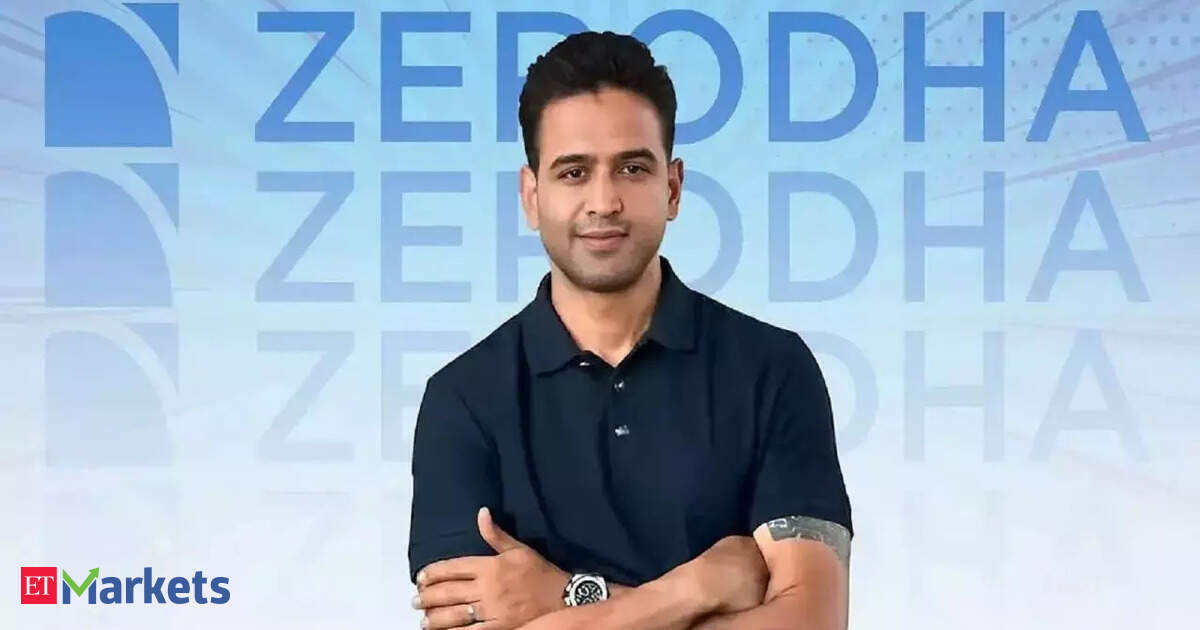

In a submit on X, Kamath recalled a dialog with a veteran from non-public fairness who had evaluated a broking agency in 2008 however backed out. “The income was concentrated in only a handful of shoppers,” the investor had stated—one thing that spooked them. On the time, a really small group of merchants generated a lot of the change turnover. “This was lots worse again then,” Kamath famous.

Quick ahead to at present, and whereas the variety of retail merchants has elevated, the issue hasn’t gone away—it has solely shifted form. “For us, it is over 80%,” Kamath stated, referring to the share of Zerodha’s income that comes from simply two F&O contracts: Nifty and Sensex. He added that this pattern is true for many brokers in India.

That’s a dangerous dependence. “Which means one change can wipe out an enormous chunk of our revenues,” he warned.

What makes it worse, Kamath identified, is the dearth of other income levers in India. There’s no cost for order move (PFOF)—a controversial however profitable apply in nations just like the US. Cryptocurrency buying and selling is basically off the desk. And new guidelines corresponding to quarterly fund settlement, which require brokers to return all unutilized funds to buyer accounts each quarter, add operational stress.

“I’m wondering why the brokerage enterprise appears to be like so attractive from the skin,” Kamath quipped.His reflection is a uncommon public unpacking of how regulatory limits, market behaviour, and structural dependencies create a fragile enterprise mannequin—even for India’s most profitable brokerages.