Colourful show of All Star Converse sneakers in shoe retailer, Manhattan, New York.

Lindsey Nicholson | Common Pictures Group | Getty Pictures

Would you be bothered in case your coat was formally categorized as a windbreaker or a raincoat, or your footwear as slippers? Companies do care although, as classifications beneath a most well-liked class can assist them pay decrease tariff charges.

As U.S. President Donald Trump imposes duties on associates and foes alike, producers are more and more rethinking the classification of their merchandise and resorting to “tariff engineering” to incur decrease duties, a number of customs legal professionals, provide chain and delivery specialists instructed CNBC.

Tariff engineering — a follow that precedes Trump — includes altering an merchandise’s supplies, altering its dimensions or compositions in order that the completed merchandise could be justified to slot in a distinct “harmonized system code,” authorized specialists mentioned.

Though most new tariffs added throughout Trump’s second time period are broad-based, the U.S. authorities has carved out exemptions for sure merchandise, leaving doorways open for corporations to learn via tariff engineering, commerce legal professionals identified.

After Trump unveiled sweeping “reciprocal” tariffs in April, a number of abroad producers moved to bundle metal and aluminum parts into their last merchandise to qualify a decrease 25% responsibility beneath Part 232, mentioned David Forgue, a companion at Chicago legislation agency Barnes, Richardson & Colburn.

Issues, nevertheless, modified shortly in June as Trump jacked up tariffs on all metal, aluminum merchandise and derivatives to 50%, besides these from the U.Ok. “Now that the duties are reversed, we’re now seeing corporations take away these parts and ship them individually once more,” Forgue mentioned.

Tariff engineering is likely one of the few issues you are able to do to attempt to get it proper and scale back your responsibility legal responsibility.

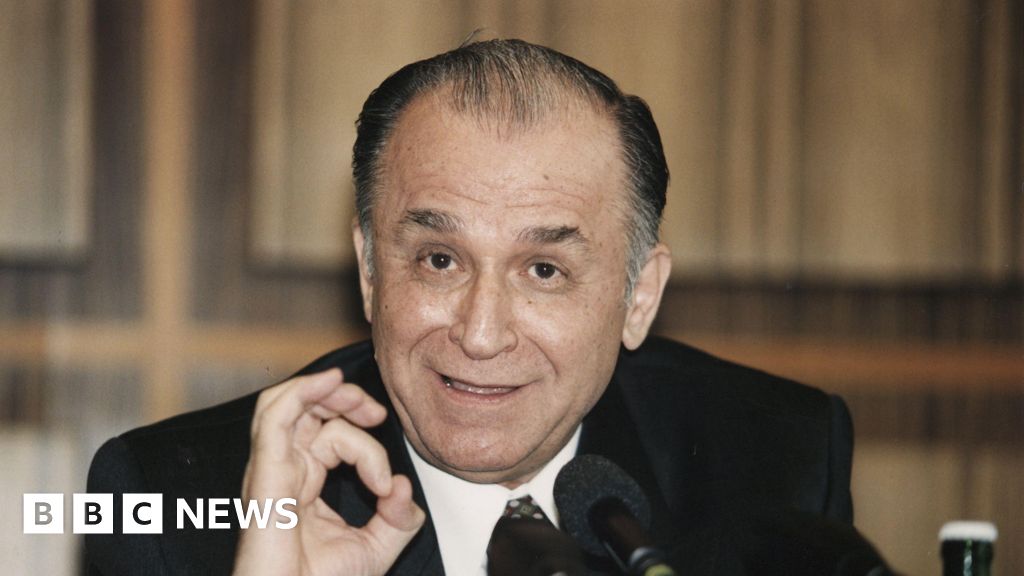

John Foote

Customs lawyer, Kelley Drye & Warren

There’s “nothing inherently unlawful and even untoward about leveraging strategic design selections that lead to creating completely different merchandise which might be topic to completely different tariff classification and responsibility charges,” mentioned John Foote, a customs lawyer at Kelley Drye & Warren in Washington D.C. “Tariff engineering is likely one of the few issues you are able to do to attempt to get it proper and scale back your responsibility legal responsibility.”

There are over 5,000 completely different product classification codes that U.S. customs authority makes use of whereas assessing tariffs. These tariff classifications had been decided via many years of negotiations between governments and business our bodies, typically various by product class.

Winnebago Industries, an American producer of motorhomes, or leisure car, mentioned in its quarterly earnings name in March that it deliberate to “work with outdoors specialists to develop and implement efficient [tariff] mitigation methods, together with tariff engineering and deferrals.”

A Winnebago Industries Inc. journey trailer stands at Motor Sportsland RV dealership in Salt Lake Metropolis, Utah, U.S., on Monday, April 6, 2020.

