Unlock the Editor’s Digest free of charge

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.

Nvidia has grow to be the primary firm to hit a $4tn market capitalisation, on the again of a speedy rebound for Wall Avenue expertise shares in latest months.

Shares within the Silicon Valley-based maker of synthetic intelligence chips rose as a lot as 2.8 per cent on Wednesday to a peak of $164.42 to surpass the milestone, however in the end closed 1.8 per cent larger at a valuation of $3.97tn. The group had already surpassed Apple’s $3.92tn report from final December.

Nvidia inventory has risen by greater than 40 per cent since early Could, when US President Donald Trump first signalled a thaw in his commerce battle with China and Nvidia struck a sequence of multibillion-dollar chip offers within the Center East.

The corporate has grow to be the largest beneficiary of a tech increase that has exceeded the headiest days of the dotcom period, because of its dominance of the chips that gasoline AI providers corresponding to ChatGPT, the OpenAI chatbot that has grow to be the fastest-growing app of all time.

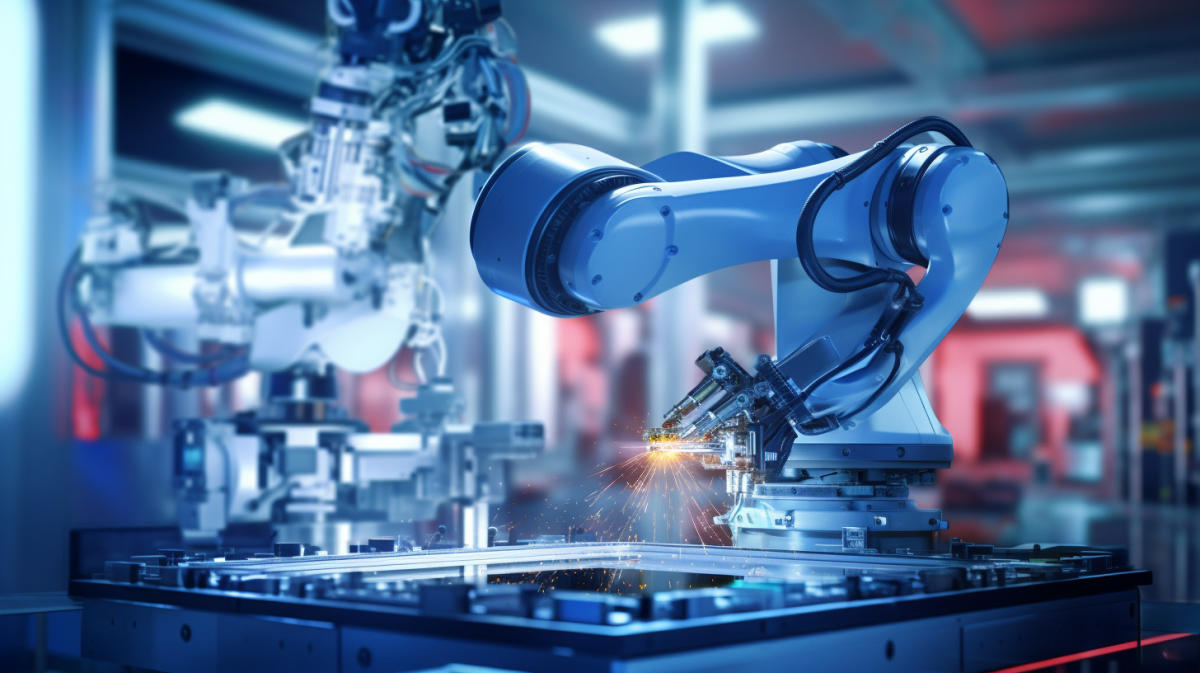

Nvidia chief govt Jensen Huang has been bullish in his predictions that AI and robotics can drive trillions of {dollars} in gross sales for his firm over the approaching years, as upgrades to its processors and information centre infrastructure lengthen its lead over rivals.

Advances in AI and new sources of demand had been “kicking into turbocharge”, Huang instructed traders in Could as Nvidia reported a 70 per cent surge in quarterly revenues.

The AI chipmaker surpassed $1tn in market worth little greater than two years in the past, months after the launch of ChatGPT triggered a touch for its processors amongst Massive Tech firms and AI start-ups seeking to prepare giant language fashions.

Nvidia’s shares hit $2tn in February 2024 and $3tn in June final 12 months. However the inventory’s momentum sputtered at the beginning of 2025, amid doubts about whether or not AI teams’ demand for its chips would continue to grow as properly as concern concerning the affect of the Trump administration’s tariffs and export restrictions to China.

These fears had been additional fuelled when Chinese language upstart DeepSeek launched a robust mannequin on the flip of the 12 months that it claimed used a fraction of the computing assets consumed by the likes of OpenAI.

Whereas vital limits on Nvidia’s potential to promote its strongest chips in China stay, traders hope that continued demand from US Massive Tech prospects, in addition to so-called “sovereign AI” offers in Europe and the Center East, will proceed to propel its progress.

Nvidia’s income is projected to succeed in nearly $200bn this 12 months, up 55 per cent 12 months on 12 months. Web revenue this 12 months is forecast to be $105bn, in response to analyst estimates collected by S&P Capital IQ, with gross margins of greater than 70 per cent.

Confidence within the sustainability of the AI increase has additionally been bolstered by sturdy income progress at main start-ups corresponding to OpenAI, which stated final month that annual recurring income had nearly doubled to $10bn, and Anthropic, which has reportedly hit $4bn in gross sales on the identical metric.

“The extra AI, the higher backside line,” Huang instructed analysts final month. “The absence of AI is the one factor I fear about.”