The LyondellBasell Houston refinery is seen in June. A number of components are holding oil costs down, together with the truth that america is now the world’s largest oil producer.

Brandon Bell/Getty Photos

disguise caption

toggle caption

Brandon Bell/Getty Photos

Instantly after Israel attacked Iran earlier this month, crude oil costs spiked up — precisely such as you’d count on with a struggle that threatens oil provides.

The value improve was substantial: 7% inside a couple of hours. However on the similar time, it wasn’t the type of meteoric rise that might sign that the world may very well be headed for an oil disaster. Costs hit $80 per barrel at their peak this month. That is nonetheless decrease than they have been in January.

“We noticed lots of people … saying, ‘Why is not crude reacting extra?'” says Rebecca Babin, a senior vitality dealer at CIBC Non-public Wealth. In any case, Iran is without doubt one of the world’s 10 greatest oil producers, and it has threatened to dam the Strait of Hormuz and prohibit much more oil from flowing.

Oil costs continued to go up and down because the battle prolonged and rose once more over the weekend after the U.S. bought concerned. However then, as Iran didn’t block the strait or in any other case intrude within the oil commerce, costs began to drop — and swiftly. Even earlier than a ceasefire was introduced, costs trended down.

Now, crude oil costs are literally decrease than they have been earlier than Israel attacked.

“The market has proven that it has been very resilient to a few of the geopolitical shocks that traditionally would have despatched costs skyrocketing,” says Angie Gildea, U.S. vitality lead for the accounting big KPMG. “We did not see that a lot with Russia-Ukraine, and we’ve not seen that with Israel-Hamas. And we’re definitely not seeing that on this case.”

Listed below are 5 explanation why the Iran battle hasn’t prompted a disaster.

Iran has not focused oil provides

The massive concern for the oil market was the chance that Iran would shut the Strait of Hormuz, by means of which about 20% of the world’s oil provide passes, or in any other case cease oil from flowing to markets.

Such a disruption to grease provides could be a significant improvement. Regardless of efforts to pivot to different sources of vitality to battle local weather change, the worldwide economic system runs on oil — greater than 100 million barrels per day, and rising. A sudden drop in provide would ship costs up, with ripple results worldwide.

However up to now, Iran has declined to dam the Strait of Hormuz, and analysts assume the prospect is unlikely at this level — partly due to the extraordinary financial ache it might trigger Iran.

Oil merchants have realized to be skeptical of spikes

Even within the absence of any precise hit to provide, there was a time when simply the potential of it might need pushed costs as much as eye-watering ranges — oil markets usually reply to concern as a lot as to actuality. However Babin says merchants have realized to be cautious, based mostly on what occurred with oil costs after Hamas attacked Israel, or when Israel attacked Iran final yr, or at different occasions when tensions have mounted.

“All through all the opposite geopolitical occasions which have occurred over the past a number of years, we get these spikes after which provide just isn’t impacted and so they revert in a short time,” she says.

It is just like the story of the boy who cried wolf: Markets maintain signaling there is a motive to panic, however because the menace fails to materialize time and again, the response is diminishing.

Autumn is approaching (on the earth of oil)

The summer time solstice could have simply handed, however oil contracts work on a unique calendar.

“The patrons of crude oil at the moment are shopping for for August and past,” explains Susan Bell, senior vp of commodities evaluation at Rystad Vitality. “And that begins to maneuver them into the decrease demand season … the place costs ought to really begin softening.”

Oil demand tends to go down when it is autumn within the Northern Hemisphere. That is additionally taken some stress off.

The world simply has an excessive amount of oil

Oil analysts name it “the basics” of the oil market: provide and demand, how a lot of the stuff the world wants and the way a lot it makes. Currently, demand has been rising slowly, thanks partly to an underwhelming Chinese language economic system. Provide, although, has been booming, partly as a result of OPEC and its allies maintain placing extra barrels available on the market.

The market is oversupplied. That pushes costs down — and it means there’s much less panicking about one thing that might probably minimize into provides.

