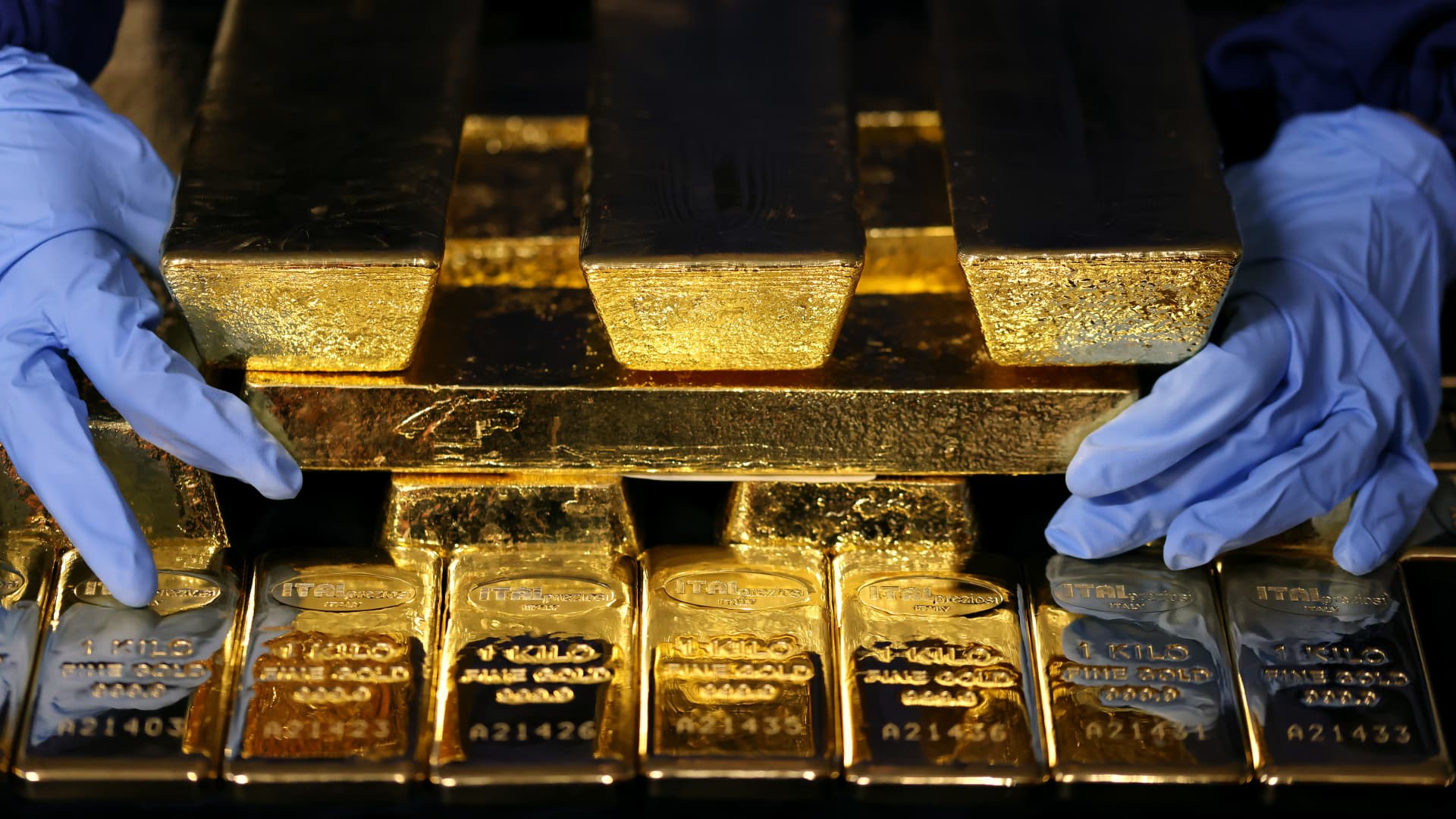

An worker arranges gold bars on the Italpreziosi SpA treasured metals refinery plant in Arezzo, Italy, on Tuesday, Could 6, 2025.

