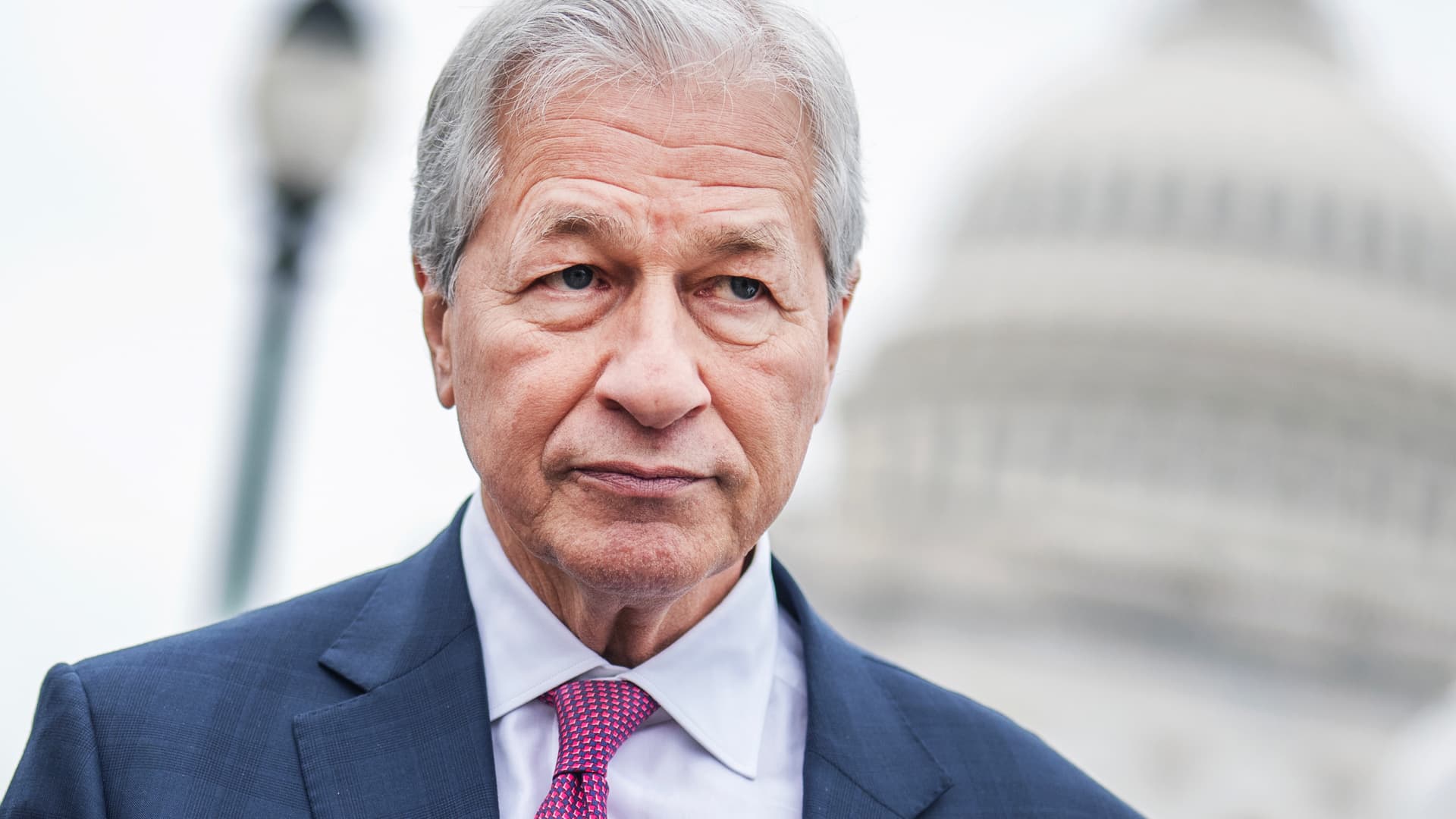

Jamie Dimon, CEO of JPMorgan Chase, leaves the U.S. Capitol after a gathering with Republican members of the Senate Banking, Housing and City Affairs Committee on the problem of de-banking on Feb. 13, 2025.

Tom Williams | Cq-roll Name, Inc. | Getty Photographs

JPMorgan Chase CEO Jamie Dimon says he would not get the enchantment of stablecoins, however he can also’t afford to remain on the sidelines.

It is the message Dimon gave Tuesday when requested throughout an earnings convention name about whether or not his firm, the biggest and most influential U.S. financial institution, was exploring the fee expertise.

Stablecoins, because the title suggests, are a sort of cryptocurrency designed to take care of a gradual worth which are often pegged to a fiat foreign money just like the U.S. greenback. Final month, JPMorgan introduced it’ll launch a extra restricted model of a stablecoin that solely works for JPMorgan shoppers; a real stablecoin would presumably be extra universally accepted.

“We’ll be concerned in each JPMorgan deposit coin and stablecoins to grasp it, to be good at it,” Dimon mentioned. “I believe they’re actual, however I do not know why you’d need to [use a] stablecoin versus simply fee.”

Dimon, 69, is likely one of the most vocal opponents of sure cryptocurrencies like bitcoin. However his financial institution is a juggernaut within the world funds business, serving to transfer almost $10 trillion every day, and so it is sensible that it will discover stablecoins at a time when the regulatory framework for the expertise has opened up.

Failing to take action may cede floor to fintech gamers who want to recreate components of the regulated monetary ecosystem, Dimon mentioned Tuesday.

“You understand, these guys are very sensible,” Dimon mentioned of his fintech rivals. “They’re attempting to determine a strategy to create financial institution accounts, to get into fee techniques and rewards packages, and we have now to be cognizant of that. And the best way to be cognizant is to be concerned.”

Citigroup, BofA cash?

Stablecoins may provide a doubtlessly quicker and cheaper type of fee over conventional banking rails together with ACH and SWIFT, that are decades-old techniques that sometimes take days to settle.

Citigroup executives mentioned Tuesday that the financial institution was “trying on the issuance of a Citi stablecoin” amongst a number of methods to play within the area. The most important alternative is round tokenized deposits and in offering custody for crypto property, they mentioned.

Financial institution of America CEO Brian Moynihan has additionally mentioned his agency would get entangled in stablecoins.

A method might be for conventional banks to collaborate by the collectively owned Early Warning Companies. That might be just like the best way they banded collectively to supply Zelle for immediate peer-to-peer funds as a strategy to defend turf towards PayPal and Block’s Money App.

When requested Tuesday a couple of attainable collaboration amongst banks, Dimon declined to offer a particular reply.

“That is an ideal query, and we’ll depart it remaining as a query,” Dimon mentioned. “You may assume we’re serious about all that.”

— With reporting from CNBC’s Jesse Pound.