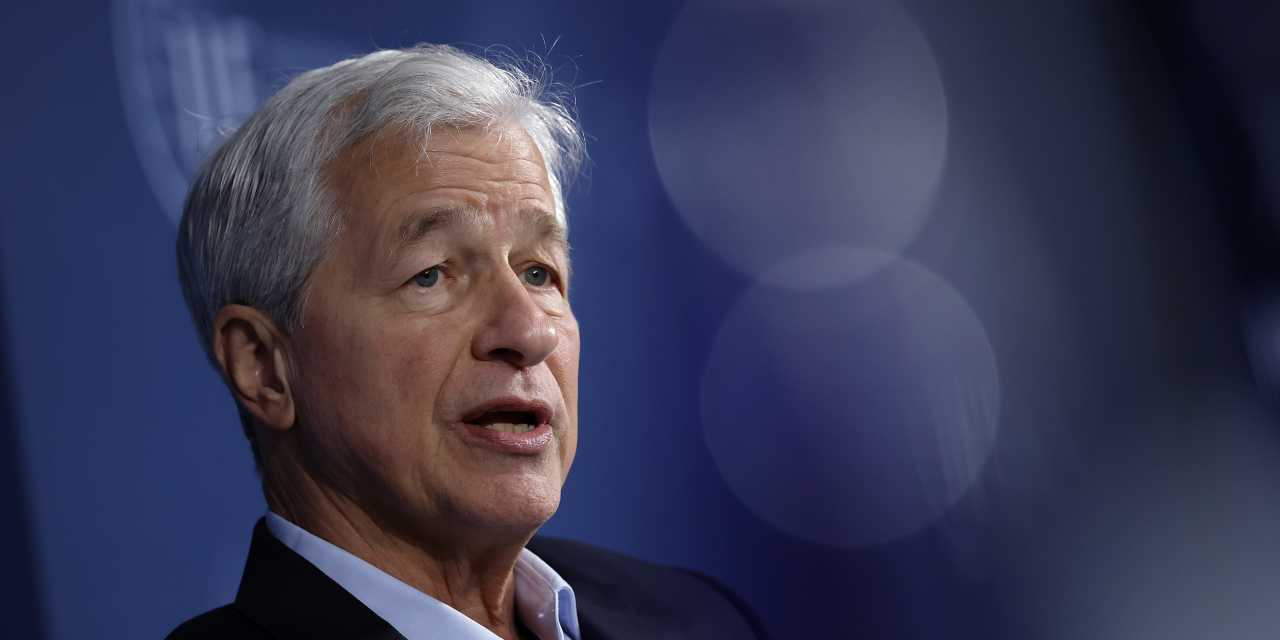

JPMorgan Chase’s Wall Road models posted sturdy development within the second quarter as chief govt Jamie Dimon mentioned the US financial system stays “resilient” regardless of the dangers posed by Donald Trump’s tariffs and the nation’s worsening fiscal outlook.

The largest US financial institution by belongings mentioned on Tuesday that buying and selling revenues jumped 15 per cent from the 12 months previous to $8.9bn, pushed by exercise in foreign money, bond, commodity and fairness markets. Funding banking charges rose 7 per cent to $2.5bn.

JPMorgan additionally signalled US debtors are holding up higher than analysts feared within the early months of the White Home’s international commerce struggle. The financial institution reported provisions to cowl potential dangerous loans of about $2.8bn within the second quarter, lower than the $3.2bn analysts polled by Bloomberg forecast.

Dimon mentioned the US financial system remained “resilient” within the June quarter. He welcomed the passage of Trump’s flagship funds invoice and likewise mentioned potential deregulation can be “optimistic for the financial outlook”.

“[H]owever, vital dangers persist — together with from tariffs and commerce uncertainty, worsening geopolitical situations, excessive fiscal deficits and elevated asset costs,” he mentioned.

JPMorgan additionally lifted a key earnings goal for its lending companies for 2025.

The financial institution raised its outlook for web curiosity revenue — the distinction between what the financial institution pays on deposits and what it earns from loans and different belongings — to about $95.5bn in 2025, from round $94.5bn beforehand. The metric has benefited considerably from larger rates of interest within the US since 2022.

The group’s web revenue within the quarter fell to $15bn, down 17 per cent from a 12 months earlier. Final 12 months it benefited from a roughly $8bn one-off achieve from its stake in Visa. Analysts had forecast earnings for the most recent quarter of $12.8bn.

BlackRock earlier mentioned that belongings beneath administration climbed to a document $12.5tn within the second quarter, as a market rally and foreign money swings helped overcome decrease than anticipated inflows.

Citigroup remains to be set to report earlier than the market opens in New York.