Bloomberg | Bloomberg | Getty Photographs

Central banks’ rising urge for food for gold meant that the dear metallic was the second-largest world reserve asset in 2024, in response to a European Central Financial institution report out Wednesday — however analysts recommend some establishments could also be nearing their fill.

Central banks’ gold stockpiles are near ranges final seen within the Sixties. Mixed with gold’s hovering worth, it’s now second solely to the U.S. greenback as their greatest reserve holding in worth phrases, the ECB mentioned in its evaluation Wednesday.

In 2023, gold and the euro have been roughly degree at round 16.5% as a share of world official reserves on common, a CNBC calculation of ECB knowledge confirmed. In 2024, that shifted to 16% for the euro and 19% for gold — with the U.S. greenback accounting for 47%.

Central banks amass liquid belongings akin to foreign currency and gold as a hedge in opposition to inflation and to diversify their holdings. It additionally permits them to promote these reserves to help their very own foreign money in occasions of stress. Gold is seen offering long-term worth and resilience by means of volatility, and central banks now account for greater than 20% of its world demand, up from round a tenth within the 2010s.

The ECB mentioned survey knowledge had discovered gold was more and more enticing to rising and creating international locations that have been involved about sanctions and the potential erosion of the function of main currencies within the worldwide financial system.

Gold costs have set a string of recent document highs over the previous few years, together with in 2025. A surprising rally has turned to choppiness in current months, as world markets have been rattled by fast-changing U.S. tariff coverage.

A turning level for the dear metallic got here across the time of Russia’s full-scale invasion of Ukraine in February 2022, which mixed with spiking inflation and expectations of rising rates of interest, spurring a flight to so-called protected haven belongings. Geopolitical and financial uncertainty has remained elevated constantly since then.

Spot gold futures.

China has been a number one driver of the gold rally, with India and Turkey amongst its different main patrons.

Rally to proceed?

Most of the tailwinds which have propelled gold nonetheless stay.

“Buyers ought to guarantee portfolio diversification and maintain enough publicity to gold and hedge funds” with additional turbulence in shares anticipated, Mark Haefele, chief funding officer at UBS World Wealth Administration, suggested shoppers in a be aware final week.

However there are indicators that central financial institution purchases could cool within the months forward.

The establishments “have performed a key function within the gold rally and can most likely proceed shopping for gold, albeit at a slower tempo than previously couple of years,” Hamad Hussain, local weather and commodities economist at Capital Economics, informed CNBC.

“Certainly, the notion of gold as hedge in opposition to world fiscal, inflationary, and geopolitical dangers helps the case for central financial institution reserve managers to allocate a better share of their portfolio to gold. Current doubts over the greenback’s safe-haven standing might additionally enhance the attractiveness of each gold and the euro as reserve belongings over the approaching years,” Hussain added.

The speed of central financial institution gold purchases fell 33% quarter-on-quarter within the first three months of the 12 months, in response to knowledge from the World Gold Council analysed by financial institution ING, whereas Chinese language purchases notably slowed.

“Given the sturdy run in gold costs, the momentum in gold shopping for might sluggish. However on a long-term foundation, the unsure geopolitical backdrop and want for diversification will help the buildup of gold as reserves,” Janet Mui, CFA, head of market evaluation at RBC Brewin Dolphin, informed CNBC.

“Because the U.S. desires to take a extra isolationist method in commerce, it is sensible for central banks of its key buying and selling companions to diversify their reserves away from the U.S. greenback.”

Although central financial institution demand has risen, the vast majority of gold demand — 70% — comes from jewelry and funding, the ECB figures confirmed.

Based on the ECB’s personal report, the affect of geopolitics and demand on gold costs going ahead will “rely on the stickiness of gold provide.”

“It has been argued that gold provide has responded elastically to will increase in demand in previous a long time, together with by means of sturdy progress in above-ground shares,” it mentioned.

“Subsequently, if historical past is any information, additional will increase within the official demand for gold reserves might also help additional progress in world gold provide.”