Individuals and companies within the US have confronted a whirlwind of coverage change in current months. However one factor has remained fastened: borrowing prices set by the US central financial institution.

The Federal Reserve caught with that technique on Wednesday, leaving its key rate of interest unchanged, whilst officers’ expectations for the economic system worsened.

The choice marked the fourth in a row with out motion, preserving the financial institution’s influential lending price hovering round 4.3%, the place it has stood since December.

That got here regardless of forecasts from policymakers suggesting they anticipate slower progress, greater unemployment and quicker inflation than they did just some months in the past.

Sometimes, the Fed lowers borrowing prices if it believes the economic system is struggling and raises them if costs begin to rise too rapidly.

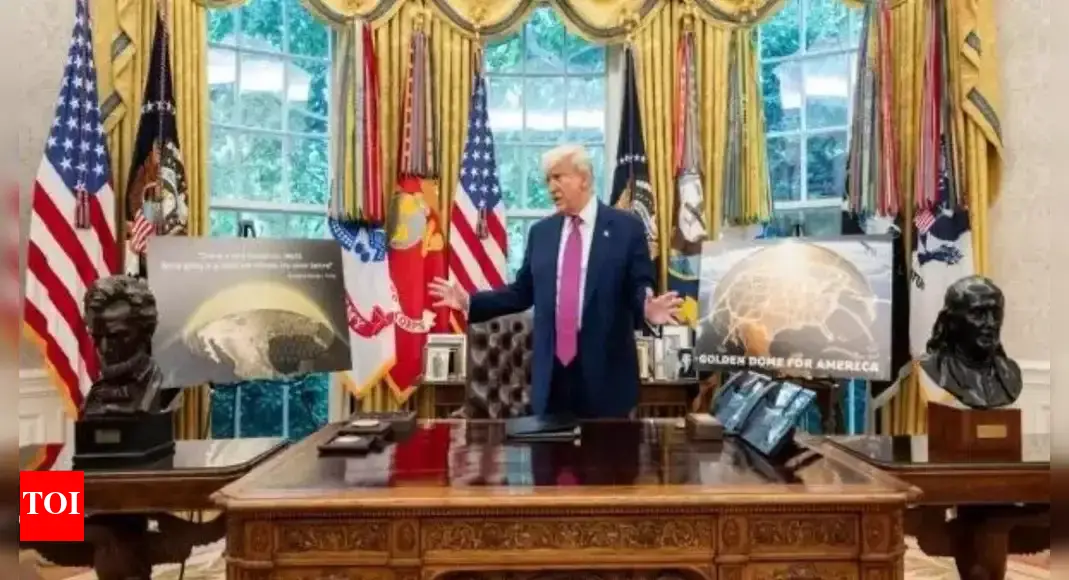

President Donald Trump has repeatedly referred to as on the Fed to chop rates of interest, whereas pushing main adjustments to financial coverage, together with elevating tariffs on items from world wide.

Fed officers, who’re empowered to set rates of interest impartial of the White Home, have mentioned they’re frightened {that a} one-time leap in costs as a result of these new levies may morph right into a extra persistent downside.

Inflation, the tempo of value will increase, stays above the Fed’s 2% goal, coming in at 2.4% in Might.

Federal Reserve chairman Jerome Powell mentioned the financial institution was braced for costs to rise extra rapidly within the months forward as companies begin to move on the price of the import taxes to their clients.

“That course of could be very onerous to foretell,” he mentioned, noting that it might rely on how massive the tariffs are and their period.

“That’s the reason we expect the suitable factor to do is maintain the place we’re.”

He mentioned the financial institution may afford to attend, noting that the economic system general remained “strong” and the unemployment price stays low at 4.2%.

However projections launched by the Fed confirmed that policymakers, on common, predict progress to sluggish to 1.4% this yr, down from 2.5% final yr and the 1.7% they had been forecasting in March.

The forecasts name for inflation of roughly 3%, up from the two.7% predicted in March and an increase within the unemployment price to 4.5%.

The outlook for rate of interest cuts in 2025 didn’t change considerably, with a majority of members nonetheless anticipating charges to drop slightly below 4% by the top of the yr.

However the projections anticipate barely greater charges in 2026 and 2027 than beforehand forecasted.

In remarks on Wednesday forward of the Fed’s resolution, Trump repeated his criticism of Powell, calling him “silly” and “too late” to behave, whereas speculating concerning the finish of his time period.

The European Central Financial institution has minimize rates of interest eight instances since final June. The Financial institution of England minimize borrowing prices final month however is anticipated to carry charges regular this week.

However Isaac Stell, funding supervisor at Wealth Membership, mentioned Trump could have “talked himself right into a little bit of a bind”, because the Fed stays dedicated to its wait-and-see method.

“Central bankers are likely to jealously guard their independence, which signifies that except there is a actually compelling motive to chop they may simply keep sat on the fence,” he mentioned.

Fed rate of interest choices decide what it prices banks for short-term loans.

That price in flip has vital affect over borrowing prices throughout the economic system, informing what common banks find yourself charging households and companies for mortgages and other forms of loans.

At 4.3%, the Fed’s benchmark rate of interest stays markedly greater than it was between 2008 and 2022, when the financial institution began to hike charges in response to rising costs.

However it’s roughly a share level decrease than the place it stood final yr.