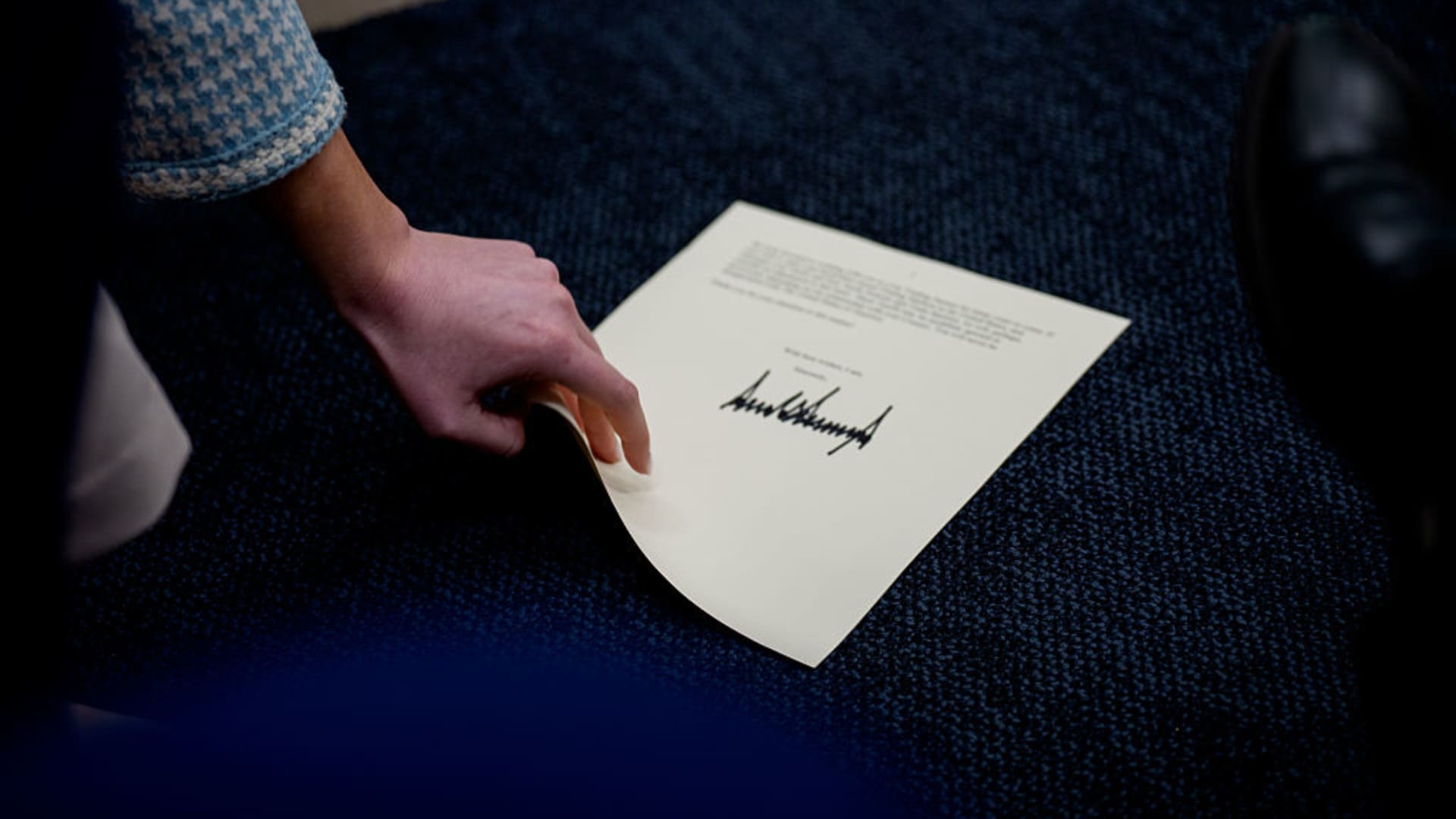

WASHINGTON, DC – JULY 7: An aide picks up a web page from a letter to Japan and South Korea, signed by U.S. President Donald Trump, asserting 25% tariffs starting on August 1st, through the every day press briefing within the Brady Press Briefing Room on the White Home on July 7, 2025 in Washington, DC.

