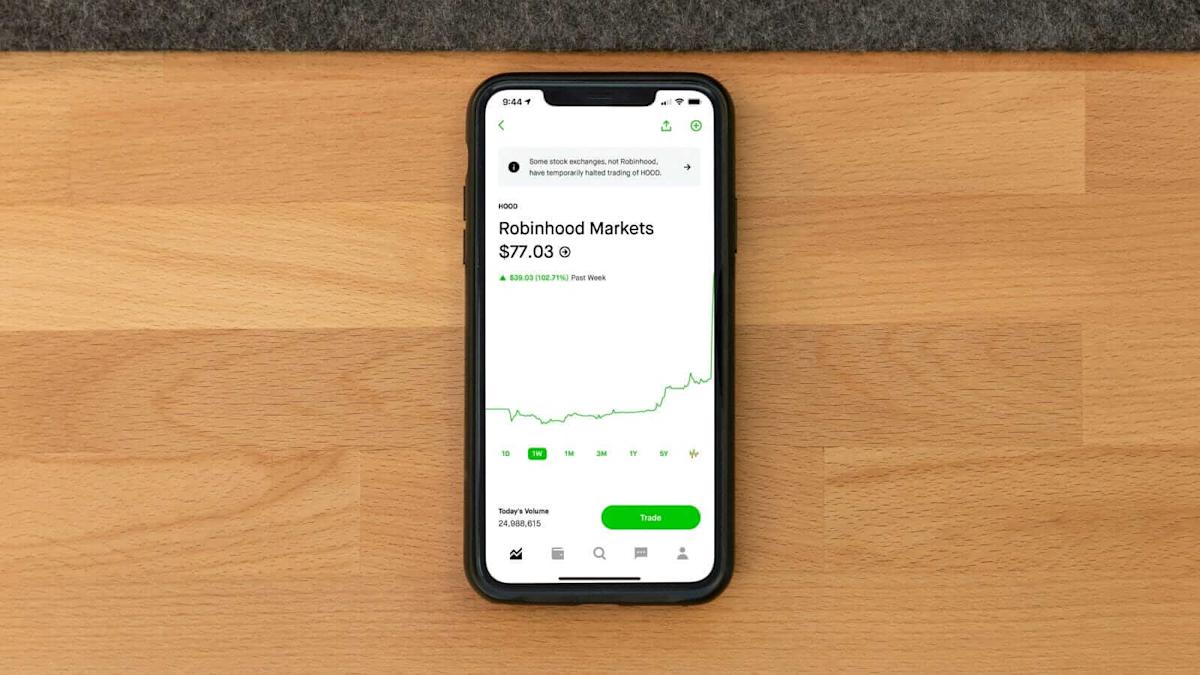

Maybe the most important secret of all: you may not want a monetary advisor, at the very least not full-time. For easy objectives, like constructing an emergency fund, paying off debt, or investing in index funds, you possibly can typically do it your self with a little analysis.

There are even low-cost robo-advisors and hybrid fashions that present steerage with out the hefty charges. Whereas complicated conditions (equivalent to enterprise possession or property planning) can warrant skilled assist, the concept that everybody wants an advisor for all times is a fantasy many within the trade are completely happy to perpetuate.

Transparency Is All the things

An excellent monetary advisor could be value each penny, however provided that their pursuits align with yours. Sadly, the trade’s opacity makes it simple for conflicts of curiosity to flourish. The secret is training. Know the way your advisor is paid, ask direct questions on charges, and demand full transparency.

Your monetary future is simply too necessary to outsource blindly. The extra you already know, the extra empowered you change into and the more durable it’s for anybody to revenue at your expense.

What Has Your Expertise Been With Monetary Advisors?

Monetary advisors could be invaluable allies, however solely when shoppers keep knowledgeable and proactive. Understanding the truths behind the trade helps you defend your wealth and your peace of thoughts.

What about you? Have you ever ever uncovered one thing about monetary recommendation that stunned you? Did it change the way you handle your cash?

Learn Extra:

7 Monetary Advisors Below Hearth for Elder Manipulation

10 Pink Flags Your Monetary Advisor Isn’t Wanting Out for You

Riley Schnepf is an Arizona native with over 9 years of writing expertise. From private finance to journey to digital advertising and marketing to popular culture, she’s written about every part below the solar. When she’s not writing, she’s spending her time outdoors, studying, or cuddling together with her two corgis.