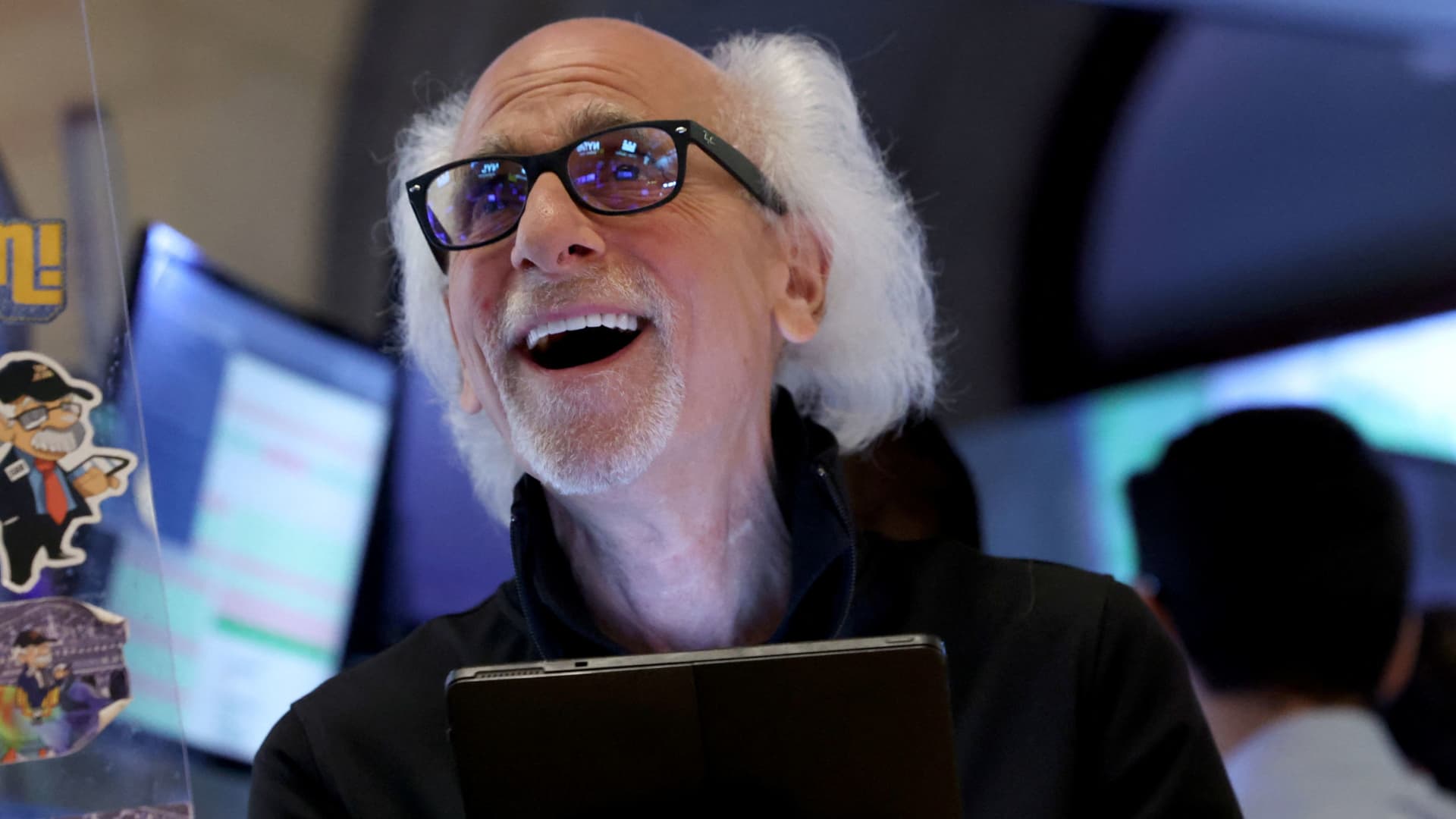

The U.S. is the world’s dominant oil producer

Final, however not least, the geopolitics of oil have been remodeled over the past decade. The shale revolution — when newer expertise like fracking unlocked extra oil from U.S. oil fields — lessened the world’s dependence on crude from the Center East.

In the present day, the U.S. is the world’s largest producer of oil, in addition to the biggest client.

“The influence on the oil market is profound,” says Jim Burkhard, who heads crude oil market analysis for S&P International. “It’s among the many most essential components why the response within the oil market to geopolitical battle within the Center East is proscribed and infrequently disappears as soon as the concern of a possible disruption dies down.”

It isn’t simply that the U.S. produces a variety of oil; it is also that the U.S. can produce rather a lot extra shale oil shortly, permitting a fast response if there was a significant provide disruption that led to a chronic worth hike.

The ability of U.S. manufacturing was what President Trump alluded to this week when he repeated his name for producers to “drill, child, drill.” However within the U.S., the place firms produce oil, not the federal government, the size of manufacturing is not dictated by politicians, however by the market.

And that market, once more, is oversupplied. Burkhard is skeptical that any U.S. growth is coming.

“We predict — we have been saying for the previous couple of months — U.S. manufacturing goes to say no,” he says.

The market is telling oil producers to chill, child, chill, at the very least for now.