Keep knowledgeable with free updates

Merely signal as much as the UK inflation myFT Digest — delivered on to your inbox.

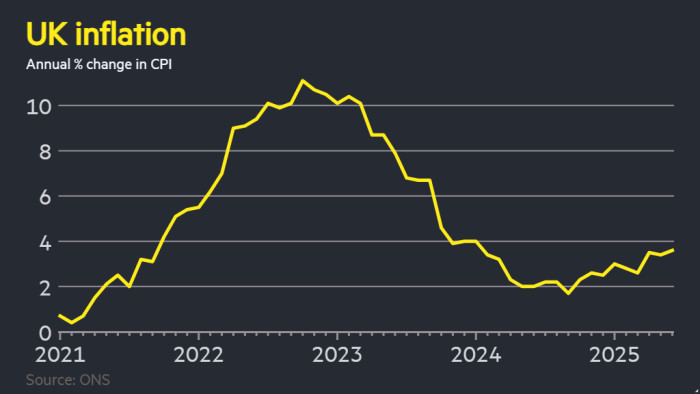

UK inflation unexpectedly rose to three.6 per cent in June, in a setback for the Financial institution of England because it seeks proof that worth pressures are cooling alongside slowing financial progress.

Wednesday’s determine from the Workplace for Nationwide Statistics exceeded the prediction of analysts polled by Reuters that inflation would stay at Could’s stage of three.4 per cent.

The pick-up in inflation was pushed by increased costs for petrol, airfares and rail tickets, the ONS mentioned.

The BoE is deliberating whether or not to chop its key rate of interest once more as quickly as August. In June, the Financial Coverage Committee voted six to 3 to maintain charges unchanged at 4.25 per cent, following a quarter-point lower in Could.

The MPC, which has an inflation goal of two per cent, has diminished rates of interest 4 occasions since final summer season however policymakers stay divided over how persistent worth pressures will show.

Core inflation, which excludes vitality and meals, was 3.7 per cent in June, up from 3.5 per cent in Could, the ONS mentioned.

Providers inflation, a key gauge of worth pressures for the MPC, was unchanged from Could’s 4.7 per cent, exceeding the 4.6 per cent predicted by economists.

The pound strengthened following the discharge of the figures, rising 0.2 per cent to $1.340.

Previous to June’s knowledge, merchants had been betting on a minimum of two extra quarter-point cuts from the BoE by the tip of the yr, in accordance with ranges implied by swaps markets.

Pooja Kumra, a charges strategist at TD Securities, mentioned the figures had been “one other bump within the street for the BoE”, including that they counsel the MPC would proceed to “apply the ‘gradual and cautious’ strategy to rate of interest cuts”.