George Frey | Bloomberg | Getty Pictures

Aneel Salman, chair of financial safety at Islamabad Coverage Analysis Institute, described the act as “intelligent artwork of outsmarting customs,” as importers and producers tweak merchandise “simply sufficient” to qualify for decrease duties.

Sensible performs

“I used to be speaking to anyone just lately and so they had been displaying me their lapel pin,” mentioned Kelley Drye & Warren’s Foote. The pin, tacked onto the individual’s swimsuit, featured a “festive design” with items of cubic zirconia on the again, Foote mentioned.

The inclusion of cubic zirconia helped the corporate that manufactures these pins avert a 14% tariff, because the merchandise now not fell beneath festive article class however obtained categorized as jewellery, Foote subsequently learnt.

“The worth attributable to the cubic zirconia was important sufficient [and] it was a comparatively straightforward manufacturing change,” Foote mentioned.

The follow of tariff engineering could be traced again to 1882, when an importer coated sugar with molasses to keep away from increased duties imposed on lighter-colored sugar. In a landmark ruling, the Supreme Courtroom dominated the act completely authorized: “as long as the products are really invoiced and freely and actually uncovered to the officers of customs for his or her examination, no fraud is dedicated.”

Since then, corporations, large and small, have continued to play chess with the U.S. tariff classification system, with a number of family names efficiently implementing strategic product tweaks to avoid wasting on tariff prices.

For example, Columbia Sportswear has by no means been shy about its use of tariff engineering. “I’ve a complete workforce of folks that work along with designers and builders and merchandisers and with customs, and to make sure that through the design course of that we’re contemplating the influence of tariffs,” Jeff Tooze, the corporate’s vice chairman of world customs and commerce, instructed Market throughout Trump’s first time period.

Amongst its alterations, the corporate added small zippered pockets under the waist on ladies’s shirts, permitting them to be exempted from increased duties beneath the U.S. customs guidelines.

Equally, footwear maker Converse provides fuzzy-felt cloth on the soles of its signature All Stars sneakers, somewhat than the standard full-rubber one, to be categorized as slippers somewhat than athletic footwear, serving to it lower tariff drastically.

Snuggies, the fluffy blanket with sleeves imported primarily from China, almost halved its tariff prices by successful a lawsuit in 2017 classifying it as a blanket, not an merchandise of clothes.

CENTRAL VALLEY, NY – NOVEMBER 17: A Columbia Sportswear Firm signal hangs in entrance of their retailer on the Woodbury Frequent Premium Shops shopping center on November 17, 2019 in Central Valley, New York.

Gary Hershorn | Corbis Information | Getty Pictures

Quick-moving shopper good and clothes, attire and footwear sectors can discover it comparatively straightforward to implement tariff engineering, mentioned Andrew Wilson, provide chain strategist at consultancy Supplino Inc.

For extra subtle and “heavily-regulated” sectors similar to automotive, aerospace, electronics and medical units, “it is particularly difficult … as a result of even minor adjustments might require intensive validation and approval,” Wilson mentioned.

“You may be one other 12 to 24 months of testing, certification and validation as a way to get that completed,” Wilson added, because it requires intensive collaboration throughout departments together with design, engineering and authorized workforce.

Guidelines of interpretation

Firms should tread a superb between between redesigning their merchandise and fraudulently misrepresenting product classifications.

A living proof illustrating the challenges with tariff engineering is Ford Motor. The automaker had for years imported its Transit Join van as a passenger van, then eliminated the second row seats to promote them as cargo vans. In doing so, Ford circumvented a hefty 25% tariff and solely paid a 2.5% import responsibility.

The U.S. Justice Division mentioned in its ruling final yr that Ford was “misclassifying cargo vans” and that the back-row seats “had been by no means supposed to be, and by no means had been, used to hold passengers.”

“The article have to be a ‘industrial actuality’ at importation. The danger is that customs [may] discover the adjustments to be “fraud or artifice,” [that case] the tariff engineering could also be rejected,” mentioned Forgue.

“In some instances altering sure issues a couple of product would not change the important character of what the nice is,” mentioned Derek Scarbrough, founding father of World Logistical Connections. “If you happen to add one thing to a buying cart, it is nonetheless a buying cart,” he added.

U.S. Customs and Border Management has developed a so-called “binding ruling” system the place corporations can receive official determinations on product classifications and HTS code earlier than importing.

Adam Lees, an lawyer at legislation agency Harris Sliwoski, who has helped purchasers put together such ruling letter requests, described it as “a means for corporations to get CBP’s official blessing” earlier than cargo.

For companies, even “small proportion financial savings could be significant,” Lees said, as volumes shipped could possibly be substantial.