Many distinguished authorized students and former authorities officers throughout the political spectrum have supported the lawsuit difficult Trump’s “Liberation Day” tariffs introduced by the Liberty Justice Heart and myself, and backed the current US Court docket of Worldwide Commerce determination in our favor. However the ruling does have its critics, and one of the vital distinguished is Harvard legislation Prof. Jack Goldsmith. He would not fairly conclude the ruling is incorrect. However he clearly has critical reservations about it, outlined in a notable article on the Govt Features substack, the place he additionally criticizes the current US District Court docket of DC (DDC) ruling in opposition to the tariffs. On this publish, I clarify why these reservations are usually misplaced.

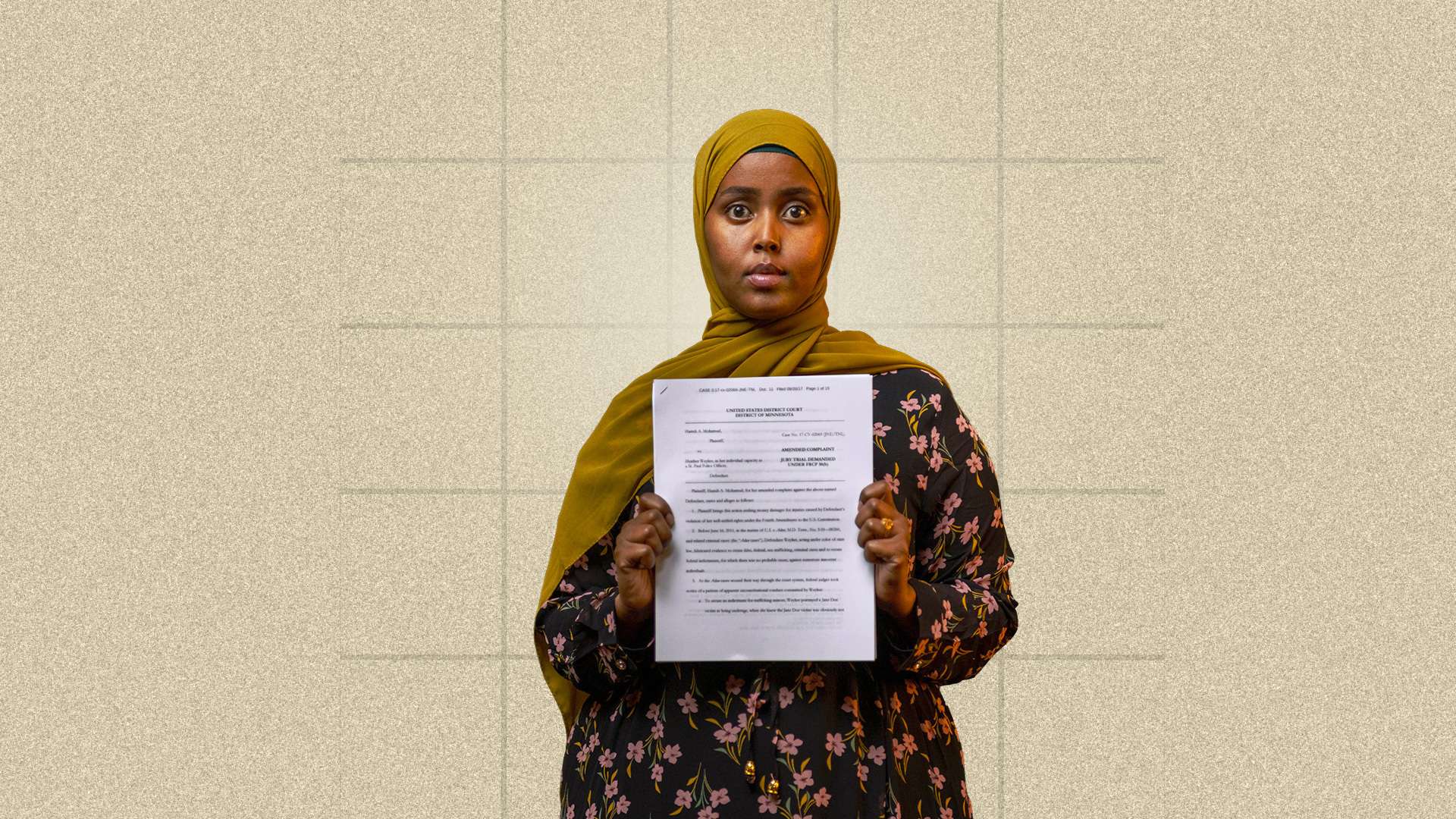

Because the CIT opinion emphasised, the important thing issue behind the choice was the “unbounded” nature of the tariff authority claimed by Trump: “The query within the two circumstances earlier than the courtroom is whether or not the Worldwide Emergency Financial Powers Act of 1977 (“IEEPA”) delegates…. to the President…. authority to impose limitless tariffs on items from almost each nation on the planet.” The CIT dominated IEEPA didn’t grant such limitless energy, and that it could be an unconstitutional delegation of legislative energy if it did.

Goldsmith contends “the administration didn’t declare an unbounded or limitless energy” as a result of “Trump’s tariffs complied with IEEPA’s substantive and procedural necessities.” He notes that Trump declared a “nationwide emergency” with respect to commerce deficits and additional claimed the deficits are an “uncommon and extraordinary menace” to the US financial system and nationwide safety, thus supposedly assembly IEEPA’s necessities.

