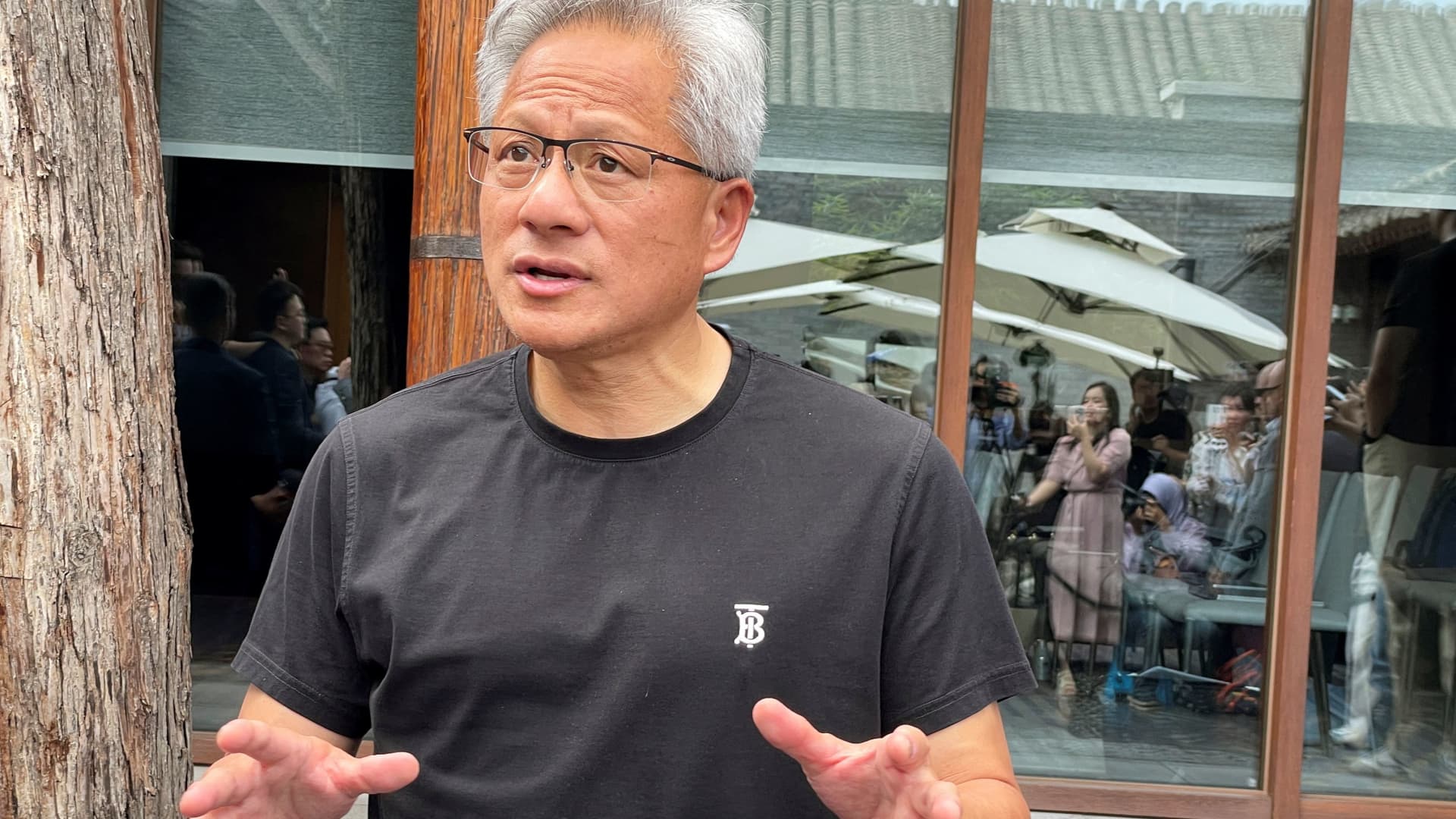

Oracle CEO Safra Catz speaks on the FII PRIORITY Summit in Miami Seaside, Florida, on Feb. 20, 2025.

Joe Raedle | Getty Pictures

Oracle shares loved their finest week since 2001 as Wall Road cheered a robust earnings report and bullish feedback on the corporate’s prospects in cloud computing.

The inventory jumped about 24% for the week, with nearly all of the beneficial properties coming within the two buying and selling days after the corporate’s quarterly earnings launch. The final time Oracle had a greater week was in April 2001, in the course of the dot-com crash, when so-called dead-cat bounces had been frequent. In the course of the prior quarter, Oracle shares misplaced nearly half their worth.

It is a a lot totally different firm at this time, and whereas Oracle was usually considered as a late entrant into the cloud infrastructure market, the corporate has discovered a distinct segment and is seeing fast progress serving to shoppers function synthetic intelligence fashions.

“Oracle is within the enviable place of getting extra demand than it could actually fulfill,” Joseph Bonner, an analyst at Argus Analysis, wrote in a word to shoppers on Friday. He recommends shopping for the shares and lifted his value goal to $235 from $200.

Oracle rose to a report on Friday, closing at $215.22.

Within the firm’s earnings report late Wednesday, income and earnings topped estimates. CEO Safra Catz stated gross sales for the brand new fiscal 12 months ought to are available above $67 billion, larger than LSEG’s $65.18 billion consensus.

“The demand is astronomical,” Larry Ellison, Oracle’s chairman instructed analysts on the earnings name. “However we have now to do that methodically. The rationale demand continues to outstrip provide is we are able to solely construct these information facilities, construct these computer systems, so quick.”

Oracle has been enjoying catch-up in cloud to rivals Amazon, Google and Microsoft.

Within the 2025 fiscal 12 months, Oracle’s capital expenditures exceeded $21 billion, which is greater than the corporate spent from 2019 to 2024. The sum ought to attain $25 billion in fiscal 2026, Catz stated on the decision.

Google anticipates $75 billion in capital spending this 12 months. Microsoft’s goal for the fiscal 12 months is $80 billion.

Oracle’s shopper listing now contains Meta, OpenAI and Elon Musk’s xAI. They’re among the many corporations that require essentially the most Nvidia graphics processing models to coach generative AI fashions that create textual content, pictures and movies in response to a couple phrases of human enter.

Startups Baseten, Bodily Intelligence and Huge Knowledge are additionally cloud shoppers, Oracle introduced this week.

“We’ll construct and function extra cloud infrastructure information facilities than all of our cloud infrastructure rivals mixed,” Ellison stated.

Oracle shares are up 29% to date in 2025, whereas the Nasdaq is up lower than 1%. Among the many most extremely valued U.S. tech corporations, the next-best performer for the 12 months is Meta, which is up round 17%.