“By the way, one factor direct platforms and media and our whole ecosystem can do to create higher traders, longer holding durations, and a greater shot at wealth creation… is cease the obsession with exhibiting final 1-year returns. This statistic could be very influential and never in a great way. It creates unrealistic expectations of returns and a perennial pointless seek for the very best performing fund.”

Hyperlink: https://x.com/iRadhikaGupta/standing/1937720600123830713

In her tweet, she emphasised the significance of rolling returns and the way they’ll result in higher funding selections over time.

“For a very long time we @EdelweissMF have had a marketing campaign – Recommendation Zaroori Hai – as a result of we imagine handholding is important in anybody’s monetary journey. This information proves why – but once more,” Gupta added.

Gupta’s tweet resonated with the significance of teaching traders on the importance of long-term metrics as an alternative of getting caught up in short-term efficiency. Gupta’s name to motion is directed at direct platforms and media, urging them to create higher traders by selling longer holding durations and a greater strategy to wealth creation.In her tweet, Gupta stresses that it’s important for platforms to coach traders about rolling returns and long-term methods. She believes that if clients need to type funds, the sorting ought to be executed based mostly on 5-year rolling returns, as an alternative of specializing in the extra transient 1-year returns.

Gupta acknowledged that Edelweiss’s marketing campaign, “Recommendation Zaroori Hai”, has all the time centered across the perception that hand holding in an investor’s journey is vital. This perception aligns with the decision for traders to grasp the broader efficiency of a mutual fund, significantly by rolling returns. Rolling returns measure the efficiency of a fund over a constant interval, smoothing out fluctuations that will occur as a result of short-term volatility.

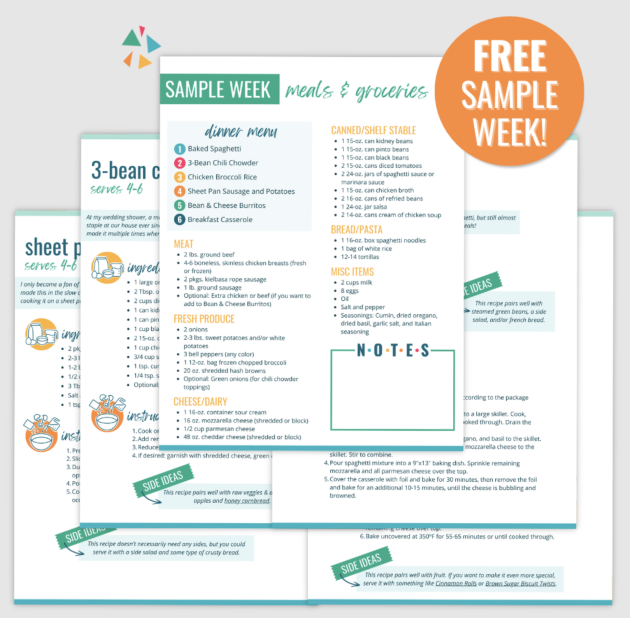

This was adopted by one other tweet from Gupta, which included a visible illustration of the Edelweiss Mid Cap Fund’s 5-year rolling returns, the place the information clearly showcases the fund’s long-term efficiency metrics and resilience.

Hyperlink: https://x.com/iRadhikaGupta/standing/1937722862393020504

Rolling returns not solely give a extra reasonable view of a fund’s efficiency but additionally permit traders to see how the fund has weathered totally different market circumstances.

She emphasised a vital think about making higher funding selections—shifting past the standard obsession with the short-term 1-year returns. She posed a query to her followers:

“What results in higher resolution making?

A. Final 1-year returns of this fund

B. The rolling returns information under”

ETMarkets.com

ETMarkets.com(Supply: X, Radhika Gupta)

The information highlights that regardless of a number of situations of unfavourable returns, the fund has persistently delivered optimistic returns for almost all of the time. Notably, 91.14% of the time, the returns have exceeded 7%, proving the fund’s potential for long-term progress.

Radhika Gupta’s name to cease obsessing over 1-year returns is a reminder for traders to take a extra measured and long-term strategy to wealth creation. As she factors out, understanding rolling returns is vital to fostering a mindset that results in higher decision-making and extra sustainable funding practices.

Educating traders to shift their focus from short-term metrics to longer-term methods is crucial for constructing a extra knowledgeable and efficient funding neighborhood.

Additionally learn: HDB Monetary IPO: Can HDFC Financial institution’s midas contact break the mega IPO curse?

(Disclaimer: Suggestions, options, views and opinions given by the consultants are their very own. These don’t signify the views of The Financial Instances)