In response to CNBC stories, the most recent transaction concerned 225,000 shares and was a part of a broader buying and selling plan adopted in March, which permits Huang to promote as much as six million shares of Nvidia via the top of 2025.

He had earlier offered a separate tranche in June price round $15 million below the identical association.

Final yr, Huang had divested practically $700 million price of shares below an analogous prearranged plan. Following the newest disclosure, Nvidia shares rose by about 1% in Friday buying and selling, CNBC reported.

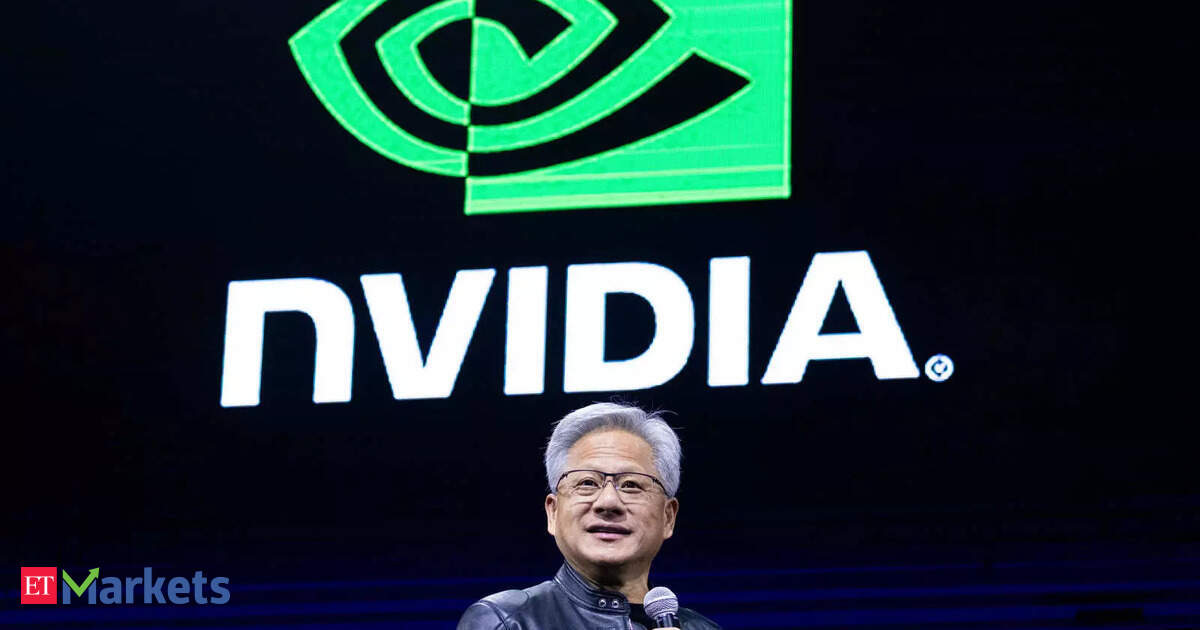

The tech govt’s wealth has surged alongside Nvidia’s meteoric rise as a pacesetter within the synthetic intelligence {hardware} house. The corporate’s GPUs have turn into indispensable for coaching and working massive language fashions, fueling large demand from each enterprises and buyers.

As per CNBC, Huang’s internet price has jumped by over $29 billion simply in 2025 to this point, marking a acquire of greater than 25%. Bloomberg’s Billionaires Index estimates his fortune at $143 billion, inserting him practically neck and neck with Berkshire Hathaway chairman Warren Buffett, who stands at $144 billion.The corporate itself has hit record-breaking milestones in current months. CNBC famous that Nvidia grew to become the primary U.S. agency to cross a $4 trillion market capitalization earlier this week, surpassing tech giants Microsoft and Apple within the course of.Regardless of his ongoing inventory gross sales, Huang continues to carry over 858 million Nvidia shares, each straight and not directly via numerous partnerships and trusts.

Additionally learn: Use market dips to construct portfolios; these 8 sectors have excessive development potential: Alok Agarwal

(Disclaimer: Suggestions, options, views and opinions given by the consultants are their very own. These don’t signify the views of The Financial Occasions)