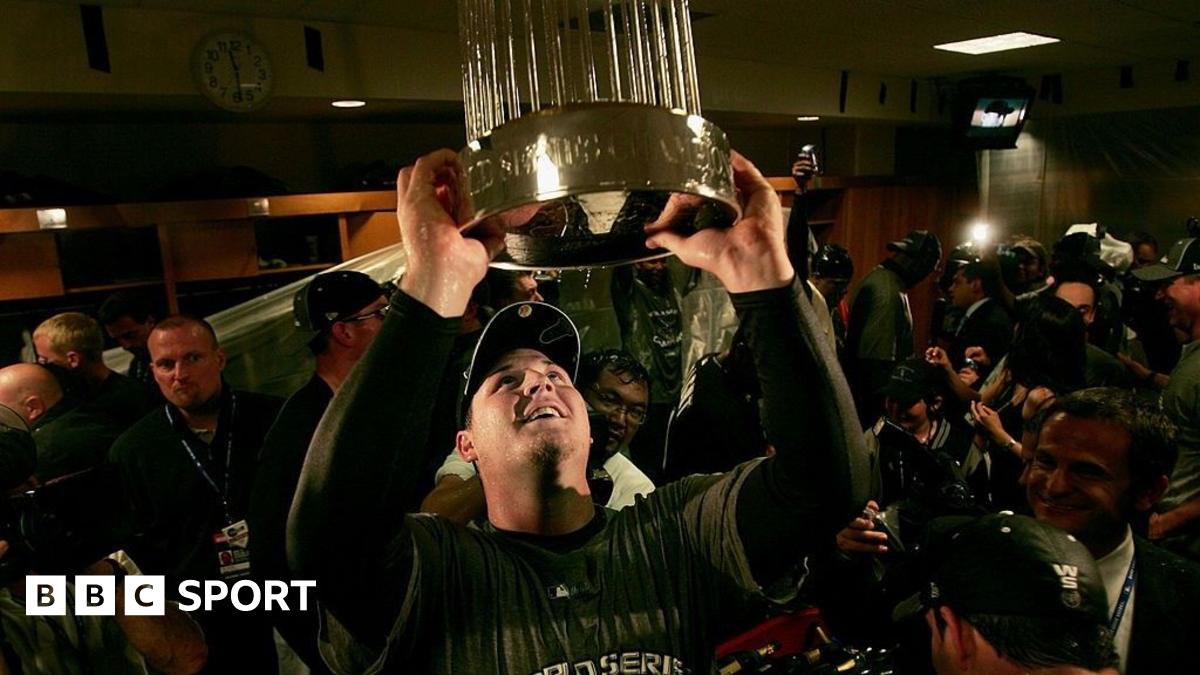

Staff at a Thai Son S.P. Co. garment manufacturing unit endeavor to supply merchandise for world purchasers, in Thu Duc, Ho Chi Minh, Vietnam, on June 21, 2025.

Daniel Ceng | Anadolu | Getty Photos

World consideration turned to Vietnam on Thursday, after U.S. President Donald Trump introduced a commerce cope with Hanoi simply days earlier than Washington’s reciprocal tariffs come again in full drive.

Underneath the settlement, the U.S. will apply a 20% responsibility on Vietnamese imports — sharply beneath the 46% charge Trump had imposed in early April. U.S. imports to Vietnam will in the meantime not be topic to tariffs.

Trump additionally stated that Vietnam had agreed to a 40% responsibility on any merchandise that initially got here from one other nation, however had been despatched to Vietnam for closing cargo to the U.S. China has reportedly repeatedly relied on this observe, generally known as transshipping, to keep away from commerce boundaries.

Vietnam is without doubt one of the few nations that has struck a commerce cope with the White Home, whereas the clock ticks down on Trump’s 90-day non permanent reprieve. Many countries have been left questioning how the way forward for their commerce relationship with the world’s largest economic system might form up.

“What we discovered from the Vietnam deal is, if something, the tariffs are going to go up from right here, not down,” Sebastian Raedler, head of European fairness technique at BofA, advised CNBC’s “Europe Early Version” on Thursday.

However different nations may also now have a neater time negotiating, Mark Williams, chief Asia economist at Capital Economics, advised CNBC.

“Different nations will really feel they need to be capable of lock in a decrease tariff charge than the 20% that President Trump says Vietnam has agreed to,” he stated, noting that “Vietnam had an unusually weak negotiating hand” because of its robust dependency on commerce with the U.S.

Extra rising market offers forward?

The deal may very well be trigger for concern for different rising market economies like Vietnam, economists and strategists at Citi stated in a word Thursday.

“On stability, we consider there’s extra for EM Asia to fret about than count on beneficial properties if this deal displays what’s to return quickly,” they famous.

Whereas the event removes uncertainty and suggests different agreements might emerge within the coming days, the 20% tariff charge is larger than the anticipated 10% levy on items, in response to Citi’s specialists. They add that the separate 40% charge on transshipped items suggests different nations can also must conform to such an obligation.

“Thailand adopted by Malaysia may be extra uncovered than different EM Asia friends (aside from Vietnam). A separate and extra punitive tariff on transshipped items was least anticipated by the market,” the word stated.

“Moreover, there could also be spillovers to different exporters which have arrange factories in Vietnam in previous years,” for instance Korea, it added.

However specialists chatting with CNBC spoke expect a number of extra commerce agreements to emerge within the coming days, with Williams noting that the U.S. seems open to creating these “tough” frameworks slightly than “full” offers.

One of many nations tapped as doubtlessly being subsequent to strike a deal is India, says Trinh Nguyen, senior economist for rising Asia at Natixis CIB. The agriculture sector might emerge as an impediment, as India “will discover it arduous to permit US market entry with out home backlash,” she instructed.

What the deal might imply for Europe

Whereas the Vietnam-U.S. deal suggests extra offers possible lie forward for different Asian nations, it doesn’t essentially imply that the identical is true for the European Union, Lavanya Venkateswaran, senior ASEAN economist at OCBC Financial institution, advised CNBC.

“The Vietnamese authorities have been clear about their intent to barter with the US, even earlier than the reciprocal bulletins had been made in April,” she stated by electronic mail, including that the identical was true for different regional economies like Indonesia and Malaysia.

“In comparison with these economies, the case with [the] EU has not all the time been clean crusing and the US has been extra public in its criticism of the EU at completely different instances prior to now few months,” Venkateswaran stated.

Natixis CIB’s Nguyen in the meantime added that “Vietnam exhibits that it is extremely tough for Europe to get what it desires — which is tariff-free.”

Some duties are prone to be imposed, she stated, and whereas the EU might retaliate by making use of equal tariffs on the U.S., Nguyen expects the EU to conform to a ten% tariff and “attempt to take wins on the sectoral facet.”

Commerce negotiations between the EU and U.S. have been difficult and gradual to develop, with sources telling CNBC {that a} bare-bones “political” cope with scant preliminary particulars stands out as the the EU’s greatest hope at this level. Analysts and economists have additionally expressed uncertainty concerning the probability of a commerce settlement, given key sticking factors like large tech regulation, taxation, and broadly mismatched world views.

Trump has referred to as for tariffs as excessive as 50% on the EU, whereas the bloc has threatened wide-ranging countermeasures, which have additionally been paused till subsequent week.