Unlock the Editor’s Digest at no cost

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly e-newsletter.

Macquarie has agreed to inject as much as £1.2bn of recent fairness into struggling utility Southern Water as a part of a recapitalisation that may end result within the debt owed to its holding firm lenders being reduce by greater than half.

Southern’s Australian proprietor will initially pump £655mn of fairness into the corporate — which gives water and sewerage companies to 4.7mn prospects within the south-east of England.

Macquarie intends to supply a minimal of £245mn in further fairness by December, a sum that would rise to as a lot as £545mn.

As a part of the deal Macquarie has additionally agreed a debt restructuring with lenders to Southern Water’s holding firms, which can apply important haircuts to the riskiest bonds within the group’s multi-tiered monetary construction.

Whereas Southern’s funds are in a much less precarious place than these of Thames Water, the UK’s largest water utility that was beforehand owned by Macquarie, it’s nonetheless on a watchlist of financially confused firms monitored by the regulator, Ofwat. It has come below stress in debt markets over issues it may breach its covenants.

Southern additionally faces a backlash from most people for sewage outflows at among the UK’s hottest seashores, together with Brighton and Whitstable, and is prone to water shortages after years of under-investment. The corporate has thought-about importing water from the Norwegian fjords.

By 2030 Southern will increase annual buyer payments by £222 to £642, the biggest improve agreed between any of the UK’s 11 privatised water and sewage firms and the regulator. This invoice improve comes on high of different inflation-linked rises.

Southern has appealed to the UK’s Competitors and Markets Authority to have the ability to improve payments even additional over the subsequent 5 years to assist it finance upgrades.

In the meantime, the corporate paid chief govt Lawrence Gosden a £183,000 bonus final yr, serving to to spice up his complete pay by 79 per cent to £764,200.

Southern introduced on Tuesday that the debt throughout its holding firms can be diminished from £865mn to £415mn. There are two important tiers of debt above Southern’s working firm, which sit at a center holding firm and a high holding firm respectively.

Bondholders together with Ares Administration and Australian infrastructure investor Westbourne Capital have agreed to a full writedown of their roughly £370mn of debt, in response to an individual accustomed to the matter.

In return, they may obtain an “equity-like” funding within the water firm, the particular person added, in an association much like a debt-for-equity swap, through which these bondholders obtain a minority stake within the enterprise.

Bondholders on the center holding firm will see no impairment to the face worth of their debt, the particular person stated, however have agreed to vary the phrases of the debt and prolong its maturity.

The maturities of the remaining debt services are being prolonged to at the least September 2030, in response to the announcement on Tuesday.

The writedowns are seen as a approach to permit new fairness to stream instantly into the utility’s heavily-indebted working firm, reasonably than getting used to service debt additional up the capital construction.

In February, Macquarie dedicated to injecting £900mn of recent fairness into Southern, a rise on the £650mn it had promised beforehand.

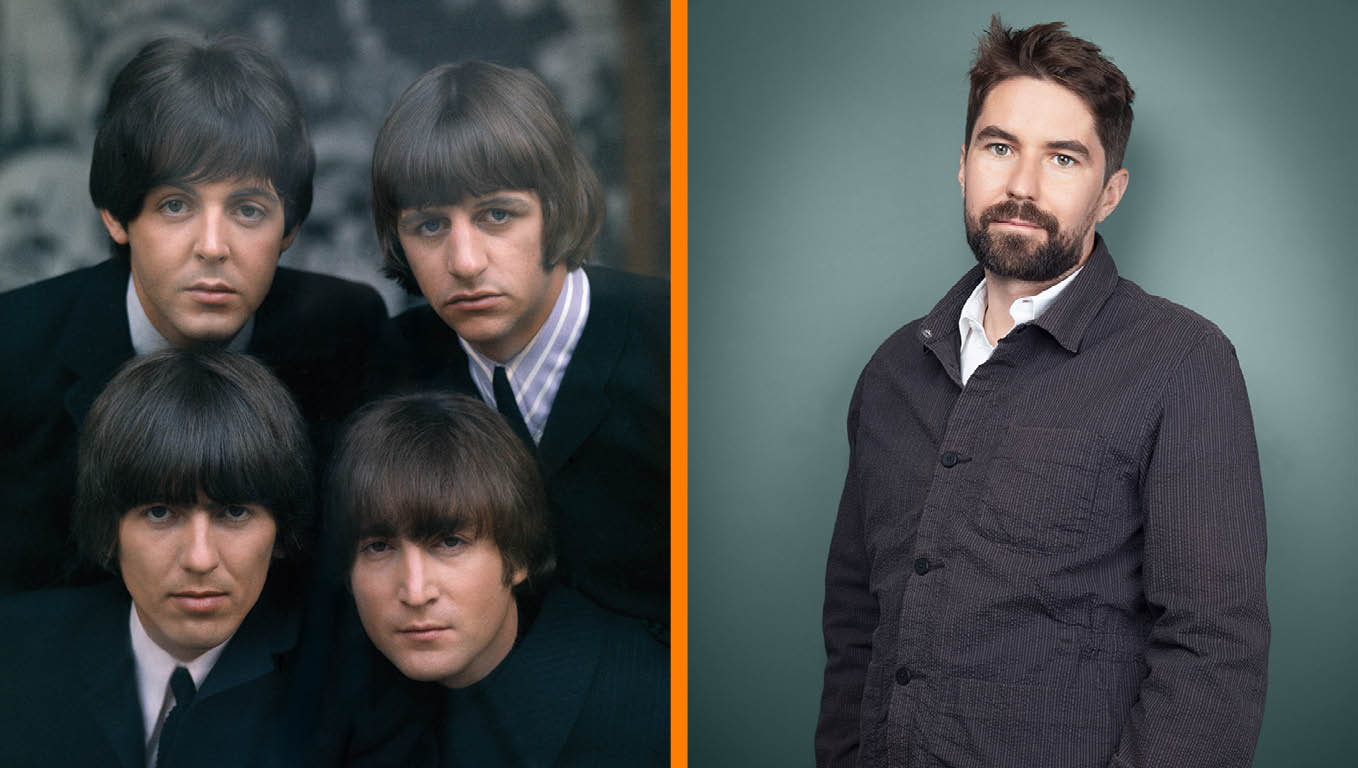

“This extra fairness funding demonstrates our dedication to Southern Water and its administration workforce, and our perception that the deliberate funding programme will ship for its prospects and the surroundings,” stated Martin Bradley, a senior managing director at Macquarie Asset Administration.