Andrew Harnik | Getty Photos Information | Getty Photos

Within the first batch of “tariff letters” despatched to buying and selling companions, U.S. President Donald Trump took purpose at two of the closest U.S. allies in Asia: Japan and South Korea — each are already bearing the brunt of the prevailing duties on auto and metal exports.

Further tariffs would additional harm these two exports-dependent economies which can be grappling with a slowdown in development, with Japan doubtless watching a technical recession, or two straight quarters of financial contraction.

Each Japan and South Korea noticed first-quarter gross home product contract on a quarter-on-quarter foundation.

Whereas South Korean imports to the U.S. face 25% tariffs, the identical as Trump promised in April, the speed on Japan has been raised by 1 proportion level to 25%.

Exports — together with companies — made up virtually 22% of Japan’s GDP in 2023, in accordance with the newest information from the World Financial institution, and 44% of South Korea’s GDP in 2023.

At present, imports of vehicles and auto elements to the U.S. incur a 25% tariff, whereas metal and aluminum entice a 50% levy on most nations.

Vehicles are Japan’s largest exports to the U.S. and are additionally amongst South Korea’s high exports. South Korea was additionally the fourth-largest exporter of metal to the U.S. in 2024, in accordance with the Worldwide Commerce Administration below the U.S. Commerce Division.

Japan’s Prime Minister Shigeru Ishiba reportedly stated the nation “actively seeks the prospect of an settlement that advantages each nations, whereas defending Japan’s nationwide curiosity.” In Could, Ishiba stated that his nation is not going to settle for a deal that doesn’t see the removing of auto tariffs.

The newly introduced tariffs will decrease Japan’s GDP by 0.1 proportion level by end-2026, in accordance with Norihiro Yamaguchi, Lead Japan Economist at Oxford Economics.

“On condition that the economic system is already affected by excessive tariffs on auto and elevated world commerce coverage uncertainly, and likewise weak consumption, the affect should not be dismissed,” he advised CNBC

Yamaguchi stated that Japan’s economic system will “barely develop” within the second half of 2025 and within the first half of 2026, if not falling right into a recession.

The U.S. is Japan’s largest export market, with 21.3 trillion yen ($145.76 billion) of shipments to the nation in 2024, whereas South Korea exported items price $127.8 billion to the U.S. in the identical 12 months, and counts the U.S. as its second-largest export market.

Reflecting a “extra intensified tariff coverage stance,” the Financial institution of Korea in Could practically halved GDP development estimates for 2025 to 0.8% from February’s projection of 1.5%.

“The restoration in home demand has been delayed, whereas export development is anticipated to sluggish additional because of the affect of U.S. tariffs,” the BOK stated.

Frederic Neumann, Chief Asia Economist at HSBC advised CNBC that ought to Japan and South Korea fail to succeed in a deal, these tariffs will pose “appreciable headwinds to development.”

Each Japan and South Korea are already going through sluggish home demand.

Providing a silver lining, Trump stated that he was keen to “maybe, contemplate an adjustment to this letter” if the nations have been to open their “heretofore closed” markets to the U.S.

Stress ways are being delivered to bear on South Korea and Japan, stated Vishnu Varathan, managing director at Mizuho Securities.

“The frustration with Japan’s extra principled and holistic method (overlaying sectoral tariffs) stalling a deal being a supply of frustration for U.S. commerce negotiators, and crucially for Trump, speaks for itself.” he added.

Whereas Trump has not publicly expressed anger towards South Korea, Varathan stated “it’s not unimaginable that there are sticking factors just like Japan’s, thereby invoking the letter.”

Markets, in the meantime, seem like shrugging of the tariff threats — for now. HSBC’s Neumann stated that Trump’s letters primarily quantities to a deadline extension for tariff negotiations by three weeks.

“Monetary markets are taking the newest information of their stride, specializing in the likelihood that the threatened tariffs should be whittled down by negotiation,” he stated.