Rolls of metal are seen at U.S. Metal – Irvin Works within the Pittsburgh suburb of West Mifflin, Pennsylvania, earlier than President Donald Trump speaks at a rally, Could 30, 2025.

Saul Loeb | AFP | Getty Pictures

U.S. Metal shares stopped buying and selling on the New York Inventory Change on Wednesday after Japan’s Nippon Metal accomplished its acquisition of the enduring American industrial title.

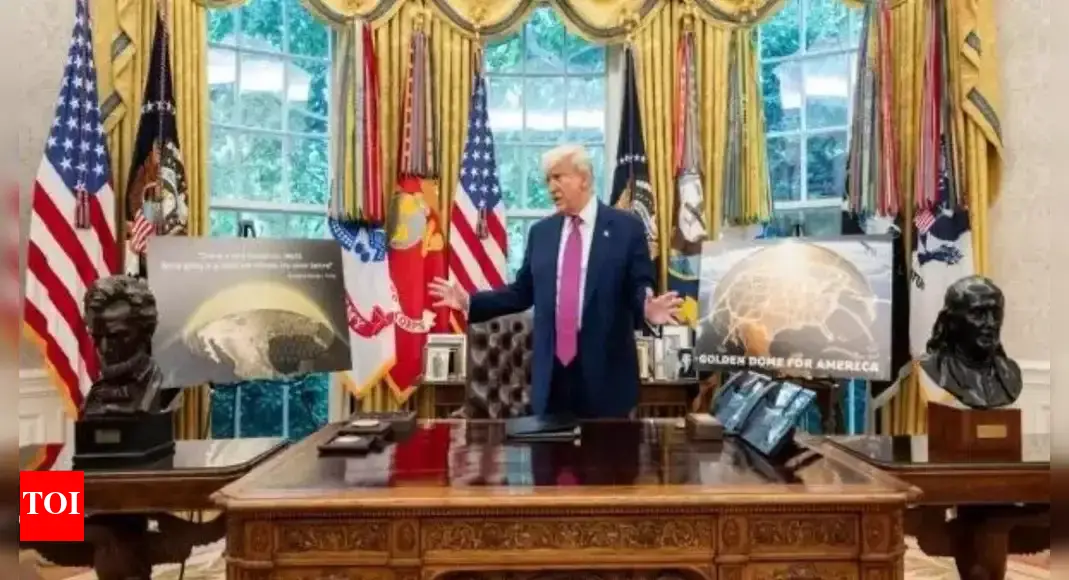

President Donald Trump has insisted for weeks that the businesses would kind a “partnership” during which U.S. Metal would stay American-owned.

However the New York Inventory Change notified the Securities and Change Fee on Wednesday that U.S. Metal’s shares can be faraway from itemizing, after the corporate grew to become an entirely owned subsidiary of Nippon Metal North America.

U.S. Metal shares stopped buying and selling at 8:30 a.m. ET on Wednesday after Nippon accomplished its acquisition, in line with a discover from the NYSE. The delisting might be efficient on June 30, NYSE mentioned.

Trump opposed Nippon’s bid to amass U.S. Metal within the runup to the 2024 presidential election, however he modified his stance after he took workplace, ordering a brand new evaluate of the deal in April. Former President Joe Biden had blocked Nippon’s acquisition in January, citing nationwide safety issues.

Trump introduced a “partnership” between U.S. and Nippon in a Could 23 submit on his social media platform Reality Social, inflicting confusion amongst traders and union members about whether or not the construction of the unique deal had modified one way or the other.

U.S. Metal and Nippon began adopting the president’s “partnership” language, although they by no means backed off from the phrases of the unique December 2023 merger settlement of their filings with SEC. U.S. Metal will proceed to function below its title.

Golden share

Trump did compel U.S. Metal and Nippon to signal a nationwide safety settlement with the U.S. authorities as a situation for him clearing the deal.

The U.S. president will wield a “golden share” below the phrases of the settlement. U.S. Metal mentioned Wednesday that the golden share offers the president veto energy over the next choices:

- Altering U.S. Metal’s title or transferring its headquarters from Pittsburgh

- Shifting U.S. Metal outdoors the U.S.

- Shifting manufacturing or jobs outdoors the U.S.

- Some choices relating to the closure or idling of U.S. Metal’s home manufacturing amenities, commerce, labor, and sourcing outdoors the U.S.

- Reductions in capital investments below the nationwide safety settlement

- Materials acquisitions of competing companies within the U.S.

A majority of U.S. Metal’s board members and its CEO might be U.S. residents, in line with the phrases of the nationwide safety settlement. Nippon additionally agreed that U.S. Metal will stay integrated within the U.S.

Nippon will make investments $11 billion in U.S. Metal by 2028, together with $1 billion in preliminary spending on a greenfield mission that might be accomplished after 2028, in line with the settlement.