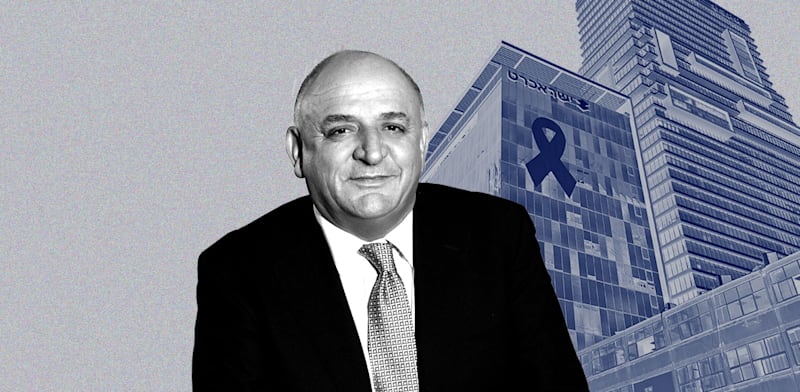

Yitzhak Tshuva has obtained a allow as we speak from the Financial institution of Israel to regulate bank card firm Isracard (TASE: ISCD). That is the final regulatory approval required for Tshuva to take over the corporate.

Tshuva will thus shortly grow to be the controlling shareholder in Isracard by Delek Group (TASE: DLEKG), which he controls. Delek Group will purchase 37% of the shares in Isracard at a valuation of NIS 3.56 billion. Along with the Isracard shares that Delek Group already owns, this may give it a 40% stake. Delek Group can pay NIS 1.3 billion, and Isracard may also distribute a dividend. The deal is anticipated to shut inside per week to 10 days.

The Financial institution of Israel acknowledged: “The Supervisor of Banks Division has concluded the method of analyzing the appliance for a allow to regulate Isracard.” The examination was required as a result of Isracard is among the three largest bank card corporations in Israel, and due to Tshuva’s previous, which features a debt settlement in Delek Actual Property, giving rise to issues on the Financial institution of Israel about monetary stability.

The Competitors Authority permitted the takeover in March, after Isracard’s shareholders voted in favor of the sale to Delek Group in February.

Isracard turned a listed firm in 2019, when Financial institution Hapoalim was compelled to promote its stake within the firm in accordance with the suggestions of the Strum committee on separation of the bank card corporations from the banks.

The battle over Isracard began two years in the past, when insurance coverage corporations Harel and Menora Mivtachim competed to purchase the corporate. Harel gained, however was blocked by the Competitors Authority, opening the way in which to a brand new spherical of bidding.

Menora Mivtachim tried its luck once more, however the race was joined by Yitzhak Tshuva, Financial institution of Jerusalem, and even El Al. Ultimately, the shareholders plumped for Tshuva’s bid, and his group has now jumped the ultimate hurdle.

The race to purchase Isracard started after Clal Insurance coverage purchased rival bank card firm Max (previously Leumi Card), signaling to the market the potential within the sector. The third firm that’s shortly anticipated to be up on the market is Cal, managed by Israel Low cost Financial institution (72%).

“We consider within the nice potential at Isracard, and in its potential to develop in clearance, and in shopper and business credit score, along with different channels into which we consider that Isracard can, and will, increase,” mentioned Delek Group CEO Idan Wallace. “I consider that becoming a member of Delek Group will give Isracard a following wind, taking it forwards, and will likely be excellent news for customers, traders in Isracard, and Delek Group, and result in realization of the nice potential that we see in Isracard, and increase competitors. Our clear intention is to show Isracard into the main firm within the sector, and we consider that it has the potential to get there.”

RELATED ARTICLES

Delek Group’s predominant enterprise is power, with holdings (by subsidiaries) within the Yam Tethys Partnership, and the Tamar, Leviathan, Tanin, and Aphrodite fuel fields within the Mediterranean, and in belongings within the North Sea and the Gulf of Mexico. It additionally owns Israel’s largest chain of gas stations.

Revealed by Globes, Israel enterprise information – en.globes.co.il – on July 9, 2025.

© Copyright of Globes Writer Itonut (1983) Ltd., 2025.