However Goldsmith overlooks the truth that the administration constantly maintained that the president has absolute, unreviewable discretion to find out qualifies as a “nationwide emergency” and an “uncommon and extraordinary menace.” And if commerce deficits—that are fully regular and never a menace in any respect—qualify as an “uncommon and extraordinary menace,” so can just about something. That is undeniably a declare to limitless tariff authority. And the CIT rightly concluded as a lot.

As CIT Choose Jane Restani put it in oral argument, the administration’s place would enable the president to impose tariffs for any “loopy” motive, reminiscent of a “peanut butter scarcity.” Certainly, the hypothetical peanut scarcity tariff could be much less abusive and ridiculous than Trump’s trade-deficit rationale. Peanut butter shortages are no less than considerably uncommon, and could be a real drawback, whereas commerce deficits are neither.

The CIT additionally rightly concluded that IEEPA would not depart dedication of what tariffs to impose fully as much as the president: “IEEPA’s provisions… impose significant limits on any such authority it confers.” Such boundless discretion would render the phrases “uncommon and extraordinary menace” superfluous (thereby violating a primary rule of statutory interpretation), and in addition create an unconstitutional delegation of “unbounded tariff authority to the President.”

Goldsmith additionally criticizes the CIT and DDC’s reliance on the “main questions” doctrine, which requires Congress to “converse clearly” when authorizing the chief to make “selections of huge financial and political significance.” Trump’s gargantuan IEEPA tariffs—beginning the most important commerce warfare because the Nice Despair and imposing some 1.4 to 2.2 trillion {dollars} in new taxes on Individuals—increase a serious query, if something does. And the truth that no earlier president has used IEEPA to impose any tariffs in any respect fulfill the extra criterion that MQD scrutiny is stronger when an assertion of energy is unprecedented.

Goldsmith notes {that a} 1975 United States Court docket of Customs and Patent Appeals (CCPA) ruling within the Yoshida case upheld the Richard Nixon’s imposition of tariffs underneath the Buying and selling with the Enemy Act (TWEA), the predecessor statute to Yoshida. However, as the CIT ruling explains at size, Yoshida didn’t rule that TWEA authorizes limitless tariff authority, and certainly emphasised that such limitless delegation could be unconstitutional. Furthermore, in enacting IEEPA, Congress sought to restrict earlier presidential emergency powers, not perpetuate them. As a Home of Representatives report resulting in the enactment of IEEPA put it, the laws relies on “a recognition that emergencies are by their nature uncommon and transient, and are to not be equated with regular ongoing issues.” Utilizing IEEPA emergency powers to handle “regular ongoing issues” is exactly what Trump is attempting to do right here.

Goldsmith additionally raises (with out endorsing) the likelihood that MQD doesn’t apply to insurance policies adopted by the president, versus subordinate govt department officers. I responded to that argument intimately right here.

Whereas not addessed in our case, a related lawsuit filed by 12 states led by Oregon and determined in the identical CIT ruling, additionally challenged Trump’s fentanyl-related IEEPA tariffs in opposition to Canada, Mexico, and China. The CIT dominated that these tariffs weren’t meaningfully “take care of” any “uncommon and extraordinary menace” created by fentanyl smuggling. Trump argued the tariffs deal with the menace by creating “leverage” in opposition to the three nations, which was not a direct sufficient hyperlink, based on the courtroom. Goldsmith contends that an oblique hyperlink is sufficient. But when creating potential leverage in opposition to some authorities —together with one which is not even inflicting the menace—is sufficient of a connection than we’ve a backdoor to limitless energy. Just about any tariff can probably be used as leverage in opposition to some authorities to attempt to get them to do one thing that may probably assist curb a menace.

The quantity of fentanyl coming into the US from Canada is negligible, and most of that from Mexico is introduced in by US residents (whom the Mexican authorities can not and shouldn’t forestall from returning house). If that’s sufficient of a linkage to an “uncommon and extraordinary menace” to justify the imposition of large tariffs underneath IEEPA, than something is. Thus, CIT was proper to reject Trump’s fentanyl tariffs, in addition to the Liberation Day ones.

Goldsmith additionally criticizes the DDC determination, which not like the CIT (which didn’t deal with this subject), dominated that IEEPA would not authorize the imposition of tariffs in any respect. IEEPA nowhere even makes use of the phrase “tariff” or any synonym. As a substitute, it authorizes the president to “regulate . . . importation . . . of . . . any property by which any overseas nation or a nationwide thereof has any curiosity.” DDC Choose Rudolph Contreras rightly concluded that regulation and taxation are distinct powers, and thus the previous doesn’t embody the latter. If the ability to “regulate” contains a vast energy to impose tariffs, then the Structure’s grant to Congress of the ability to “lay and gather Taxes, Duties, Imposts and Excises” could be superfluous, since Congress additionally has the authority to “regulate Commerce with overseas Nations.” On the very least, the ability to “regulate” can not create a vast energy to impose tariffs. Choose Contreras’ opinion features a detailed dialogue of the excellence between the 2 powers that Goldsmith largely fails to handle.

I do agree with Goldsmith that the most important questions doctrine prone to be an vital subject as these circumstances proceed on attraction. However appellate courts even have loads of different causes to affirm the CIT and DDC rulings in opposition to Trump’s tariffs.